FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:S

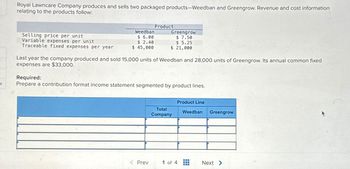

Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information

relating to the products follow:

Selling price per unit

Variable expenses per unit

Traceable fixed expenses per year

Weedban

$ 6.00

$2.40

$ 45,000

Product

Greengrow

$ 7.50

$5.25

$ 21,000

Last year the company produced and sold 15,000 units of Weedban and 28,000 units of Greengrow. Its annual common fixed

expenses are $33,000.

Prev

Required:

Prepare a contribution format income statement segmented by product lines.

Total

Company

1 of 4

Product Line

Weedban Greengrow

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Clay Earth Company sells ceramic pottery at a wholesale price of $ 7.00 per unit. The variable cost of manufacturing is $1.75 per unit. The fixed costs are $5,500 per month. It sold 4, 700 units during this month. Calculate Clay Earth's operating income (loss) for this month. A. $(19,175) B. $(5,500) C. $19, 175 D. $27,400arrow_forwardComer Company produces and sells strings of colorful indoor/outdoor lights for holiday display to retailers for $16.13 per string. The variable costs per string are as follows: Direct materials $1.87 Direct labor 1.70 Variable factory overhead 0.57 Variable selling expense 0.42 Fixed manufacturing cost totals $805,272 per year. Administrative cost (all fixed) totals $614,367. Comer expects to sell 253,600 strings of light next year. Required: 1. Calculate the break-even point in units.fill in the blank 1 units 2. Calculate the margin of safety in units.fill in the blank 2 units 3. Calculate the margin of safety in dollars.$fill in the blank 3 4. Conceptual Connection: Suppose Comer actually experiences a price decrease next year while all other costs and the number of units sold remain the same. Would this increase or decrease risk for the company? (Hint: Consider what would happen to the number of break-even units and to the margin of safety.) IncreaseDecrease Please…arrow_forwardStar Company produces and sells two products, J and R. Revenue and cost information for the two products from last month is given below: selling price per unit variable costs per unit Product J $14.90 $ 5.30 Product R $15.80 $ 8.70 Each month Star Company has 60,000 direct labor hours available and 72,000 machine hours available. Product J requires 8 direct labor hours for each unit and 4 machine hours for each unit. Product R requires 6 direct labor hours for each unit and 9 machine hours for each unit. For the coming month, Star Company would like to use linear programming in order to maximize its monthly profits. Calculate the number of units of Product that should be produced in order to maximize net income.arrow_forward

- Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost Information relating to the products follow: Selling price per unit Variable expenses per unit Product Weedban $ 6.00 $ 2.40 $ 45,000 Greengrow $ 7.50 $ 5.25 $ 21,000 Traceable fixed expenses per year Last year the company produced and sold 15,000 units of Weedban and 28,000 units of Greengrow. Its annual common fixed expenses are $33,000. Required: Prepare a contribution format Income statement segmented by product lines. × Answer is not complete. Product Line Total Company Weedban Sales Variable expenses Contribution margin $ 300,000 $ 90,000 183,000 → 38,000 ✔ Greengrow $ 210,000 147,000 117,000 54,000 63,000 Traceable fixed expenses Gross margin 66,000 45,000 63,000 x x 51,000 $ 9,000 $ 0 33,000 Net operating income S 18,000arrow_forwardCandyland Inc. produces a particularly rich praline fudge. Each 10-ounce box sells for $5.60.Variable unit costs are as follows:Pecans $0.70Sugar 0.35Butter 1.85Other ingredients 0.34Box, packing material 0.76Selling commission 0.20Fixed overhead cost is $32,300 per year. Fixed selling and administrative costs are $12,500per year. Candyland sold 35,000 boxes last year.Required:1. What is the contribution margin per unit for a box of praline fudge? What is thecontribution margin ratio?2. How many boxes must be sold to break even? What is the break-even sales revenue?3. What was Candyland’s operating income last year?4. What was the margin of safety in sales dollars? 5. CONCEPTUAL CONNECTION Suppose that Candyland Inc. raises the price to $6.20 perbox but anticipates a sales drop to 31,500 boxes. What will be the new break-even point inunits? Should Candyland raise the price? Explain.arrow_forwardAssume that Nantucket Nectars reports the following costs: Nantucket Nectars Company of Making 12-Ounce Glass Bottles (1000,000 units) Total Cost for 1,000,000 Bottles Cost per Bottle DM $ 60,000 $0.06 DL 20,000 0.02 Variable MOH 40,000 0.04 Fixed MOH 80,000 0.08 Total Costs $ 200,000 $ 0.20 Another manufacturer offers to sell Nantucket Nectars the bottles for $0.18. Should Nantucket Nectars make or buy the bottles? How to make this decision Compare: prices from outside supplier versus the relevant cost Price from outside = 0.18 TC = 0.20 Benefit of buying it with another supplier = 0.02 Benefit = 20,000 and hence should buy bottlesarrow_forward

- Feather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $40 per unit. Variable expenses are $20.00 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Sales Variable expenses Contribution margin Fixed expenses $ 1,040,000 520,000 520,000 160,000 Net operating income 360,000 Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year's unit sales and total sales increase by 48,000 units and $1,920,000, respectively. If the fixed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 14%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize…arrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Product Weedban $ 10.00 $ 3.00 $ 133,000 Greengrow $31.00 $11.00 $ 35,000 Last year the company produced and sold 41,500 units of Weedban and 24,500 units of Greengrow. Its annual common fixed expenses are $105,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forwardAndretti Company has a single product called a Dak. The company normally produces and sells 89,000 Daks each year at a selling price of $60 per unit. The company's unit costs at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit $ 8.50 9.00 2.30 9.00 ($801,000 total) 3.70 2.50 ($222,500 total) $35.00 A number of questions relating to the production and sale of Daks follow. Each question is independent.arrow_forward

- Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Weedban $9.00 $ 3.10 $ 133,000 Product Greengrow $34.00 $12.00 $ 36,000 Last year the company produced and sold 44,000 units of Weedban and 19,000 units of Greengrow. Its annual common fixed expenses are $97,000. Required: Prepare a contribution format income statement segmented by product lines. Total Company Product Line Weedban Greengrowarrow_forwardBedtime Bedding Company manufactures pillows. The Cover Division makes covers and the Assembly Division makes the finished products. The covers can be sold separately for $5.00. The pillows sell for $6.00. The information related to manufacturing for the most recent year is as follows: Cover Division manufacturing costs $6,000,000 Sales of covers by Cover Division 4,000,000 Market value of covers transferred to Assembly 6,000,000 Sales of pillows by Assembly Division 7,200,000 Additional manufacturing costs of Assembly Division 1,500,000 Compute the operating income for each division and the company as a whole. Use market value as the transfer price. Are all managers happy with this concept? Explainarrow_forwardMirabella Beauty manufactures and sells a face cream to small specialty stores in the greater Los Angeles area. It presents the monthly operating income statement shown here to George Lupe, a potential investor in the business. Help Mr. Lupe understand Mirabella Beauty's cost structure. Mirabella Beauty Operating Income Statement, June 2020 Units sold $10,000 Revenues $200,000 Cost of goods sold Variable manufacturing costs $70,000 Fixed manufacturing costs $32,900 Total 102,900 Gross margin 97,100 Operating costs Variable marketing costs $58,000 Fixed marketing and administrative costs 17,500 Total operating costs 75,500 Operating income $21,600 Recast the income statement to emphasize contribution margin. Calculate the contribution margin percentage and breakeven point in units and revenues for June2020. What is the margin of safety (in units) for June 2020? If sales in June were only 8,500 units and Mirabella's tax rate is 30%, calculate its net income.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education