ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

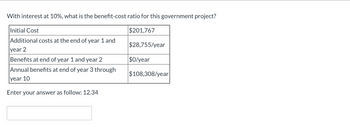

Transcribed Image Text:With interest at 10%, what is the benefit-cost ratio for this government project?

Initial Cost

$201,767

Additional costs at the end of year 1 and

year 2

Benefits at end of year 1 and year 2

Annual benefits at end of year 3 through

year 10

Enter your answer as follow: 12.34

$28,755/year

$0/year

$108,308/year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Q2 (a) There are a variety of costs to be considered in an engineering economic analysis. These costs are differ in their frequency of occurrence, relative magnitude, and degree of impact on the study. Explain any FOUR (4) type of costs that associated with products or services in construction activities. OPEN-ENDED C2 (8 marks)arrow_forwardFor the following 4 options (one must be chosen), what is the smallest MARR for the "Do Nothing" option to be chosen? Option A Year O Cost ($) Years 1-10 Benefit ($) 5.26% 9.59% 7.09 % 10.69% "Do Nothing" 0 O -1,000 153 B -1,500 207 C -2,000 261arrow_forwardQuestion content area top Part 1 A 1,500 square foot house in New Jersey costs $1,400 each winter to heat with its existing oil-burning furnace. For an investment of $4,000, a natural gas furnace can be installed, and the winter heating bill is estimated to be $800. If the homeowner's MARR is 7% per year, what is the discounted payback period of this proposed investment?arrow_forward

- Please handwriten solutionarrow_forwardA project being consider by a local government has the following estimated benefit – cost data - $1000 investment for the first 2 years and then recurring cost of $5000 for the coming 2 years and $8000 for year 5& 6 respectively. Also there are benefits of $20,000, $30,000, $ 30,000 and $20,000 starting from the third year. Consider the interest rate to be 10%, design an optimal solution to perform cost-benefit analysis and conclude if the project is suitable or not.arrow_forwardCalculate the benefit-to-cost ratio of a project that involves the following cash flow: Initial Cost $500 Uniform $155 (for a total of 15 years) Annual Benefit Assume a 9% interest rate. Group of answer choices 2.9 2.4 0.68 1.2arrow_forward

- With interest at 10%, what is the benefit-cost ratio for this government project? $208,355 Initial Cost Additional costs at the end of year 1 and year 2 Benefits at end of year 1 and year 2 Annual benefits at end of year 3 through year 10 $23,720/year $0/year $91,825/year Enter your answer as follow: 12.34arrow_forwardQ4. The cash flow details of a public project is as follows = BD 250000 Initial cost /investment Annual benefits/revenues = BD 120000 Worth of annual cost Salvage value Interest rate per year 8% and useful lie 30 Years Use the three project evaluation methods( PW, FW, AW) = BD 12,000 = BD 150000arrow_forwardUSAA is considering adding a new runway and has 3 options for the runway surface: asphalt, concrete, and a mixture of both. The benefit from all 3 alternatives is the same. Therefore, these projects are cost-based alternatives, and the cash flows are provided in the table below. Using conventional benefit/cost ratio with MARR of 9%, which alternative should be selected? First cost AW of resurfacing cost Asphalt Concrete Mixture $250,000,000 $350,000,000 $400,000,000 $30,000,000 $20,000,000 $10,000,000 Disbenefits at construction time $5,000,000 Life, years Asphalt is better Concrete is better The Mixture is better 20 $10,000,000 20 $12,000,000 20arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education