ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

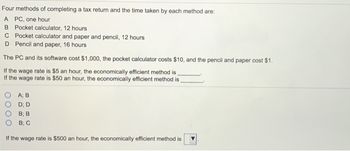

Transcribed Image Text:Four methods of completing a tax return and the time taken by each method are:

A PC, one hour

B Pocket calculator, 12 hours

C Pocket calculator and paper and pencil, 12 hours

D Pencil and paper, 16 hours

The PC and its software cost $1,000, the pocket calculator costs $10, and the pencil and paper cost $1.

If the wage rate is $5 an hour, the economically efficient method is

If the wage rate is $50 an hour, the economically efficient method is

A; B

D; D

B; B

B; C

If the wage rate is $500 an hour, the economically efficient method is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Note:Hand written solution should be avoided.arrow_forwardOnly typed answerarrow_forwardThe operating budget of the Western Robotics Company was $300 million last year. If the operating budget this year is 12 percent less than last year, what is this year’s operating budget? Answer $_______ million.arrow_forward

- Suppose a project needs to hire 50 electricians. At the initial wage of 60K/year (including benefits) 480 are currently employed in the local area and 20 are estimated to be unemployed. The MEBT (marginal excess tax burden ) is 0.2. After electricians are hired for the project, the local wage increases to 65K/year and the number employed locally increases to 510. 1)Estimate the opportunity cost of hiring the workers.arrow_forwardThree production processes - A, B, and C - have the following cost structure: the selling price is 5.26 per unit Process Fixed Cost per Year Variable Cost per Unit A 119164 2.54 B 80631 4.52 C 70617 5.27 1. What is the cost of process A for a volume of 7104 units? (round to the nearest cent).arrow_forwardA certain company has a selling price of for their product of 1500-3/4x dollars per unit and fixed costs of $800 and variable costs of 1/4x+1210 dollars per unit, where x is the total number of units produced. A.) FInd the Break even point? B.) When will the company make profit? C.) What is the make profit and the corresponding production level?arrow_forward

- Given the following information, what adjustment would be needed to account for the difference in the living area or the market condition between the subject property and the comparable property (choose the closest answer) Market Conditions Lot Size Adjustments Bath -0.50% (per month) Effective Age (Years) $1,000 (per year) Bedrooms $25,000 (per acre) Living Area (Sq. Ft) $45.00 (per sq. ft.) $1,250 (per bath) $3,000 (per bedroom)arrow_forwardProblem 6Cannes Croissants (not a real company) wishes to determine the optimum production quantity for its topselling product, almond croissants. The annual demandfor almond croissants is 12,000 units. The setup costs fora production run of the croissants is US$15. The holdingcost per unit per year is US$0.50. Production is mostefficient when 80 croissants are produced per day. Thecompany operates 300 days during a year.a What is the economic production quantity (EPQ)?b How many production runs will there by per year?c What is the maximum inventory level?d What is the total annual cost (in US dollars)?e What is the length of a production run in days?arrow_forward15 x+1160 dollars, where x is the total number of units produced. Suppose further that the selling price of its product is 16 Suppose a company has fixed costs of $4000 and variable costs per unit of 1. 1300 x dollars per unit. 16 (a) Find the break-even points. (Enter your answers as a comma-separated list.) (b) Find the maximum revenue. $. (c) Form the profit function P(x) from the cost and revenue functions. P(x) = %3D Find the maximum profit. $4 (d) What price will maximize the profit? (Round your answer to the nearest cent.) %$4 Need Help? Read It Watch Itarrow_forward

- If he wants the average cost of production to be $1, how many lures would he e) have to produce in one month? e)_ If he wants to make a profit of at least $4000 per month, what is the f) minimum number of lures he would have to produce if he sells every lure he produces for $4? f)_arrow_forwardProfit Analysis Unendo, is a large computer game manufacturer. They have estimated that the demand function for their game "Star Wars Battlefront III" is as follows... STAR WARE BATTLEFRONT p = 86 - 0.05q where p is the price of a game and q is the number of game produced and sold per week. They estimate that their cost function in dollars is ... Clq) = 179 + 5000; where the fixed cost is $5000 and the marginal cost is $17 per game Unendo wishes to maximize the weekly profit of producing and selling the game. Find the maximum profit they can earn. (Round your answer to 2 decimal places, if necessary)arrow_forwardGiven Question #1 Cost function C= 3000+6Q Q = 4400 - 200Q Q= 1600 P = 14 Profit= 22400-12600 = 9800 Question #2 Q=$480 - Laredo Q=$1120 - SA Question #3 Ed=−1.25 - Laredo Ed=−0.55 - SA 0.5<0.8− markup index it is charging less. - Laredo 0.64<-1/-0.55--markup index it is charging less. - SA Please answer question number #4 (A-C) For Laredo onlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education