FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

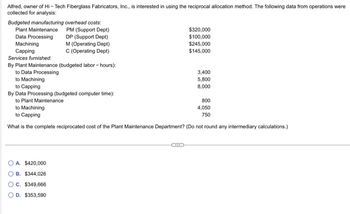

Transcribed Image Text:Alfred, owner of Hi-Tech Fiberglass Fabricators, Inc., is interested in using the reciprocal allocation method. The following data from operations were

collected for analysis:

Budgeted manufacturing overhead costs:

Plant Maintenance

Data Processing

Machining

Capping

PM (Support Dept)

DP (Support Dept)

M (Operating Dept)

C (Operating Dept)

Services furnished:

By Plant Maintenance (budgeted labor - hours):

to Data Processing

to Machining

to Capping

By Data Processing (budgeted computer time):

to Plant Maintenance

to Machining

to Capping

What is the complete reciprocated cost of the Plant Maintenance

OA. $420,000

B. $344,026

OC. $349,666

OD. $353,590

$320,000

$100,000

$245,000

$145,000

3,400

5,800

8,000

800

4,050

750

(Do not round any intermediary calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Activity Rates and Product Costs using Activity-Based Costing Lonsdale Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Activity Casting Assembly Inspecting Setup Materials handling Activity Base Machine hours Direct labor hours Number of inspections Number of setups Number of loads Units produced Budgeted Activity Cost Activity Base Corporate records were obtained to estimate the amount c activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Entry Dining Total 5,440 4,830 10,270 4,680 7,030 11,710 1,870 590 2,460 270 810 10,800 Activity Casting Assembly Inspecting Setup Materials handling a. Determine the activity rate for each activity. If required, round the rate to the nearest dollar. Activity Rate $ $ $ $225,940 Machine hours 222,490 39,360 46,860 50,470 $ Direct…arrow_forwardPanamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below. Activity Cost Activity Base Procurement $348,600 Number of purchase orders Scheduling 200,100 Number of production orders Materials handling 471,600 Number of moves Product development 741,200 Number of engineering changes Production 1,511,600 Machine hours Number of Number of Number Number of Number Purchase Production of Engineering Machine of Orders Orders Moves Changes Hours Units Disk drives 3,910 380 1,430 10 1,900 2,400 Tape drives 1,600 235 570 8,000 3,700 Wire drives 11,300 880 4,200 28 11,500 2,300 The activity rate for the procurement activity cost pool is Oa. $133.85 per purchase order Ob. $70.64 per purchase order Oc. S20.74 per purchase order Od. S233.18 per purchase order Previous Next Submit Test for…arrow_forwardVishnuarrow_forward

- >>>>__arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardObjective: Consider that you are an analyst at Regeneron Pharmaceuticals. You need to decide how to allocate administrative overhead costs to Regeneron's main commercial products (Eylea, Dupixent, Kevzara and Praluent). Determine how to appropriately allocate the costs in the table below to each of the commercial products using an allocation methodology of your choice. Department2019 Annual Operating ExpenseTime spent supporting Commercial productsCommercial$200MM100%IT$100MM25%Facilities$150MM0%Finance$25MM20%Human Resources$75MM10% Use the supporting document Net Product Sales of REGN Products to facilitate your analysis. Provide a written summary of how you allocated the overhead costs to each product in an outline of no more than one page. As a starting point, it's recommended that you revisit the material we covered in Chapter 12. Guidance on calculations:Start off with Net Product Sales of REGN Products. Your objective pertains to 2019 expenses, so you should be reviewing 2019…arrow_forward

- Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below. Activity Cost Activity Base Procurement $364,200 Number of purchase orders Scheduling 243,400 Number of production orders Materials handling 417,300 Number of moves Product development 773,900 Number of engineering changes Production 1,428,300 Machine hours Number of Number of Number Number of Number Purchase Production of Engineering Machine of Orders Orders Moves Changes Hours Units Disk drives 4,120 270 1,500 11 2,200 2,100 Tape drives 2,400 245 500 7 8,500 3,500 Wire drives 11,500 790 3,500 21 10,700 2,400 The activity-based cost for each tape drive unit is Oa. $291.69 Ob. $239.52 Oc. $740.06 Od. $20.21arrow_forwardGarrell Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study: Time-driven activity rate (cost per unit of activity) Activity cost pool: Receiving Calls Resolving Issues Settling Disputes Cost Object Data: Number of calls received Number of issues resolved Number of disputes settled Customer P 31 17 1 $5.46 $8.58 $13.26 Customer Q 21 10 Required: Using time-driven activity-based costing, determine the total Customer Support Department cost assigned to cach customer.arrow_forwardHeidelberg Fabrication manufactures two products, G-09 and G-35: Units produced Direct materials cost per unit Machine-hours per unit Production runs per quarter G-09 19,400 $7 4 144 Machine depreciation Setup labor Materials handling Total Production at the plant is automated and any labor cost is included in overhead. Data on manufacturing overhead at the plant follow: G-35 3,880 $ 19 7 72 $184,760 52,380 41,904 $ 199,044 Required: a. Heidelberg currently applies overhead on the basis of machine-hours. What is the predetermined overhead rate for the quarter? Note: Round your answer to 2 decimal places. b. Heidelberg is thinking of adopting an ABC system. They have tentatively chosen the following cost drivers: machine-hours for machine depreciation, production runs for setup labor, and direct material dollars for materials handling. Compute the cost driver rates for the proposed system at Heidelberg.arrow_forward

- Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below. Activity Cost Activity Base Procurement $302,300 Number of purchase orders Scheduling $220,600 Number of production orders Materials handling $416,500 Number of moves Product development $755,400 Number of engineering changes Production $1,551,600 Machine hours Number ofPurchaseOrders Number ofProductionOrders NumberofMoves Number ofEngineeringChanges MachineHours NumberofUnits Disk drives 4,160 380 1,320 11 1,900 1,600 Tape drives 2,500 155 770 6 9,900 4,000 Wire drives 12,700 770 3,900 23 10,400 2,700 Determine the activity rate per production order for…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Question Content Area Activity rates and product costs using activity-based costing Idris Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Activity BudgetedActivity Cost Activity Base Casting $640,000 Machine hours Assembly 125,000 Direct labor hours Inspecting 30,000 Number of inspections Setup 28,000 Number of setups Materials handling 20,000 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 7,500 12,500 20,000…arrow_forwardA company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the company's three activity cost pools are shown in the following table: Budgeted Activity Activity Cost Pool Budgeted Cost Product A Product B Product C Activity 1 $ 87,000 7,700 10,700 21,700 Activity 2 $ 62,000 8,700 16,700 9,700 Activity 3 $ 116,000 4,200 2,700 3,325 How much overhead will be assigned to Product B using activity-based costing?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education