FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

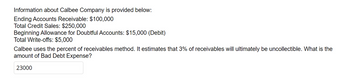

Transcribed Image Text:Information about Calbee Company is provided below:

Ending Accounts Receivable: $100,000

Total Credit Sales: $250,000

Beginning Allowance for Doubtful Accounts: $15,000 (Debit)

Total Write-offs: $5,000

Calbee uses the percent of receivables method. It estimates that 3% of receivables will ultimately be uncollectible. What is the

amount of Bad Debt Expense?

23000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Louise Company has the following balances: Net Credit Sales $ 1,200,000 Accounts Receivable 240,000 Allowance for Doubtful Accounts (beginning balance) 3,000 Uncollectible accounts are estimated to be 6% of the receivables balance. Given this information, what is the company’s estimated bad debt expense for the year?arrow_forwardI NEED HELP FINDING THE DOLLAR AMOUNT Vaughn Inc. uses the allowance method to estimate uncollectible accounts receivable. The company produced the following aging of the accounts receivable at year-end. Calculate the total estimated bad debts based on the below information. Number of Days Outstanding Total 0–30 31–60 61–90 91–120 Over 120 Accounts receivable 331,400 104,000 70,800 65,400 49,100 $42,100 % uncollectible 2% 5% 6% 9% 21% Estimated Bad debts $enter a dollar amount $enter a dollar amount $enter a dollar amount $enter a dollar amount $enter a dollar amount $enter a dollar amountarrow_forward(Recording Bad Debts) Duncan Company reports the following financial information before adjustments. Debit Credit Accounts Receivable $90,000 Allowance for Doubtful Accounts $1,750 Sales Revenue (all on credit) $680,000 Prepare the journal entry to record bad debt expense assuming Duncan Company estimates bad debts at (a) 1% of net sales and (b) 5% of accounts receivable.arrow_forward

- Assume Simple Company had credit sales of $243,000 and cost of goods sold of $143,000 for the period. Simple uses the percentage of credit sales method and estimates that 2 percent of credit sales would result in uncollectible accounts. Before the end-of-period adjustment is made, the Allowance for Doubtful Accounts has a credit balance of $180. Required: What amount of Bad Debt Expense would the company record as an end-of-period adjustment?arrow_forwardHIRDT CO. USES THE PERCENTAGE-OF- RECEIVABLES BASIS TO RECORD BAD DEBT EXPENSE AND CONCLUDES THAT 3% OF ACCOUNTS RECEIVABLE WILL BECOME UNCOLLECTIBLE. ACCOUNTS RECEIVABLE ARE $401,100 AT THE END OF THE YEAR, AND THE ALLOWANCE FOR DOUBTFUL ACCOUNTS HAS A CREDIT BALANCE OF $3,110. IF THE ALLOWANCE FOR DOUBTFUL ACCOUNTS HAD A DEBIT BALANCE OF $890 INSTEAD OF A CREDIT BALANCE OF $3,110, PREPARE THE ADJUSTING JOURNAL ENTRY FOR BAD DEBT EXPENSE.arrow_forwardTammany Professional Engineers uses the Percentage of Receivables method to account for bad debt. The following is a summary of Tammany’s Accounts Receivable Aging Report. Cash Sales $42,000 Credit Sales $21,000 Allowance for Uncollectible Accounts December 31, 2020 $4,375 Current > 30 >60 >90 $115,000 $98,000 $75,000 $15,000 Estimated Uncollectible 1% 2% 4% 5% Required: Prepare the total estimate of uncollectible accounts and give the amount of the required adjustment. Do not prepare a journal entry. Please show your work if possible. In addition to submitting your answer here, you should also write it down so you an use it for the next problem.arrow_forward

- I'm not so sure about my answer please help me.....arrow_forwardData for the year ended December 31 are presented below. Sales (100% on credit) $2,100,000 Sales returns 150,000 Accounts Receivable (December 31) 420,000 Allowance for Doubtful Accounts (Before adjustment at December 31) 25,000 Estimated amount of uncollected accounts based on an aging analysis 75,000 If the company uses the aging of accounts receivable method to estimate its bad debts, what will be the net realizable value of its accounts receivable after the adjustment for bad debt expense?arrow_forwardGG Company uses the percentage of sales method for recording bad debts expense. For the year, cash sales are $700,000 and credit sales are $2,500,000. Management estimates that 1% is the sales percentage to use. What adjusting entry will Company make to record the bad debts expense? Select one: a. The answer does not exist b. Bad Debt Expense .25,000 Allowance for Doubtful Accounts 25,000 С. Bad Debt Expense .32,000 Allowance for Doubtful Accounts 32,000 d. Bad Debt Expense 25,000 Accounts Receivable 25,000 е. Bad Debt Expense .32,000 Accounts Receivable 32,000arrow_forward

- Al Khuwair Corporation's has the following data: Accounts Receivable RO 520,000 Allowance for Doubtful Accounts (debit) 5,500 Bad debts are 8% of outstanding receivables. The company should record bad debt expense as: Select one: a. RO 440 b. RO 41,600 c. RO 525,500 d. None of the answers are correct e. RO 47,100arrow_forwardWohoo Publishers uses the allowance method to estimate uncollectible accounts receivables. The company produced the following aging of the accounts receivable at year-end (Y in thousands). Accounts receivable % uncollectible Estimated bad debts Total 200,000 0-30 days 77,000 2% 31-60 days 46,000 5% 61-90 days 91-120 days 39,000 6% 23,000 10% Over 120 days 15,000 25%arrow_forward5. The Adams Company had total credit sales for the year of $1,500,000. As of year end, but before estimating bad debts, the company had a $130,000 debit balance in accounts receivable and a $500 credit balance in the allowance for uncollectible accounts. If the Adams Company estimates bad debts as 4% of ending accounts receivable, the journal entry of the Adams Company will be: a. Bad debt expense Allowance for doubtful accounts b. Bad debt expense Accounts receivable c. Bad debt expense Accounts receivable d. Bad debt expense Allowance for doubtful accounts $4,700 $5,200 $5,200 $5,700 $4,700 $5,200 $5,200 $5,700arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education