FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

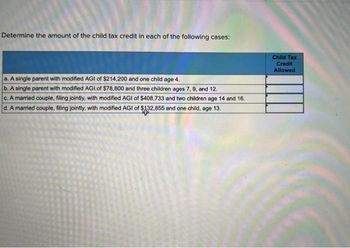

Transcribed Image Text:Determine the amount of the child tax credit in each of the following cases:

a. A single parent with modified AGI of $214,200 and one child age 4.

b. A single parent with modified AGL of $78,800 and three children ages 7, 9, and 12.

c. A married couple, filing jointly, with modified AGI of $408,733 and two children age 14 and 16.

d. A married couple, filing jointly, with modified AGI of $432,855 and one child, age 13.

Child Tax

Credit

Allowed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- As a tax return preparer for The Fernando Rodriguez Tax & Accounting Service, you have been asked to calculate the missing information for one of the firm's tax clients. The following table gives the standard deduction for various filing statuses. Standard Deductions Single or married filing separately $12,000 Married filing jointly or surviving spouse $24,000 Head of household $18,000 65 or older and/or blindand/or someone else canclaim you (or your spouseif filing jointly) as a dependent: Varies(See www.irs.gov for information.) Using the standard deduction table above, complete the following table (in $). Name Filing Status Income Adjustments toIncome Adjusted GrossIncome StandardDeduction ItemizedDeductions TaxableIncome Lerner married filingjointly $ $1,366 $47,378 $ $5,329 $arrow_forwardXavier and his wife Maria have total W-2 income of $95,102. They will file their tax return as married filing jointly. They had a total of $7,910 withheld from their paychecks for federal income tax. Using the 22% from the tax table, Indicate whether the amount is a refund or additional tax.arrow_forwardTaxpayers are allowed two tax breaks for adoption expenses. They are allowed: Qualified Expenses Paid personally Paid by employer a. Exclusion Exclusion Exclusion Credit Oc. Credit Exclusion Od. Credit Creditarrow_forward

- Use the 2015 tax table to find the income tax for a taxpayer with taxable income of $25,156 filing as single. Use the 2015 tax table to find the income tax for a taxpayer with taxable income of $69,633 filing as married filing jointly.arrow_forwardHaresharrow_forwardL. A. and Paula file as married taxpayers. In August of this year, they received a $5,200 refund of state income taxes that they paid last year. How much of the refund, if any, must L. A. and Paula include in gross income under the following independent scenarios? Assume the standard deduction last year was $25,100. Note: Leave no answer blank. Enter zero if applicable. Required: a. Last year L. A. and Paula had itemized deductions of $19,200, and they chose to claim the standard deduction. b. Last year L. A. and Paula claimed itemized deductions of $31,400. Their itemized deductions included state income taxes paid of $7,500 and no other state or local taxes. c. Last year L. A. and Paula claimed itemized deductions of $27,600. Their itemized deductions included state income taxes paid of $10,500, which were limited to $10,000 due to the cap on state and local tax deductions.arrow_forward

- Determine the amount of the child tax credit in each of the following cases: > Answer is complete but not entirely correct. a. A single parent with modified AGI of $214,600 and one child age 4. b. A single parent with modified AGI of $79,200 and three children ages 7, 9, and 12. c. A married couple, filing jointly, with modified AGI of $409,133 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,255 and one child, age 13. Child Tax Credit Allowed $ $ $ $ 1,250 ✓✔ 9,600 X 3,544 x 3,000arrow_forwardProblem 9-55 (LO 9-5) Determine the amount of the child tax credit in each of the following cases: a. A single parent with modified AGI of $213,400 and one child age 4. b. A single parent with modified AGI of $78,000 and three children ages 7, 9, and 12. c. A married couple, filing jointly, with modified AGI of $407,933 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $132,055 and one child, age 13. Child Tax Credit Allowedarrow_forwarduse the marginal tax rates in the table below to compute the tax owed in the following situation. Winona and Jim are married filing jointly, with a taxable income of $288,000. They are entitled to a $6000 tax credit. Solve. The tax owed is $. enter your response here. Tax Rate Married filing jointly 10% up to $18,650 15% up to $75,900 25% up to $153,100 28% up to $233,350 33% up to $416,700 35% up to $470,700 39.6% above $470,700 Standard deduction $12,700 Exemption (per person) $4050arrow_forward

- 3arrow_forwardScott and Bonnue, married taxpayers, earn $258,000 in taxable income and $7,700 in interest from an investment in City of Tampa bonds. Using the 2023 U.S. tax rate schedule for married filing jointly, answer the following question regarding their tax rates. How much federal tax will the owe? Blank 1 Blank 1 Add your answerarrow_forwardUse the Tax Rate Tables, Exhibit 18-3, to calculate the tax liability for the following taxpayers. Name Filing Status Taxable Income Tax Liability 10. Rua Head of Household $175,800 $36,554 11. Dylewski Married, Jointly $52,500 ANSWER$5,919 12. Williams Single $61,300 blank 2 13. Cabral Married, Separately $185,188 ANSWER$40,949.66arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education