FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

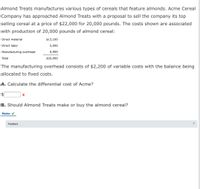

Transcribed Image Text:Almond Treats manufactures various types of cereals that feature almonds. Acme Cereal

Company has approached Almond Treats with a proposal to sell the company its top

selling cereal at a price of $22,000 for 20,000 pounds. The costs shown are associated

with production of 20,000 pounds of almond cereal:

Direct material

$13,100

Direct labor

5,000

Manufacturing overhead

6,900

Total

$25,000

The manufacturing overhead consists of $2,200 of variable costs with the balance being

allocated to fixed costs.

A. Calculate the differential cost of Acme?

B. Should Almond Treats make or buy the almond cereal?

Make v

Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Product Weedban $ 10.00 $2.40 $ 131,000 Greengrow $ 34.00 $14.00 $ 31,000 Last year the company produced and sold 42,000 units of Weedban and 16,500 units of Greengrow. Its annual common fixed expenses are $111,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forwardRoyal Lawncare Company produces and sells two packaged products—Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit $ 10.00 $ 31.00 Variable expenses per unit $ 2.40 $ 10.00 Traceable fixed expenses per year $ 130,000 $ 31,000 Last year the company produced and sold 38,000 units of Weedban and 20,500 units of Greengrow. Its annual common fixed expenses are $101,000. Required: Prepare a contribution format income statement segmented by product lines.arrow_forwardb) Almond Delites manufactures various types of biscuits. FMF Biscuits Ltd has approached wwwwwww Almond Delites with a proposal to sell the company its top-selling biscuit at a price of $22 000 for 20 000 units. The costs shown are associated with the production of 20 000 units of almond biscuits: Direct materials Direct labour Manufacturing overhead Total cost $12,000 $5,000 $ 8,000 $25,000 The manufacturing overhead consists of $2 000 of variable costs, with the balance being allocated to fixed costs. Assume that 40% of the fixed costs would be avoidable if the almond biscuits were purchased externally rather than produced internally. Required: i) Should Almond Delites make or buy the almond biscuit? ANSWER b (i): ii) What qualitative factors should Almond Delites consider before making its decision? ANSWER b (ii):arrow_forward

- Almond Treats manufactures various types of cereals that feature almonds. Acme Cereal Company has approached Almond Treats with a proposal to sell the company its top selling cereal at a price of $22,000 for 20,000 pounds. The costs shown are associated with production of 20,000 pounds of almond cereal: Direct material $13,000 Direct labor 5,000 7,000 Manufacturing overhead Total $25,000 The manufacturing overhead consists of $2,000 of variable costs with the balance being allocated to fixed costs. PLEASE NOTE: Costs per unit are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). 1. What is Almond Treats' relevant cost? 2. What does Acme's offer cost? 3. If Almond Treats accepts the offer, what will the effect on profit be? o Incremental dollar amount = . Increase or Decrease? Please note: Your answer is either "Increase" or "Decrease" - capital…arrow_forward6. Almond Treats manufactures various types of cereals that feature almonds. Acme Cereal Company has approached Almond Treats with a proposal to sell the company its top selling cereal at a price of $22,000 for 20,000 pounds. The costs shown are associated with production of 20,000 pounds of almond cereal: Direct material $13,000 Direct labor 5,000 Manufacturing overhead 7,000 Total 25,000 The manufacturing overhead consists of $2,000 of variable costs with the balance being allocated to fixed costs. PLEASE NOTE: Costs per unit are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). What is Almond Treats' relevant cost? What does Acme's offer cost? If Almond Treats accepts the offer, what will the effect on profit be? Incremental dollar amount = . Increase or Decrease? .…arrow_forwardBeach Blanket Bonanza Corporation sells its popular mid-century beach towel for $18 per unit, and the standard cost card for the product shows the following costs: Direct material $1 Direct labor 2 Overhead (80% fixed) 7 Total $10 Beach Blanket Bonanza Corporation received a special order for 1,000 units of the beach towel. The only additional cost to Beach Blanket Bonanza would be foreign import taxes of $1 per unit. If Beach Blanket Bonanza is able to sell all of the current production domestically, what would be the minimum sales price that Beach Blanket Bonanza would consider for this special order? Group of answer choices $11.00 $19.00 $5.40 $18.00arrow_forward

- a) Almond Delites manufactures various types of biscuits. FMF Biscuits Ltd has approached Almond Delites with a proposal to sell the company its top-selling biscuit at a price of $22 000 for 20 000 units. The costs shown are associated with the production of 20 000 units of almond biscuits: Direct materials: $12,000 Direct labor: $5,000 Variable overhead: $8,000 Fixed overhead: $25,000 The manufacturing overhead consists of $2 000 of variable costs, with the balance being allocated to fixed costs. Assume that 40% of the fixed costs would be avoidable if the almond biscuits were purchased externally rather than produced internally. Required: i)Should Almond Delites make or buy the almond biscuit? ii) What qualitative factors should Almond Delites consider before making its decision?arrow_forwardAlmond Treats manufactures various types of cereals that feature almonds. Acme Cereal Company has approached Almond Treats with a proposal to sell the company its top selling cereal at a price of $21,800 for 20,000 pounds. The costs shown are associated with production of 20,000 pounds of almond cereal: Direct material $13,000 Direct labor 5,100 Manufacturing overhead 7,100 Total $25,200 The manufacturing overhead consists of $2,200 of variable costs with the balance being allocated to fixed costs. A. Calculate the differential cost of Acme? $fill in the blank 1 B. Should Almond Treats make or buy the almond cereal? Make or buy?arrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Weedban $9.00 $ 2.60 $ 137,000 Product Greengrow $36.00 $ 10.00 $ 38,000 Last year the company produced and sold 36,500 units of Weedban and 17,500 units of Greengrow. Its annual common fixed expenses are $98,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forward

- Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit S 10.00 S 31.00 Variable expenses per unit $ 3.10 $ 13.00 Traceable fixed expenses per year $ 135,000 S 47,000 Last year the company produced and sold 36, 500 units of Weedban and 17,000 units of Greengrow. Its annual common fixed expenses are $105,000. Required: Prepare a contribution format income statement segmented by product lines.arrow_forwardStandard Direct Materials Cost per Unit Billingsly Company produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (7,100 bars) are as follows: Ingredient Quantity Price Cocoa 600 Ibs. $1.25 per Ib. Sugar 120 Ibs. $0.50 per Ib. Milk 180 gal. $2.60 per gal. Determine the standard direct materials cost per bar of chocolate. Round to two decimal places. $ per bararrow_forwardRain Incorporated currently manufactures part QX100, which is used in several products produced by the company. Monthly production costs for 10,000 units of QX100 are as followarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education