Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

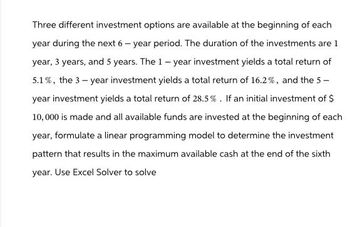

Transcribed Image Text:Three different investment options are available at the beginning of each

year during the next 6-year period. The duration of the investments are 1

year, 3 years, and 5 years. The 1-year investment yields a total return of

5.1%, the 3-year investment yields a total return of 16.2%, and the 5-

year investment yields a total return of 28.5%. If an initial investment of $

10,000 is made and all available funds are invested at the beginning of each

year, formulate a linear programming model to determine the investment

pattern that results in the maximum available cash at the end of the sixth

year. Use Excel Solver to solve

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Suppose that we make contributions to a fund of $125 today and $750 in twoyears for a return of $1000 in one year. First write the Net Present Value as a function of the discount factor ν. Secondly, use the NPV to calculate the yield rate of this investment (select the larger value for i. Finally, explain whether or not this is a good investment for us. Please show all workarrow_forwardAn investment will provide the following future cash flows. Year 1 = 5,919 Year 2 = 8,327 Year 3 and 4 = 4,718 Year 5 = 3,048 Using a 9.01% discount rate, what is the present value of this investment?arrow_forwardGiven the following information, compute the standard deviation for Investment A: Payoff Probability 30% 0.6 15% 0.3 -12% 0.1 Group of answer choices a. None of these are correct b. 6% c. 9% d. 13%arrow_forward

- A potential investment costs $2,404. You estimate that the investment has three possible outcomes, one it is worth $1,355 with a probability of 60% or two, it is worth $5,138 with a probability of 15% or three, it is worth $7,018. What is the standard deviation? Iarrow_forwardTwo investments, A and B, cost the same but have different cash flows. The IRR for Investment A is 24% while the IRR for Investment B is 19%. If a required return of 16% is used, however, the NPVs of the two investment are the same. What is the range of required returns in which: a. You would choose A over B? c. You would choose B over A?arrow_forwardSuppose now that your portfolio must yield an expected return of 13% and be efficient, that is, on the best feasible CAL. What is the proportion invested in the T-bill fund?arrow_forward

- State the return rate (in %) for your optimal portfolio.arrow_forwardA project has a beta of 0.91, the risk-free rate is 3.5%, and the market risk premium is 8.0%. The project's expected rate of return is %.arrow_forwardAn investment has been found to have two different IRRs, one at 14% and the other at 20%. When a required return of 17% is used, the NPV of the investment is negative. Knowing this: a. What range of required returns will generate a negative NPV? b. What range of required returns will generate a positive NPV?arrow_forward

- We have three assets A1, A2, A3 and the following information: E(r1)=15%, σ1=12%,; E(r2)=19% and risk σ2=30%; E(r3)=25% and Risk σ3=35% a) Calculate the effective diversification between A1, A2, A3, and assume ρ12=ρ13=ρ23=0, the expected returns are i.17%, ii.11%arrow_forwardYou invest $5000 at time t=0 and an additional $2000 at time t=1/2. At time t=1/2 you have $5300 in your account and at time t=1 you have $7300 in your account. Find the dollar-weighted rate of return rd and the time-weighted rate of return rt on this investment.A. rd= 2.86 %, rt=3.43 %B. rd= 2 %, rt=2.4 %C. rd= 6.26 %, rt=7.5 %D. rd= 2.51 %, rt=3 %E. rd= 5.01 %, rt= 6 % Please answer it only correct without using Excelarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education