ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

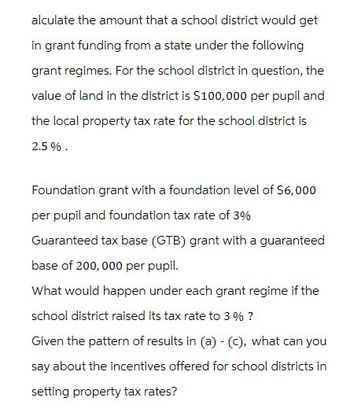

Transcribed Image Text:alculate the amount that a school district would get

in grant funding from a state under the following

grant regimes. For the school district in question, the

value of land in the district is $100,000 per pupil and

the local property tax rate for the school district is

2.5%.

Foundation grant with a foundation level of $6,000

per pupil and foundation tax rate of 3%

Guaranteed tax base (GTB) grant with a guaranteed

base of 200,000 per pupil.

What would happen under each grant regime if the

school district raised its tax rate to 3% ?

Given the pattern of results in (a) - (C), what can you

say about the incentives offered for school districts in

setting property tax rates?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ) Find the after-tax (income tax = 20%) weighted average cost of capital (WACC) given: %3D Fund Amount Before-Tax Interest Rate $150,000 $400,000 $250,000 $200,000 11% Loan Bonds 6% Retained Earnings Common Stock 15% 12%arrow_forwardDefine the term the economic evaluation of investment projects?arrow_forwardIf the federal tax rate is 36% and the state tax rate is 7%, the effective tax rate is closest to: (a) 40.5% (b) 37.3% (c) 35.4% (d ) 31.8%arrow_forward

- Which of the following characteristics of the unified transfer tax system are common to both testamentary transfers and lifetime gifts? A single applicable credit amount that offsets taxes due A step-up in income tax cost basis when the transfer is made An annual exclusion per donee per year from taxation A cumulative calculation using the same progressive tax rate schedule A) I, II, and III B) II and IV C) I, II, III, and IV D) I and IVarrow_forwardFour methods of completing a tax return and the time taken by each method are: A PC, one hour B Pocket calculator, 12 hours C Pocket calculator and paper and pencil, 12 hours D Pencil and paper, 16 hours The PC and its software cost $1,000, the pocket calculator costs $10, and the pencil and paper cost $1. If the wage rate is $5 an hour, the economically efficient method is If the wage rate is $50 an hour, the economically efficient method is A; B D; D B; B B; C If the wage rate is $500 an hour, the economically efficient method isarrow_forwardIn a city by a river, flood damage to businesses and homes averages $5,000,000 per year. A proposed levee system would prevent all flood damage, at a cost of $50,000,000 to construct and $3,000,000 per year for maintenance and interest. The city proposes to finance the construction by selling bonds; these bonds would have a 20-year term and pay 6% interest on par value. The bonds will be renewed at maturity for the same term and at the same interest rate. The benefit-cost ratio for the levee system is A. less than 0.5 B. greater than 0.5 but less than 1.0 C. greater than 1.0 but less than 1.5 D. greater than 1.5arrow_forward

- The cumulative value of FDI by Sovereign Wealth Funds (SWFS) is FDI stock. More than 50% 20% Less than 1% 30% 10% of globalarrow_forward(A) The biggest source of campaign funding today is: (a)public funding through the national government (b) PAC donations (c) individual donations (d) the two major political parties' direct funding of candidates (B) President Trump (a) Publicly conceeded defeat in the 2020 elections, but only after the gerogia electrol college was formally reviewed by an independent audit (b) was challenged in the primaries by a number of other republican candidates, but ultimately was renominated by the party for a 2nd term (c) refused to concede defeat after the 2020 elections (d) won the popular vote in 2020, but lost in the Electoral Collesearrow_forwardFOUR (4)activities would use to assist some l toddlers to develop their gross motor skills.Activities should be age and stage appropriate. Activities should be creative.Activities should cater to the domains of learningplease explain eacharrow_forward

- (c) Indicate a (license) fee, in pesos per day, that the government could charge to achieve the socially efficient (i.e. profit maximizing) number of wells.arrow_forwardplease calculate highlighted fields?arrow_forwardFor a 60–40 D-E mix of investment capital, the maximum cost for debt capital that would yield a WACC of 10% when the cost of equity capital is 4% is closest to: (a) 8% (b) 12% (c) 14% (d ) 16%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education