FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

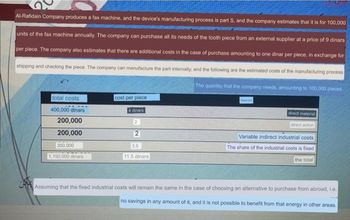

Transcribed Image Text:Al-Rafidain Company produces a fax machine, and the device's manufacturing process is part S, and the company estimates that it is for 100,000

units of the fax machine annually. The company can purchase all its needs of the tooth piece from an external supplier at a price of 9 dinars

per piece. The company also estimates that there are additional costs in the case of purchase amounting to one dinar per piece, in exchange for

shipping and checking the piece. The company can manufacture the part internally, and the following are the estimated costs of the manufacturing process

The quantity that the company needs, amounting to 100,000 pieces

total costs

400,000 dinars

200,000

200,000

350,000

1,150,000 dinars

cost per piece

4 dinars

2

2

3.5

11.5 dinars

direct material

direct action

Variable indirect industrial costs

The share of the industrial costs is fixed

the total

Assuming that the fixed industrial costs will remain the same in the case of choosing an alternative to purchase from abroad, i.e.

no savings in any amount of it, and it is not possible to benefit from that energy in other areas.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At Cullumber Electronics, it costs $30 per unit ($16 variable and $14 fixed) to make an MP3 player that normally sells for $51. A foreign wholesaler offers to buy 3,580 units at $28 each. Cullumber Electronics will incur special shipping costs of $3 per unit. Assuming that Cullumber Electronics has excess operating capacity, indicate the net income (loss) Cullumber Electronics would realize by accepting the special order. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Costs-Variable manufacturing Shipping Net income The special order should be $ 69 accepted Reject Order $ Accept Order 4 Net Income Increase (Decrease)arrow_forwardThe Nature and Wildlife Corporation has manufacturing facilities in country A and an assembly plant in country B. In June 2020, the company will ship 1,000 units with a production cost of $65 per unit to its plant in country B. Its operating expenses in country A are $15,000 for the month. The income tax rate in country A is 20% and in country B it is 40%. The company plans to have a transfer price of $100 per unit. The final product can be sold in country B for $140. Country B’s operating expenses are $10,000 during the month. How much will the combined profits of the two operations be in April 2021?arrow_forwardCarondelet Coffee has begun making and selling pastries. The fixed costs of making the pastry are $4,000, and the company estimates that the variable costs are $.75 per pastry. How many pastries does Carondelet have to sell to earn net income of $5,000 if it sells each pastry for $3 apiece?arrow_forward

- Leo Consulting enters into a contract with Highgate University to restructure Highgate's processes for purchasing goods from suppliers. The contract states that Leo will earn a fixed fee of $80,000 and earn an additional $16,000 if Highgate achieves $160,000 of cost savings. Leo estimates a 50% chance that Highgate will achieve $160,000 of cost savings. Assuming that Leo determines the transaction price as the expected value of expected consideration, what transaction price will Leo estimate for this contract? Transaction price for the contractarrow_forwardSmith Petroleum has spent $204,000 to refine 64,000 gallons of petroleum distillate, which can be sold for $6.20 per gallon. Alternatively, Smith can process the distillate further and produce 53,000 gallons of cleaner fluid. The additional processing will cost $1.80 per gallon of distillate. The cleaner fluid can be sold for $9.30 per gallon. To sell cleaner fluid, Smith must pay a sales commission of $0.10 per gallon and a transportation charge of $0.16 per gallon. Read the requirements. Requirement 1. Fill in the diagram for Smith's alternatives. Joint costs of producing 64,000 gallons of petroleum distillate The Cost of processing further Revenues from selling as is Revenues from processing further Requirement 2. Identify the sunk cost. Is the sunk cost relevant to Smith's decision? is a sunk cost that C differ between the alternatives of selling as is or processing further. Consequently, this sunk cost is ▼to the sell-or-process-further decision.arrow_forwardToro Company is expanding its US-based plastic molding plant as it continues to transfer work from Juarez, Mexico contractors. The plant bought a $1.1 million precision injection molding machine to make plastic parts for Toro lawn mowers, trimmers, and snow blowers. The plant expects to hire 12 people, including some engineers for the expansion. If the average loaded cost (i.e., including benefits) of each employee is $100,000 per year, determine the annual worth of the new systems over a five-year planning period at an interest rate of 10% per year. Assume a 20% salvage value for the new equipment. $-2,436,420 $-2,539,420 $-1,454,142 $-1,973,420arrow_forward

- Markland Manufacturing manufactures desk lamps intends to increase capacity by obtaining new equipment. Two vendors have presented proposals. The purchase cost for proposal A is $30,000, and for proposal B, $80,000. Each proposal will produce lamps of the same quality. Proposal A is expected to produce lamps at $15.00/lamp, while proposal B is significantly more efficient and will produce them at $10.00/lamp. The revenue generated by the sale of each lamp is $20.00/unit. A. What is the point of indifference?B. The manufacturer expects to sell 12,000 lamps and has informed the vendors that it has chosen proposal B. The vendor of proposal A has offered to re-negotiate the purchase price of its proposal in order to win the contract. What purchase price will cause the manufacturerto reconsider its decision?arrow_forwardNeptune Company has developed a small inflatable toy that it is anxious to introduce to its customers. The company's Marketing Department estimates that demand for the new toy will range between 15,000 units and 35,000 units per month. The new toy will sell for $3 per unit. Enough capacity exists in the company's plant to produce 18,000 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.00, and incremental fixed expenses associated with the toy would total $22,000 per month. Neptune has also identified an outside supplier who could produce the toy for a price of $1.75 per unit plus a fixed fee of $15,000 per month for any production volume up to 20,000 units. For a production volume between 20,001 and 40,000 units the fixed fee would increase to a total of $30,000 per month. Required: 1. Calculate the break-even point in unit sales assuming that Neptune does not hire the outside supplier. 2. How much profit will Neptune earn assuming: a. It…arrow_forwardOne of your Taiwanese suppliers has bid on a new line of molded plastic parts that is currently being assembled at your plant. The supplier has bid $0.10 per part, given a forecast you provided of 200,000 parts in year 1, 400,000 in year 2; and 600,000 in year 3. Shipping and handling of parts from the supplier's factory is estimated at $0.03 per unit. Additional inventory handling charges should amount to $0.005 per unit. Finally, administrative costs are estimated at $30 per month. Although your plant is able to continue producing the part, the plant would need to invest in another molding machine, which would cost $20,000. Direct materials can be purchased for $0.04 per unit. Direct labor is estimated at $0.05 per unit for wages plus a 50 percent surcharge for benefits and, indirect labor is estimated at $0.009 per unit plus 50 percent benefits. Up-front engineering and design costs will amount to $50,000. Finally, management has insisted that overhead be allocated if the parts are…arrow_forward

- A company produces wooden tables. The company has fixed costs of $1600, and it costs an additional $50 per table. The company sells the tables at a price of $157 per table. If the company needs to earn a profit of $7200, how much money in costs should it be prepared to cover? It should be prepared to cover Round to the nearest whole number.arrow_forwardThis question is based on t he following information: B Hon Company purchases thermostats and use them in heating units it manufactures. Annual requirement for the thermostat is 2,000 units. The cost per thermostat is P 20. The cost of placing a single order is P 50 while the cost of storage is 25% of the average inventory value. The suppler of the thermostat offers a discount of 2% if the company will order in lots of 500 units. 1. How much would be the total costs associated with the inventory if the company adopts the discounted ordering policy? . A. P 40,000 B. P 40,625 C. P 41,000 D. P 42,0002. How much is the net cash flow net of income taxes for the 3rd year?A. 17,268B. 22,000C. 22,994D. 30,618arrow_forwardCrane, Inc., sells two types of water pitchers, plastic and glass. Plastic pitchers cost the company $30 and are sold for $40. Glass pitchers cost $26 and are sold for $47. All other costs are fixed at $280,800 per year. Current sales plans call for 14,000 plastic pitchers and 28,000 glass pitchers to be sold in the coming year. Crane, Inc., has just received a sales catalog from a new supplier that is offering plastic pitchers for $28. What would be the new contribution margin per unit if managers switched to the new supplier? What would be the new breakeven point if managers switched to the new supplier? (Use contribution margin per unit to calculate breakeven units. Round answers to 0 decimal places, e.g. 25,000.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education