FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

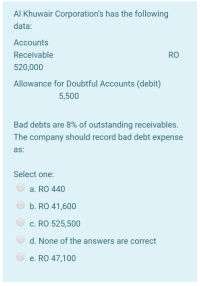

Transcribed Image Text:Al Khuwair Corporation's has the following

data:

Accounts

Receivable

RO

520,000

Allowance for Doubtful Accounts (debit)

5,500

Bad debts are 8% of outstanding receivables.

The company should record bad debt expense

as:

Select one:

a. RO 440

b. RO 41,600

c. RO 525,500

d. None of the answers are correct

O e. RO 47,100

Expert Solution

arrow_forward

Step 1

The allowance for doubtful debts ending balance would be 8% of the outstanding accounts receivables.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Munabhaiarrow_forwardA recent report for UPS contained the following data: (in thousands) Accounts receivable Less: Allowance for bad debts Net accounts receivable Bad debt expense Current year $1,034,608 36,800 $ 997,808 $55,147 Previous year $ 805,495 38,225 S 767,270 $31,388 Required: 1. Prepare the journal entry for the amount of accounts receivable that were actually written off during the current year. 2. Prepare the journal entry to record the bad debt expense for the current year 3. What is the purpose of the account "Allowance for doubtful accounts"? Although the normal balance of this account is a credit balance, it sometimes has a debit balance. Briefly explain how this can happen.arrow_forward(Recording Bad Debts) Duncan Company reports the following financial information before adjustments. Debit Credit Accounts Receivable $90,000 Allowance for Doubtful Accounts $1,750 Sales Revenue (all on credit) $680,000 Prepare the journal entry to record bad debt expense assuming Duncan Company estimates bad debts at (a) 1% of net sales and (b) 5% of accounts receivable.arrow_forward

- The trial balance before adjustment of saturn corp shows the following balances. Dr. P97,400 3,300 Cr. Accounts Receivable Allowance for Doubtful Accounts Sales Revenue (all on credit) Give the entry for estimated bad debts assuming that the allowance is to provide for doubtful accounts on the basis of (a) 4% of gross accounts receivable and (b) 5% of gross accounts receivable and Allowance for Doubtful Accounts has a P1,857 credit balance. P643,200arrow_forwardThe following are independents questions. If Jess Company had $300,000 of Accounts Receivable and it expected that bad debt expenses are 8% of Accounts Receivable, knowing that company journalized Bad debt expense at $20,000. The company's AFDA balance in the trial balance was: O Credit $4,000 O Debit $4,000 O Debit $1,600 O Credit $1,600 K O None of the above ins 2020 was S140 000 rs$alearrow_forwardidiyah Co. estimates that RO 6,500 of its accounts receivable to be uncollectible. If Allowance for Doubtful Accounts has a RO 200 debit balance, the company should record a elect one: O a. None of the answers are correct O b. debit to Bad Debt Expense for RO 5,300. O c credit to Allowance for Doubtful Accounts for RO 6,500. O d. debit to Allowance for Doubtful Accounts for RO 5,300. O e. credit to Bad Debt Expense for RO 7,700.arrow_forward

- 8arrow_forwardCalculate the total estimated uncollectibles based on the below information. Accounts receivable % uncollectible Estimated Bad debts Total $307,100 $ 0-30 $100,200 1% $ 31-60 $65,900 4% Number of Days Outstanding $ 61-90 $59,800 5% 91-120 $44,600 8% $ Over 120 $36.600 20%arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education