FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![[The following information applies to the questions displayed below.]

Lansing Company's current-year income statement and selected balance sheet data at December 31 of the current and

prior years follow.

LANSING COMPANY

Income Statement

For Current Year Ended December 31

Sales revenue

Expenses

Cost of goods sold

Depreciation expense

Salaries expense

Rent expense

Insurance expense

Interest expense

Utilities expense

Net income

At December 31

Accounts receivable

Inventory

Accounts payable

$ 97,200

Salaries payable

Utilities payable

Prepaid insurance

Prepaid rent

42,000

12,000

18,000

LANSING COMPANY

Selected Balance Sheet Accounts

Current Year

$ 5,600

1,980

4,400

880

220

260

220

9,000

3,800

3,600

2,800

$ 6,000

Prior Year

$ 5,800

1,540

4,600

700

160

280

180](https://content.bartleby.com/qna-images/question/96ccea39-6e20-4e83-b9fb-b22d2ae10407/4e8c0f23-495c-4201-940e-fb82acc48362/8a9ikjr_thumbnail.png)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Lansing Company's current-year income statement and selected balance sheet data at December 31 of the current and

prior years follow.

LANSING COMPANY

Income Statement

For Current Year Ended December 31

Sales revenue

Expenses

Cost of goods sold

Depreciation expense

Salaries expense

Rent expense

Insurance expense

Interest expense

Utilities expense

Net income

At December 31

Accounts receivable

Inventory

Accounts payable

$ 97,200

Salaries payable

Utilities payable

Prepaid insurance

Prepaid rent

42,000

12,000

18,000

LANSING COMPANY

Selected Balance Sheet Accounts

Current Year

$ 5,600

1,980

4,400

880

220

260

220

9,000

3,800

3,600

2,800

$ 6,000

Prior Year

$ 5,800

1,540

4,600

700

160

280

180

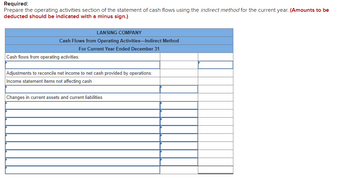

Transcribed Image Text:Required:

Prepare the operating activities section of the statement of cash flows using the indirect method for the current year. (Amounts to be

deducted should be indicated with a minus sign.)

LANSING COMPANY

Cash Flows from Operating Activities-Indirect Method

For Current Year Ended December 31

Cash flows from operating activities:

Adjustments to reconcile net income to net cash provided by operations:

Income statement items not affecting cash

Changes in current assets and current liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you give some explanation of why Amortization Expense is included as a source of cash in a cash flow statement?arrow_forwardThe sum of the cash generated or used by each section of the statement of the cash flows should be equal the difference between the beginning and ending balance of the cash and cash equivalent accounts. True or false?arrow_forwardWhen using the indirect method of determining net cash flows from operating activities, how are revenues and expenses reported on the statement of cash flows if their cash effects are identical to the amounts reported in the income statement?arrow_forward

- When preparing a statement of cash flows, cash equivalents are subtracted from cash in order to calculate the net change in cash during a period. True Falsearrow_forwardHelp with part "a" please!arrow_forwardHamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement Sales Revenue $1,860 Expenses: Cost of Goods Sold 850 Depreciation Expense Salaries and Wages Expense Rent Expense 150 450 200 Insurance Expense 75 Interest Expense Utilities Expense 45 Net Income 35 Selected Balance Sheet Accounts Current Year Prior Year 72 Inventory Accounts Receivable 55 355 400 Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 10 14 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forward

- Using the Exhibit below, assume that the balance of Accounts Payable was $60,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $65,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forwardabels and Amount Descriptions Instructions Labels Dec. 31, Dec. 31, December 31, 20Y3 20Y3 20Y2 For the Year Ended December 31, 20Y3 Amount Descriptions Assets 3 Cash $625,680.00 $586,230.00 Cash received from sale of investments 228,100.00 208,850.00 4 Accounts receivable (net) 5 Inventories Cash paid for purchase of land Cash paid for purchase of equipment Cash received from issuing common 640,910.00 617,650.00 0.00 240,620.00 6 Investments 7 Land 328,090.00 0,00 stock 704,540.00 553,320.00 8 Equipment 9 Accumulated depreciation-equipment Cash dividends (166,310.00) (147840.00) Decrease in accounts payable Decreașe in accounts receivable Decrease in accrued expenses payable 10 Total assets $2,361,010.00 $2,058,830.00 11 Liabilities and Stockholders' Equity $425,280.00 $404,550.00 52,020.00 12 Accounts payable Decrease in inventories 41,990.00 13 Accrued expenses payable Depreciation 24,190.00 20,170.00 14 Dividends payablie Gain on sale of investments 15 Common stock, $4 par…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education