ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

part f please

Transcribed Image Text:The consumption and saving functions in the Keynesian model

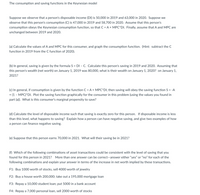

Suppose we observe that a person's disposable income (DI) is 50,000 in 2019 and 63,000 in 2020. Suppose we

observe that this person's consumption (C) is 47,000 in 2019 and 58,700 in 2020. Assume that this person's

consumption obeys the Keynesian consumption function, so that C = A + MPC*DI. Finally, assume that A and MPC are

unchanged between 2019 and 2020.

(a) Calculate the values of A and MPC for this consumer, and graph the consumption function. (Hint: subtract the C

function in 2019 from the C function of 2020).

(b) In general, saving is given by the formula S = DI - C. Calculate this person's saving in 2019 and 2020. Assuming that

this person's wealth (net worth) on January 1, 2019 was 80,000, what is their wealth on January 1, 2020? on January 1,

2021?

(c) In general, if consumption is given by the function C = A + MPC*DI, then saving will obey the saving function S = -A

+ (1 - MPC)*DI. Plot the saving function graphically for the consumer in this problem (using the values you found in

part (a)). What is this consumer's marginal propensity to save?

(d) Calculate the level of disposable income such that saving is exactly zero for this person. If disposable income is less

than this level, what happens to saving? Explain how a person can have negative saving, and give two examples of how

a person can finance negative saving.

(e) Suppose that this person earns 70,000 in 2021. What will their saving be in 2021?

(f) Which of the following combinations of asset transactions could be consistent with the level of saving that you

found for this person in 2021?

More than one answer can be correct-answer either "yes" or “no" for each of the

following combinations and explain your answer in terms of the increase in net worth implied by these transactions.

F1: Buy 1000 worth of stocks, sell 4000 worth of jewelry

F2: Buy a house worth 200,000; take out a 195,000 mortgage loan

F3: Repay a 10,000 student loan; put 5000 in a bank account

F4: Repay a 7,000 personal loan, sell 2000 worth of stocks

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education