ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:table (see below), and support your final statement with a

reason.

Be sure to show all work, indicate the recommended alternative

each time, provide a summary table (see below),

and support your final statement with a reason.

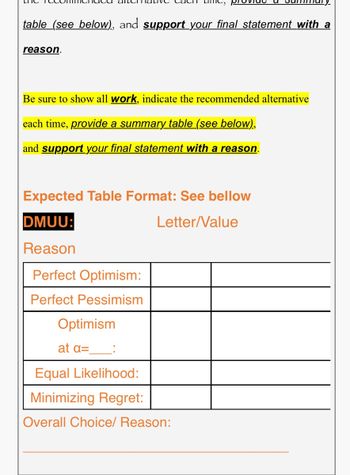

Expected Table Format: See bellow

DMUU:

Letter/Value

Reason

Perfect Optimism:

Perfect Pessimism

Optimism

at a=

Equal Likelihood:

Minimizing Regret:

Overall Choice/ Reason:

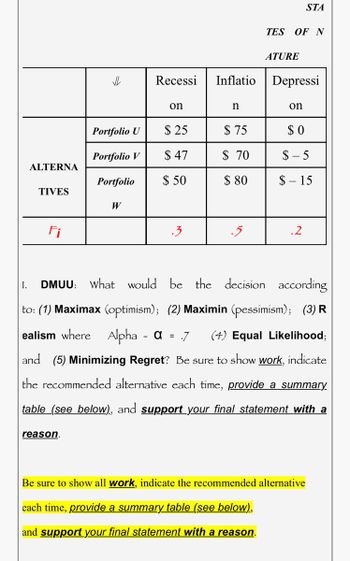

Transcribed Image Text:ALTERNA

TIVES

Fi

VL

reason.

Portfolio U

Portfolio V

Portfolio

W

Recessi

on

$25

$ 47

$50

.3

Inflatio

n

$75

$ 70

$ 80

TES OF N

ATURE

Depressi

on

STA

$0

$-5

$-15

.2

1. DMUU: What would be the decision according

to: (1) Maximax (optimism); (2) Maximin (pessímísm); (3) R

ealism where Alpha - α = .7 (4) Equal Likelihood;

and (5) Minimizing Regret? Be sure to show work, indicate

the recommended alternative each time, provide a summary.

table_(see below), and support your final statement with a

Be sure to show all work, indicate the recommended alternative

each time, provide a summary table (see below),

and support your final statement with a reason.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Notable recipients of the Nobel Prize In Economics have been recognized for their contributions to the Multiple Choice ince. your is be theories in measuring risk along with return on securities. O theories of working capital management О PRE options pricing model. theories of international capital budgeting. IA W + 100% 7 K bise. Recycle Binarrow_forwardTrue or False: If you make sound financial decisions, you'll be able to live within your means. O True O Falsearrow_forwardHelparrow_forward

- Tyler buys a futures contract from Alex that gives him the right to buy 1,000 barrels of oil at $125 per barrel in 48 months. What happens in 48 months if the actual price per barrel of oil is $100? A.) Tyler must pay Alex $25,000. B.) Tyler makes a profit of $25 per barrel, or $25,000. C.) The contract becomes void because the price turned out lower than expected. D.) Alex must give Tyler $10,000.arrow_forwardFor Stock ABC the December next year Forward is $450. A call option on ABC, has a Strike of $420 and costs (premium) $50. What is the intrinsic and extrinsic value? A. Intrinsic $30, Extrinsic $30 B. Intrinsic $40, Extrinsic $10 C. Intrinsic $0, Extrinsic $30 D. Intrinsic $30, Extrinsic $20arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education