FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

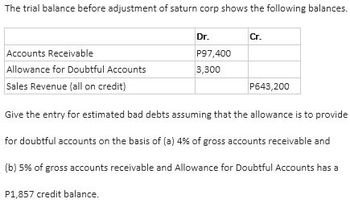

Transcribed Image Text:### Trial Balance Before Adjustment for Saturn Corp

The trial balance before adjustment of Saturn Corp shows the following balances:

| | Dr. | Cr. |

|----------------|---------|----------|

| Accounts Receivable | P97,400 | |

| Allowance for Doubtful Accounts | | 3,300 |

| Sales Revenue (all on credit) | | P643,200 |

### Instructions for Estimating Bad Debts

Give the entry for estimated bad debts assuming that the allowance is to provide for doubtful accounts on the basis of:

1. **4% of gross accounts receivable**

2. **5% of gross accounts receivable if the Allowance for Doubtful Accounts has a P1,857 credit balance**

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Munabhaiarrow_forwardUnder the direct write-off method of accounting for uncollectible accounts, Bad Debt Expense is recorded Oa. when a credit sale is past due O b. whenever a predetermined amount of credit sales has been made Oc. when an account is determined to be worthless O d. at the end of each accounting periodarrow_forwardThe trial balance before adjustment of saturn corp shows the following balances. Dr. P97,400 3,300 Cr. Accounts Receivable Allowance for Doubtful Accounts Sales Revenue (all on credit) Give the entry for estimated bad debts assuming that the allowance is to provide for doubtful accounts on the basis of (a) 4% of gross accounts receivable and (b) 5% of gross accounts receivable and Allowance for Doubtful Accounts has a P1,857 credit balance. P643,200arrow_forward

- idiyah Co. estimates that RO 6,500 of its accounts receivable to be uncollectible. If Allowance for Doubtful Accounts has a RO 200 debit balance, the company should record a elect one: O a. None of the answers are correct O b. debit to Bad Debt Expense for RO 5,300. O c credit to Allowance for Doubtful Accounts for RO 6,500. O d. debit to Allowance for Doubtful Accounts for RO 5,300. O e. credit to Bad Debt Expense for RO 7,700.arrow_forwardUsing the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $16700. If the balance of the Allowance for Doubtful Accounts is $2070 credit before adjustment, what is the amount of bad debt expense for that period? $16700 $2070 $14630 $18770arrow_forwardOne company has estimated that $3150 of its accounts receiable will be uncollectible. If allownace for doubtful accounts already has a credit balance of $1102, and the percentage of receivables method is used, it sadjustment to recrod for the period will require a debit to what for what amount?arrow_forward

- hi Can you assist me in undertanding better how you calculated the written off amount ? Why is the formula addind the opening and closing balance of the allowance for doubtful accounts and substract the allowance estimated ? You mentionned the bad debt was equal to total estimated allowance for doubtful accounts- balance in allowance for doubtful account . Is this the same formula to use for the write off ? Many thanksarrow_forwardThe trial balance before adjustment of Monty Inc. shows the following balances. Accounts Receivable Allowance for Doubtful Accounts Sales Revenue (all on credit) (a) Dr. (b) $106,200 2,065 Cr. Give the entry for estimated bad debts assuming that the allowance is to provide for doubtful accounts on the basis of (a) 4% of gross accounts receivable and (b) 5% of gross accounts receivable and Allowance for Doubtful Accounts has a $1,955 credit balance. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation $802,400 Debit Creditarrow_forwardU Your answer is partially correct. Sandhill Corp uses the percentage-of-receivables basis to record bad debt expense. Accounts receivable (ending balance) Allowance for doubtful accounts (unadjusted) The company estimates that 3% of accounts receivable will become uncollectible. (a) Prepare the adjusting journal entry to record bad debt expense for the year. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation $565,000 (debit) 4,900 (debit) Bad Debt Expense Allowance for Doubtful Accounts Debit 21850 Credit 21850arrow_forward

- Pleasearrow_forwardThe trial balance before adjustment of Ehrlich Company reports the following balances: Dr. Cr. Accounts receivable $420,000 Allowance for doubtful accounts (debit balance) $ 5,000 Sales (all on credit) 2,000,000 Sales returns and allowances 70,000 Instructions – show all calculations a. Prepare the entry for estimated bad debts assuming that doubtful accounts are estimated to be 5% of gross accounts receivable. b. Prepare the entry for the estimated bad debts assuming that the company estimates bad debts based on the percentage of sales method, using 2% of net sales.arrow_forwardYou are appointed as the accountant of LALA-BTS Company. You noted that the Company estimated that 3% of its credit sales will not be collectible. Further documents showed the following balances before adjustments: •Credit Sales P2,500,000 •Accounts Receivable P300,000 •Allowance for doubtful accounts - 10,000 debit Determine the net realizable value of the accounts receivable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education