FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

| Married filing jointly and surviving spouses | $25,900 |

|---|---|

| Married filing separately | 12,950 |

| Head of household | 19,400 |

| Single | 12,950 |

Transcribed Image Text:Individual Tax Rate Schedules

Married Filing Jointly and Surviving Spouse

If taxable income is

Not over $20,550

Over $20,550 but not over $83,550

Over $83,550 but not over $178,150

Over $178,150 but not over $340,100

Over $340,100 but not over $431,900

Over $431,900 but not over $647,850

Over $647,850

Married Filing Separately

If taxable income is

Not over $10,275

Over $10,275 but not over $41,775

Over $41,775 but not over $89,075

Over $89,075 but not over $170,050

Over $170,050 but not over $215,950

Over $215,950 but not over $323,925

Over $323,925

Head of Household

If taxable income is

Not over $14,650

Over $14,650 but not over $55,900

Over $55,900 but not over $89,050

Over $89,050 but not over $170,050

Over $170,050 but not over $215,950

Over $215,950 but not over $539,900

Over $539,900

Single

If taxable income is

Not over $10,275

Over $10,275 but not over $41,775

Over $41,775 but not over $89,075

Over $89,075 but not over $170,050

Over $170,050 but not over $215,950

Over $215,950 but not over $539,900

Over $539,900

The tax is

10% of taxable income

$2,055.00 +12% of excess over $20,550

$9,615.00 +22% of excess over $83,550

$30,427.00 +24% of excess over $178,150

$69,295.00 + 32% of excess over $340,100

$98,671.00 + 35% of excess over $431,900

$174.253.50 +37% of excess over $647,850

The tax is

10% of taxable income

$1,027.50 +12% of excess over $10,275

$4,807.50 +22% of excess over $41,775

$15,213.50 +24% of excess over $89,075

$34,647.50+32% of excess over $170,050

$49,335.50 +35% of excess over $215,950

$87,126.75 +37% of excess over $323,925

The tax is

10% of taxable income

$1,465.00+ 12% of excess over $14,650

$6,415.00 +22% of excess over $55,900

$13,708.00 +24% of excess over $89,050

$33,148.00 + 32% of excess over $170,050

$47,836.00 + 35% of excess over $215,950

$161,218.50 +37% of excess over $539,900

The tax is

10% of taxable income

$1,027.50 +12% of excess over $10,275

$4,807.50 +22% of excess over $41,775

$15,213.50 +24% of excess over $89,075

$34,647.50+32% of excess over $170,050

$49,335.50 +35% of excess over $215,950

$162,718 +37% of excess over $539,900

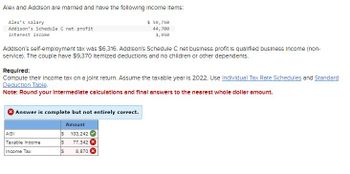

Transcribed Image Text:Alex and Addison are married and have the following income Items:

Alex's salary

$ 59,750

44,700

Addison's Schedule C net profit

Interest income

1,950

Addison's self-employment tax was $6,316. Addison's Schedule C net business profit is qualified business Income (non-

service). The couple have $9,370 Itemized deductions and no children or other dependents.

Required:

Compute their income tax on a joint return. Assume the taxable year is 2022. Use Individual Tax Rate Schedules and Standard

Deduction Table.

Note: Round your intermediate calculations and final answers to the nearest whole dollar amount.

Answer is complete but not entirely correct.

Amount

S 103,242

S

$

AGI

Taxable Income

Income Tax

77,342 x

8,870 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- PROPORTION OF LOSS-MAKERS BY MARITAL STATUS Married Unmarried 90% 80% 72% 70% 64% 65% 60% <50% 40% 30% 20% 10% 0 Source: SEBI 74% 75% 65% FY19 FY20 FY21arrow_forwardEmerson and Dakota formed a partnership dividing income as follows: Annual salary allowance to Emerson of $34,000 Interest of 10% on each partner's capital balance on January 1 Any remaining net income divided equally. Emerson and Dakota had $30,000 and $146,800, respectively, in their January 1 capital balances. Net income for the year was $201,600. How much net income should be distributed to Dakota?$fill in the blank 1arrow_forwardEmmett and Sierra formed a partnership dividing income as follows: 1. Annual salary allowance to Emmett of $42,100 2. Interest of 8% on each partner's capital balance on January 1 3. Any remaining net income divided equally. Emmett and Sierra had $21,600 and $133,600, respectively in their January 1 capital balances. Net income for the year was $232,800. How much net income should be distributed to Emmett?arrow_forward

- Bruce and Anna Wayne 1 child $78, 000 gross annual combined salaries $2, 000 invested in Bruce's IRA during the year $580 in a savings account interest $ 8, 300 in medical expenses $15, 500 in home mortgage interest $4, 800 given to charity $5, 600 paid in state income taxes $3, 750 paid in local property taxes $ 4, 000 Federal Income tax withheld during the year 1. What is the Wayne's gross income? $83, 980 $87, 030 $ 83,000 $78, 580 2. What is their adjusted gross income? $76,580 $71,000 $81, 980 $83,980arrow_forwardOlga is married and files a joint tax return with her husband. What amount of AMT exemption may she deduct under each of the following alternative circumstances? Exhibit 8-5. (Leave no answer blank. Enter zero if applicable.) c. Her AMTI is $1,612,500. Amount of AMT exemptionarrow_forwardInterview Notes Michael is 49 years old and files as single. His 2021 adjusted gross income (AGI) is $49,500, which includes gambling winningsof $1,000. Michael would like to itemize his deductions this year. Michael brings documentation for the following expenses: $8,200 Hospital and doctor bills $700 Contributions to Health Savings Account (HSA) $2,500 Long Term Care Insurance premiums before age limitation applied $3,400 State withholding (higher than Michael’s calculated state sales tax deduction) $300 Personal property taxes based on value of vehicle $400 Friend’s personal GoFundMe campaign $275 Cash contributions to the Red Cross $100 Fair market value of clothing in good condition donated to the SalvationArmy (Michael purchased clothing for $800) $7,500 Mortgage interest $820 Real estate tax $230 Mortgage Insurance Premiums (PMI) on a home he purchased in 2017. $150 Homeowners association fees $2,000 Gambling losses 11. If Michael chooses to itemize, which of the following…arrow_forward

- Emerson and Dakota formed a partnership dividing income as follows: 1. Annual salary allowance to Emerson of $34,000 2. Interest of 10% on each partner's capital balance on January 1 3. Any remaining net income divided equally. Emerson and Dakota had $34,000 and $142,000, respectively, in their January 1 capital balances. Net income for the year was $230,800. How much net income should be distributed to Dakota?arrow_forwardChris 45 and Alison 46 are marries and they will file a joint return . During the year they earned 82500 wages. They also jad investment income consisting of 200 interest income from a savng account 350 interest income from a certificate of deposit held with another bank 250 interest income from a us treasury 500 tax exempt interest income from municipal bond and 1700 in ordinart dividends from a mutual fund what amout will cris and allison report for taxable interest in their 1040arrow_forwardQuestion 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education