FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

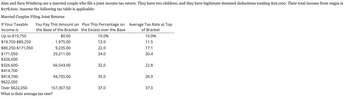

Transcribed Image Text:Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, and they have legitimate itemized deductions totaling $26,000. Their total income from wages is

$278,600. Assume the following tax table is applicable:

Married Couples Filing Joint Returns

If Your Taxable

Income Is

Up to $19,750

$19,750-$80,250

$80,250-$171,050

$171,050-

$326,600

$326,600-

$414,700

$414,700-

$622,050

You Pay This Amount on Plus This Percentage on

the Base of the Bracket the Excess over the Base

10.0%

12.0

22.0

24.0

Over $622,050

What is their average tax rate?

$0.00

1,975.00

9,235.00

29,211.00

66,543.00

94,735.00

167,307.50

32.0

35.0

37.0

Average Tax Rate at Top

of Bracket

10.0%

11.5

17.1

20.4

22.8

26.9

37.0

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- a. Bristol, who is single, has AMTI of $737,200. Her AMT exemption is $ b. Marley and Naila are married and file a joint tax return. Their AMTI is $ 1,226,400. Their AMT exemption is $arrow_forward@arrow_forwardDetermine the amount of the child tax credit in each of the following cases: a. A single parent with modified AGI of $215,300 and one child age 4. b. A single parent with modified AGI of $79,900 and three children ages 7, 9, and 12. c. A married couple, filing jointly, with modified AGI of $409,833 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,955 and one child, age 13. Child Tax Credit Allowedarrow_forward

- Xavier and his wife Maria have total W-2 income of $95,102. They will file their tax return as married filing jointly. They had a total of $7,910 withheld from their paychecks for federal income tax. Using the 22% from the tax table, Indicate whether the amount is a refund or additional tax.arrow_forwardTaxpayers are allowed two tax breaks for adoption expenses. They are allowed: Qualified Expenses Paid personally Paid by employer a. Exclusion Exclusion Exclusion Credit Oc. Credit Exclusion Od. Credit Creditarrow_forwardRoger and Nicole are married filing a joint income tax return. Their AGI for 2021 is $98,000. They are both taking classes to earn their graduate degrees. During 2021, Roger's tuition expenses totaled $7,500 while Nicole's expenses were $6,800. They are not eligible for the American Opportunity Tax Credit because they claimed the credit during the four years they were undergraduate students. What is their Lifetime Learning tax credit for 2021? $0 $2,860 $2,000 $2,500 2:41 PM 55°F 12/14/2021arrow_forward

- Determine the amount of the child tax credit in each of the following cases: a. A single parent with modified AGI of $214,800 and one child age 4. b. A single parent with modified AGI of $79,400 and three children ages 7, 9, and 12. c. A married couple, filing jointly, with modified AGI of $409,333 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,455 and one child, age 13. Child Tax Credit Allowedarrow_forward1.arrow_forwardOwearrow_forward

- Havel and Petra are married and will file a joint tax return. Havel has W-2 income of $ 40, 240, and Petra has W-2 income of $46, 677. Use the appropriate Tax Tables and Tax Rate Schedules. Required: What is their tax liability using the Tax Tables? What is their tax liability using the Tax Rate Schedule. How do I find the permitted deduction?arrow_forwardMickey and Jenny Porter file a joint tax return, and they itemize deductions. The Porters incur $2,000 in investment expenses. They also incur $3,000 of investment interest expense during the year. The Porters' income for the year consists of $150,000 in salary and $2,500 of interest income. b. What would their investment interest expense deduction be if they also had a ($2,000) long-term capital loss?arrow_forwardSheila and Joe Wells are married with two dependent children. During 2021, they have gross income of $99,800, deductions for AGI of $3,500, itemized deductions of $10,000 and tax credits of $2,000. The Wells' had $6,000 withheld by their employer for federal income tax. They have a total tax of Blank 1 and an amount due/refund of Blank 2 (Use the tax table in Appendix D) Correct Answer Blank 1: 8149 Blank 2: 149arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education