Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

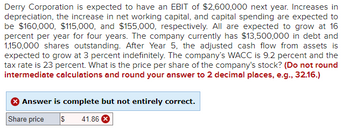

Transcribed Image Text:Derry Corporation is projected to have an EBIT of $2,600,000 next year. The increases in depreciation, net working capital, and capital spending are expected to be $160,000, $115,000, and $155,000, respectively, with all growing at 16% per year for four years. The company has $13,500,000 in debt and 1,150,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3% indefinitely. The company's WACC is 9.2%, and the tax rate is 23%. The task is to determine the stock's price per share, rounding the answer to two decimal places. Note: Intermediate calculations should not be rounded.

The provided solution indicates a share price of $41.86, but it is marked as not entirely correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- HEADLAND Ltd. had earnings per share of $4 as of December 31, 2022, but paid no dividends. Earnings were expected to grow at 16.1 percent per year for the following five years. HEADLAND Ltd. will start paying dividends for the first time on December 31, 2027, distributing 50 percent of its earnings to shareholders. Earnings growth will be 5 percent per year for the next six years (that is, from January 1, 2028, through to December 31, 2033). Starting on December 31, 2033, HEADLAND Ltd. will begin to pay out 80 percent of its earnings in dividends and earnings growth will stabilize at 2 percent per year in perpetuity.The required rate of return on HEADLAND stock is 10 percent. What should be the current share price of HEADLAND? (Round intermediate calculations to 6 decimal places, e.g. 15.612125 and the final answer to 2 decimal places, e.g. 15.61.) Current share price of HEADLAND $arrow_forwardi need the answer quicklyarrow_forwardDerry Corporation is expected to have an EBIT of $3,400,000 next year. Increases in depreciation, the increase in net working capital, and capital spending are expected to be $160,000, $155,000, and $195,000, respectively. All are expected to grow at 18 percent per year for four years. The company currently has $17,500,000 in debt and 1,350,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 2.5 percent indefinitely. The company's WACC is 9.1 percent and the tax rate is 21 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Share pricearrow_forward

- Pearl Corp. is expected to have an EBIT of $2,000,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $160,000, $85,000, and $125,000, respectively. All are expected to grow at 16 percent per year for four years. The company currently has $10,500,000 in debt and 850,000 shares outstanding. At Year 5, you believe that the company's sales will be $14,850,000 and the appropriate price-sales ratio is 2.2. The company’s WACC is 8.5 percent and the tax rate is 22 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardEsther’s Egg Farm is constructing its pro forma financial statements for this year. At year end, assets were $400,000 and accounts payable (the only current liabilities account) were $125,000. Last year’s sales were $500,000. Esther’s expects to grow by 15 percent this year. Assets and accounts payable are expected to grow proportionally to sales. Common stock currently equals $140,000, and retained earnings are $98,000. Esther’s plans to sell $15,000 of new common stock this year. The firm’s profit margin on sales is 6 percent, and 40 percent of earnings will be paid out as dividends. How much new long-term debt financing will Esther’s need this year to finance its expected growth? Esther’s is currently operating at full capacity.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education