FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

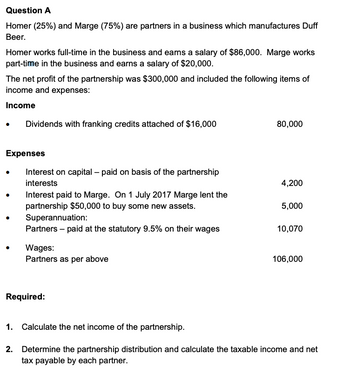

Transcribed Image Text:Question A

Homer (25%) and Marge (75%) are partners in a business which manufactures Duff

Beer.

Homer works full-time in the business and earns a salary of $86,000. Marge works

part-time in the business and earns a salary of $20,000.

The net profit of the partnership was $300,000 and included the following items of

income and expenses:

Income

Dividends with franking credits attached of $16,000

80,000

Expenses

Interest on capital - paid on basis of the partnership

interests

4,200

Interest paid to Marge. On 1 July 2017 Marge lent the

partnership $50,000 to buy some new assets.

5,000

Superannuation:

Partners - paid at the statutory 9.5% on their wages

10,070

Wages:

Partners as per above

106,000

Required:

1. Calculate the net income of the partnership.

2. Determine the partnership distribution and calculate the taxable income and net

tax payable by each partner.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please Introduction and show work and no plagiarism please i humble requestarrow_forwardThe following is the Balance Sheet of Mohammed and Hamed who share profits in the ratio of 5:4. Balance Sheet as at 31-12-2021 Liabilities Amount Assets (RO.) Amount (RO.) Sundry Creditors 30,000 Cash in Hand Capital Account Debtors Stock 90,000 Furniture 30,000 20,000 30,000 10,000 Plant and Machinery 30,000 Total 120,000 Total 120,000 On that date Marwan is admitted into the partnership on the following terms • That Marwan is to bring in OMR 30,000 as capital and OMR 10,000 as premium for goodwill for 1/5th share. • That the value of stock is reduced by 10% while plant & machinery is appreciated by 10%. • That furniture is devalued at OMR 8,500 • That a provision for doubtful debt is to be created on sundry debtors at 7.5% and OMR 150 is to be provided for electricity bill. • Investment worth OMR 5,000 (not mentioned in the balance sheet) is to be taken into account. • A creditor of OMR 300 is not likely to claim his money and is to be written off. Required: Record journal entries…arrow_forwardThis year Sheila's income from her partnership is $225.000 Sheila's business deductions from the partnership total $440,000. Sheila also earns $170,000 of W-2 income and has $65,000 of investment income What is the amount of the excess business loss that is carried forward as a NOL? A.$0 B. $150.000 C. $200.000 D. $216.000arrow_forward

- Vikaramarrow_forwardRex and Kelsey are partners who share income in the ratio of 3:2. Their capital balances are $95,000 and $140,000 respectively, on January 1. The partnership generated net income of $40,000 for the year. What is Rex's capital balance after closing the revenue and expense accounts to the capital accounts? a. $71,000 b. $119,000 c. $146,000 d. $111,000 e. None of the above.arrow_forwardInstructions The capital accounts of Trent Henry and Tim Chou have balances of $142,900 and $85,800, respectively. LeAnne Gilbert and Becky Clarke are to be admitted to the partnership. Gilbert buys one-fifth of Henry's interest for $31,400 and one-fourth of Chou's interest for $20,200. Clarke contributes $74,500 cash to the partnership, for which she is to receive an ownership equity of $74,500. Required: A. On December 31, journalize the entries to record the admission of (1) Gilbert and (2) Clarke. Refer to the Chart of Accounts for exact wording of account titles. B. What are the capital balances of each partner after the admission of the new partners?arrow_forward

- Samuel and Darci are partners. The partnership capital for Samuel is $65,500 and that of Darci is $89,200. Josh is admitted as a new partner by investing $56,800 cash. Josh is given a 20% interest in return for his investment. The amount of the bonus to the old partners is a.$56,800 b.$0 c.$14,500 d.$70,500arrow_forwardO Jackie contributed $60,000 in cash to a partnership for a 50% interest. This year, the partnership earned $200,000 ordinary business income, made a $20,000 contribution to the United Way, and distributed $25,000 cash to Jackie. Her tax basis in the partnership at year end is: Multiple Choice $125,000 $85,000 $110,000 Saved $215,000 ☆ Help Save & Exit Suarrow_forwardDo not give answer in imagearrow_forward

- Domesticarrow_forwardAngel has a one-fourth and Brian has a three-fourths interest in a partnership that operates a toy manufacturing company. The partnership books disclose the following information for the current calendar year: Sales $235,000 Sales returns and allowances 10,000 Beginning Inventory 50,000 Purchases 50,000 Manufacturing cost of labor and supplies 105,000 Ending Inventory 61,000 Salaries 26,000 Guaranteed payments to partners($8,400/each) 16,800 Rent expense 17,000 Interest expense 550 Taxes expense 8,500 Bad debt expense 1,000 Repairs expense 3,000 Depreciation expense (tax depreciation) 2,470 Utilities expense 1,680 Net long-term capital gain (sold computer) 600 Compute the partnership ordinary income?arrow_forwardDuring the current year, Marsha Engles withdrew $4,000 monthly from the partnership of Engles and Cox Water Management Consultants. Is it possible that her share of partnership net income for the current year might be more or less than $48,000? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education