Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

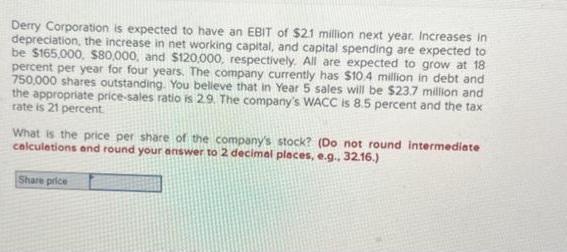

Transcribed Image Text:Derry Corporation is expected to have an EBIT of $21 million next year. Increases in

depreciation, the increase in net working capital, and capital spending are expected to

be $165,000, $80,000, and $120,000, respectively. All are expected to grow at 18

percent per year for four years. The company currently has $10.4 million in debt and

750,000 shares outstanding. You believe that in Year 5 sales will be $23.7 million and

the appropriate price-sales ratio is 2.9. The company's WACC is 8.5 percent and the tax

rate is 21 percent.

What is the price per share of the company's stock? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

Share price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are valuing Soda City Inc. It has $118 million of debt, $83 million of cash, and 168 million shares outstanding. You estimate its cost of capital is 11.2%. You forecast that it will generate revenues of $714 million and $786 million over the next two years, after which it will grow at a stable rate in perpetuity. Projected operating profit margin is 27%, tax rate is 26%, reinvestment rate is 34%, and terminal EV/FCFF exit multiple at the end of year 2 is 13. What is your estimate of its share value? Round to one decimal place. Solve Using equationarrow_forwardDerry Corporation is expected to have an EBIT of $2,600,000 next year. Increases in depreciation, the increase in net working capital, and capital spending are expected to be $160,000, $115,000, and $155,000, respectively. All are expected to grow at 16 percent per year for four years. The company currently has $13,500,000 in debt and 1,150,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3 percent indefinitely. The company's WACC is 9.2 percent and the tax rate is 23 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Share price $ 41.86arrow_forwardYou expect that Bean Enterprises will have earnings per share of $2 for the coming year. Bean plans to retain all of its earnings for the next three years. For the subsequent two years, the firm plans on retaining 50% of its earnings. It will then retain only 25% of its earnings from that point forward. Retained earnings will be invested in projects with an expected return of 20% per year. If Bean's equity cost of capital is 12%, then the price of a share of Bean's stock is closest to: A. $27.63 B. $16.58 C. $11.05 OD. $44.21arrow_forward

- You have looked at the current financial statements for J&R Homes, Company. The company has an EBIT of $3,110,000 this year. Depreciation, the increase in net working capital, and capital spending were $238,000, $103,000, and $480,000, respectively. You expect that over the next five years, EBIT will grow at 19 percent per year, depreciation and capital spending will grow at 24 percent per year, and NWC will grow at 14 percent per year. The company currently has $17.7 million in debt and 370,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3 percent indefinitely. The company’s WACC is 8.5 percent and the tax rate is 24 percent. What is the price per share of the company's stock?arrow_forwardDerry Corporation is expected to have an EBIT of $3,100,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $245,000, $150,000, and $250,000, respectively. All are expected to grow at 15 percent per year for four years. The company currently has $19,500,000 in debt and 860,000 shares outstanding. At Year 5, you believe that the company's sales will be $28,700,000 and the appropriate price-sales ratio is 3.4. The company's WACC is 9.7 percent and the tax rate is 23 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share pricearrow_forwardBerea Resources is planning a$75million capital expenditure program for the coming vear. Next year, Berea expects to report to the IR5 earnings of s40 milion after interest and tanes The company presently has 22 milion shares of commoo stock issued and outstanding. Dividend payments are expected to increase from the present level of s8 millon co 512 manion, The company expects its current asset needs to increase from a current level of$22millon to$27malion, Current liabilibes, exduding short-tern bank berrowirgs, are expected to incease from$13million to$18milion. Interest payments are s5 milion next year, and long-term debt retiremert obligations are$6million next year. Deoreciation next year is expectad to be$16million on the company's financial statements, but the company will report depreciation of$19million for tax purposes. How much extemal financing is required by Berea for the coming yean? Enter your answer in malions. For example, an answer of tt milion should be enternd as 1,…arrow_forward

- A company is projected to generate free cash flows of $457 million next year, growing at a 4.4% rate until the end of year 3. After that, cash flows are expected to grow at a stable rate of 2.8%. The company's cost of capital is 10.1%. The company owes $268 million to lenders and has $24 million in cash. If it has 179 million shares outstanding, what is your estimate for its share value? Round to one decimal place.arrow_forwardA firm expects to generate $100 million in free cash flow in a year. This free cash flow is expected to grow at a constant annual rate of 5%. The firm has a 19% cost of capital, $366 million of debt, and 20 million shares of common stock outstanding. Compute the value of the firm. (show your answers in millions - example, $10,000,000 would be entered as 10)arrow_forwardVWX Inc., has sales of $500,000, net income of $80,000, dividend payout of 50%, total assets of $700,000 and target debt-equity ratio of 1.5. If the company grows at its sustainable growth rate in the coming year, how much new borrowing (to the nearest dollar) will take place?arrow_forward

- Derry Corporation is expected to have an EBIT of $2,550,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $190,000, $95,000, and $195,000, respectively. All are expected to grow at 16 percent per year for four years. The company currently has $14,000,000 in debt and 805,000 shares outstanding. At Year 5, you believe that the company's sales will be $27,600,000 and the appropriate price-sales ratio is 2.2. The company's WACC is 8.5 percent and the tax rate is 22 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share pricearrow_forwardHappy Time Inc. is expected to generate the following cash flows for the next year, as shown in the table below. Happy Time now only has one outstanding debt with a face value of $110 million to be repaid in the next year. The current market value for the debt is $67 million. The tax rate is zero. If you invest in the corporate debt of Happy Time Inc. today, what is your expected percentage return on this investment? Cash flow in the next year Economy Probability Amount Boom 0.3 Normal 0.4 Recession 0.3 O 36.87% O -26.37% 64.8% O-16.63% $110 million $101 million $61 millionarrow_forwardBlur Corp. has an expected net operating profit after taxes, EBIT(1-T), of $7,600 million in the coming year. In addition, the firm is expected to have net capital expenditures of $1,140 million, and net operating working capital (NOWC) is expected to increase by $10 million. How much free cash flow (FCF) Is Blur Corp. expected to generate over the next year? ○ $118,668 million $6,450 million ○ $8,730 million O $6,470 million Blur Corp.'s FCFs are expected to grow at a constant rate of 4.62% per year in the future. The market value of Blur Corp.'s outstanding debt is $31,412 million, and its preferred stocks' value is $17,451 million. Blur Corp. has 150 million shares of common stock outstanding, and its weighted average cost of capital (WACC) equals 13.86%. Term Total firm value Intrinsic value of common equity Intrinsic value per share Value (Millions) Using the preceding information and the FCF you calculated in the previous question, calculate the appropriate values in this table.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education