ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Aggregate Expenditure(in millions of dollars)

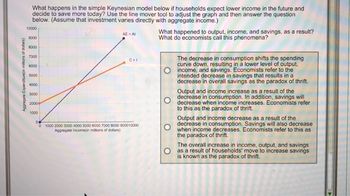

What happens in the simple Keynesian model below if households expect lower income in the future and

decide to save more today? Use the line mover tool to adjust the graph and then answer the question

below. (Assume that investment varies directly with aggregate income.)

10000

9000

8000

7000

6000

5000

4000

3000

2000

1000

AE = Al

C+1

0

0 1000 2000 3000 4000 5000 6000 7000 8000 900010000

Aggregate Income(in millions of dollars)

What happened to output, income, and savings, as a result?

What do economists call this phenomena?

The decrease in consumption shifts the spending

curve down, resulting in a lower level of output,

income, and savings. Economists refer to the

intended decrease in savings that results in a

decrease in overall savings as the paradox of thrift.

Output and income increase as a result of the

decrease in consumption. In addition, savings will

decrease when income increases. Economists refer

to this as the paradox of thrift.

Output and income decrease as a result of the

decrease in consumption. Savings will also decrease

when income decreases. Economists refer to this as

the paradox of thrift.

The overall increase in income, output, and savings

as a result of households' move to increase savings

is known as the paradox of thrift.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Good afternoon , please help solve the following table with showing how you calculated thank you .arrow_forward14. Calculate Equilibrium GDP (Y*) in each of the following situations (IP is Autonomous Planned Investment): (a) C 50+.75(Y-10), IP = 100, G=20, NX = -15. (b) a = 10, MP C = .8, T10, TR= 5, IP=50, G = 40, NX = 0. (c) a = 15, MP C .85, T = 15, TR= 10, IP= 55, G=45, NX = 5. (d) The MPC is 0.75, Autonomous Consumption is 100, Autonomous Planned Investment is 80, Government Spending is 50, Net Exports are -20, Lump-sum Taxes are 50, and Transfer Payments are 20.arrow_forwardAssume an economy were characterized by the following equations C = C + bYD I=Ī - di G=G T=T X=X IM= Z +fY MD= a + Bi+yY MS=Ⓒ P = 1 (1) (2) (3) (4) (5) (6) (7) (8) (9) where the notation denoting parameters C,b,1,d,e,G,T,X,Z,f,a, ß,y, are all positive and YD denotes disposable income. We assume that 0arrow_forwardConsider the following model. Expenditure is given by: E = C +1 + G. The consumption function is specified as: C = c0 +cY. We assume a closed macroeconomics system so that: Y=E. If the model parameters are configured such that I= 500, G=2000, c0=1000 and c=0.8, what will the level of consumption expenditure, C, be equal to? a. 4,375 b. 15,000 c. 14,000 Cd. 14,500arrow_forwardA certain country's GDP (total monetary value of all finished goods and services produced in that country) can be approximated by g(t) = 2,000-420e 0.07t billion dollars per year (0 ≤t≤ 5), where t is time in years since January 2010. Find an expression for the total GDP G(t) of sold goods in this country from January 2010 to time t. HINT: [Use the shortcuts.] G(t) = Estimate, to the nearest billion dollars, the country's total GDP from January 2010 through June 2014. (The actual value was 7,321 billion dollars.) Xbillion dollarsarrow_forwardWhat is the equilibrium level ofarrow_forwardConsider a national income model as: Y= C + I0 + G Y= National Income C= (Planned) Consumption Expenditure I0= Investment G= Government Expenditure Consider Y= 20trillion, G= 4.2trillion, I0= 3.8 trillion. Explain the key elements missing from the National Income model. Add a new endogenous variable to represent that missing element or endogenize one of the exogenous variables to address this issue. C= a+ b(Y-T0) (a>0, 0<b<1) G= gY (0<g<1)arrow_forwardPlsAnswer the last three question fully with your own knowledgearrow_forwardShow full answers to the questions and steps to this exercisearrow_forwardpast b pleasearrow_forwardWe again assume asimple closed economy with GDP of 100 and:c0(autonomous consumption) = 20c1 (marginal propensity to consume) = 0.6I (investment) = 20.a) Now assume that c0falls by 5 (i.e. 5% of GDP), i.e. for any given level of output,consumption will fall by 5. Show the implied fall in the AD function in yourdiagram and show that output will fall by more than 5.b) Show that the multiplier is equal to 2.5, and hence that, in the new equilibrium,output will have fallen by 12.5 (i.e. by 12.5%)c) How big would the impact be if, say, c1 = 0.4 or c1 = 0.8? Explain the difference.arrow_forward2. Question 2: Suppose that you estimate a model of the aggregate annual retail sales of new cars that specifies that sales of new cars are a function of real disposable income, the average retail price of a car adjusted by the consumer price index, and the number of sports utility vehicles sold (you decide to add this independent variable to take account of the fact that some potential new car buyers purchase sports utility vehicles instead). You use the data (annual from 2000 to 2014) and obtain the following estimated regression equation: CARS, = 1.32 + 4.91Y D; + 0.0012 PRICE, - 7.14 SUV (2.39) (0.00045) (71.40) 1 where CARS = new car sales (in hundreds of thousands of units) in year t, YD; = real disposable income (in hundreds of billions of dollars), PRICE = the average real price of a new car in yeart (in dollars), SUV = the number of sports utility vehicles sold in year t (in millions). You expect the variable YD to have a positive coefficient and the variables PRICE and SUV to…arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education