Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

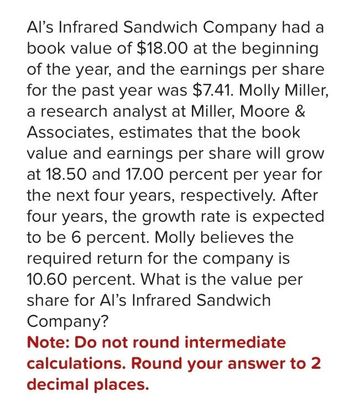

Transcribed Image Text:Al's Infrared Sandwich Company had a

book value of $18.00 at the beginning

of the year, and the earnings per share

for the past year was $7.41. Molly Miller,

a research analyst at Miller, Moore &

Associates, estimates that the book

value and earnings per share will grow

at 18.50 and 17.00 percent per year for

the next four years, respectively. After

four years, the growth rate is expected

to be 6 percent. Molly believes the

required return for the company is

10.60 percent. What is the value per

share for Al's Infrared Sandwich

Company?

Note: Do not round intermediate

calculations. Round your answer to 2

decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Sunshine's sales are $625 million in the current fiscal year (which ends today) and are expected to grow 25% per year for the next three years, and then 4% per year (forever) once the company's growth moderates to a steady state. Sunshine’s current stock price is $14 per share, and the company has 175 million shares outstanding. Sunshine's growth has attracted the attention of one of its older and larger competitors: Coca Cola. Coke manufactures carbonated soft drinks, and would like to acquire a brand in the increasingly popular non-carbonated, healthy beverage category. Coke’s management has no intention of interfering with the production or marketing of Sunshine's drinks, but feels that as a more established competitor with significantly more proven relationships with retailers it can substantially lower Sunshine's distribution costs which are 7 cents per dollar of sales. Coke is confident that the most important synergy that it can realize from an acquisition of Sunshine is…arrow_forwardBaghibenarrow_forwardGood Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 50 percent and the probability of a recession is 50 percent. It is projected that the company will generate a total cash flow of $126 million in a boom year and $78 million in a recession. The company's required debt payment at the end of the year is $75 million. The market value of the company's outstanding debt is $58 million. The company pays no taxes. What is the expected rate of return on the company's debt? O 34.5% O O 29.3% O 100%arrow_forward

- Mars Corporation is interested in estimating the expected rate of sales growth sustainability and additional financing needed to support improvements fast sales next year. Last year, revenue was $5.5 million; net profit is $500,000; investment in assets is $2,500,000; payables and accruals are $1,000,000; and shareholder equity at the end of the year is $1,500,000 (that is, the equity at the beginning of the year of $1,000,000 plus retained earnings of $500,000). The business does not pay dividends and does not expect to pay dividends in the future. a.Compute forecasted sales and changes in sales first. What is your estimate of the funds additions needed next year to support the upgrade sales by 20 percent? Also include the interpretation of the results of the calculationsarrow_forwardGood Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 70 percent and the probability of a recession is 30 percent. It is projected that the company will generate a total cash flow of $186 million in a boom year and $77 million in a recession. The company's required debt payment at the end of the year is $111 million. The market value of the company's outstanding debt is $84 million. The company pays no taxes. a. What payoff do bondholders expect to receive in the event of a recession? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the promised return on the company's debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the expected return on the company's debt? (Do not round intermediate calculations and…arrow_forwardPro Build Inc. has had a net income of $16 million in its most recent year. Net income is expected to grow by 3% per year. The firm always pays out 20% of net income as dividends and has 3 million shares of common stock outstanding. The required return is 14%. What is the value of the stock?arrow_forward

- Derry Corporation is expected to have an EBIT of $3,400,000 next year. Increases in depreciation, the increase in net working capital, and capital spending are expected to be $160,000, $155,000, and $195,000, respectively. All are expected to grow at 18 percent per year for four years. The company currently has $17,500,000 in debt and 1,350,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 2.5 percent indefinitely. The company's WACC is 9.1 percent and the tax rate is 21 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Share pricearrow_forwardDerry Corporation is expected to have an EBIT of $21 million next year. Increases in depreciation, the increase in net working capital, and capital spending are expected to be $165,000, $80,000, and $120,000, respectively. All are expected to grow at 18 percent per year for four years. The company currently has $10.4 million in debt and 750,000 shares outstanding. You believe that in Year 5 sales will be $23.7 million and the appropriate price-sales ratio is 2.9. The company's WACC is 8.5 percent and the tax rate is 21 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Share pricearrow_forwardPearl Corp. is expected to have an EBIT of $2,000,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $160,000, $85,000, and $125,000, respectively. All are expected to grow at 16 percent per year for four years. The company currently has $10,500,000 in debt and 850,000 shares outstanding. At Year 5, you believe that the company's sales will be $14,850,000 and the appropriate price-sales ratio is 2.2. The company’s WACC is 8.5 percent and the tax rate is 22 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- Esther’s Egg Farm is constructing its pro forma financial statements for this year. At year end, assets were $400,000 and accounts payable (the only current liabilities account) were $125,000. Last year’s sales were $500,000. Esther’s expects to grow by 15 percent this year. Assets and accounts payable are expected to grow proportionally to sales. Common stock currently equals $140,000, and retained earnings are $98,000. Esther’s plans to sell $15,000 of new common stock this year. The firm’s profit margin on sales is 6 percent, and 40 percent of earnings will be paid out as dividends. How much new long-term debt financing will Esther’s need this year to finance its expected growth? Esther’s is currently operating at full capacity.arrow_forwardInternational Inc. is an outdoor furniture company that is planning to considerably grow over the coming years. Gaining very good reputation with its high-quality products , the company is projecting that it can grow at 10% over the coming 4 years and then the growth rate will decrease to 3% thereafter. Its earning per share (EPS) this year was $4 and the company,s dividend pay-out ratio was 30% that is its most recent dividends was $1.2. In order to finance this growth, the company needs to invest in new machinery and working capital. 1) If the company chooses to raise equity, what would be the expected price/share given the projected growth rates and given that the expected return on the company,s equity is 15% (assume the company uses the dividend discount model). 2) If the company instead decides to take an amortizing loan from its bank, the maximum loan value would be $10M which will be just enough to finance the necessary expansion. If the Annualized Percentage Rate (APR) that…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education