FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:After reviewing the new activity-based costing system that Nancy Chen has implemented at IVC's CenterPoint manufacturing facility,

Tom Spencer, the production supervisor, believes that he can reduce production costs by reducing the time spent on machine setups.

He has spent the last month working with employees in the plant to change over the machines more quickly with the same reliability.

He plans to produce 109,000 units of the Sport model and 44,500 units of the Pro model in the first quarter. He believes that with his

more efficient setup routine, he can reduce the number of setup hours for both the Sport and the Pro products by 34 percent.

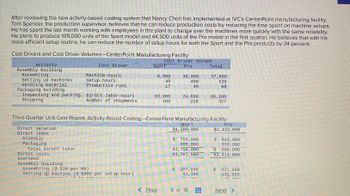

Cost Drivers and Cost Driver Volumes-CenterPoint Manufacturing Facility

Activity

Assembly building

Assembling

Setting up machines

Handling material

Packaging building

Inspecting and packing:

Shipping

Direct material

Direct labor

Assembly

Packaging.

Total direct labor.

Direct costs

Overhead

Assembly building

Cost Driver

SAREEFFSENEGER

Machine-hour's

Setup hours

Production runs

20

Direct labor-hours.

Number of shipments

Assembling (@S30 per MH)

Setting up machine ( $900 per setup hour)

IG

ARA

Third Quarter Unit Cost Report, Activity-Based Costing-CenterPoint Manufacturing Facility

Sport

$1,509,000

gi

S

W

Cost Driver Volume

Pro

Sport

6,900

49

17

63,600

189

< Prev

30, 900

490

49

24,600

218

$ 759,000

999,000

$1,758,000

$3, 267,000

$ 207,000

44,180

3 of 18

Ann

Total

37,800

539

66

www

88, 200

327

Pro

$2,418,000

$ 618,000

378,000

$ 996,000

$3,414, 000

$ 927,000

441,000

L2

Ann

Next >

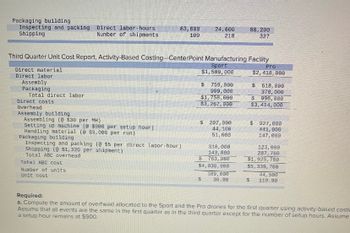

Transcribed Image Text:Packaging building

Inspecting and packing Direct labor-hours

Shipping

Number of shipments

Direct material

Direct labor

Assembly

Packaging

Third Quarter Unit Cost Report, Activity-Based Costing-CenterPoint Manufacturing Facility

Sport

$1,509,000

Total direct labor

Direct costs

Overhead

Assembly building

Assembling (@ $30 per MH)

Setting up machine (@ $900 per setup hour)

Handling material (@ $3,000 per run)

63, 600

109

Packaging building.

Inspecting and packing (@ $5 per direct labor-hour)

Shipping (@$1,320 per shipment)

Total ABC overhead.

Total ABC cost

Number of units

Unit cost

24, 600

218

759, 000

999,000

$1,758,000

$3,267,000

$207,000

44, 100

51,000

$

318,000.

143, 880

763,980

$4,030, 980

109,000

36.98

$

88, 200

327

Pro

$2,418,000

$ 618,000

378,000

$ 996,000

$3,414,000

$927,000

441, 000

147,000

123, 000

287, 760

$1,925, 760

$5,339, 760

44,500

$ 119.99

Required:

a. Compute the amount of overhead allocated to the Sport and the Pro drones for the first quarter using activity-based costin

Assume that all events are the same in the first quarter as in the third quarter except for the number of setup hours. Assume

a setup hour remains at $900.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fiske Corporation manufactures a popular regional brand of kitchen utensils. The design and variety have been fairly constant over the last three years. The managers at Fiske are planning for some changes in the product line next year, but first they want to understand better the relation between activity and factory costs as experienced with the current products. Discussions with the plant supervisor suggest that overhead seems to vary with labor-hours, machine-hours, or both. The following data were collected from the last three years of operations: Quarter Machine-Hours Labor-Hours Factory costs 1 18,850 14,905 $ 3,388,671 2 18,590 15,477 3,425,136 3 17,480 16,720 3,617,144 4 19,240 15,983 3,573,240 5 21,280 17,501 3,812,284 6 19,630 17,369 3,777,312 7 19,240 15,290 3,531,726 8 18,850 14,366 3,369,102 9 18,460 15,994 3,512,487 10 20,670 16,995 3,730,734 11 17,550 14,278 3,135,315 12 18,460 19,244 3,723,786 Required: Use the high-low method to…arrow_forwardYou have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president has asked that you review the company's costing system and "do what you can to help us get better control of our manufacturing overhead costs." You find that the company has never used a flexible budget, and you suggest that preparing such a budget would be an excellent first step in overhead planning and control. After much effort and analysis, you determined the following cost formulas and gathered the following actual cost data for March: Utilities Maintenance Supplies Indirect labor Depreciation Cost Formula $16,800+ $0.12 per machine-hour $38,200+ $1.50 per machine-hour $0.70 per machine-hour $94,900 + $1.60 per machine-hour $67,500 Actual Cost in March $ 21,000 $ 62,000 $ 13,800 $ 127,800 $ 69,200 During March, the company worked 18,000 machine-hours and produced 12,000 units. The company had originally planned to work 20,000 machine-hours during March.…arrow_forwardTrivor, Inc., produces a special line of toy racing cars. Trivor produces the cars in batches. To manufacture each batch of cars, Trivor must set up the machines and molds. Setup costs are fixed batch-level costs. In the long run, number of setup-hours is the cost driver of set up costs. A separate Setup Department is responsible for setting up machines and molds for each style of car. The following information pertains to 2020: (Click the icon to view the information.) Read the requirements. Requirement a. Calculate the spending variance for fixed setup overhead costs. (Label the variance as favorable (F) or unfavorable (U).) The spending variance for fixed setup overhead costs is Requirements Calculate the following: a. The spending variance for fixed setup overhead costs b. The budgeted fixed setup overhead rate c. The production-volume variance for fixed overhead setup costs Print Done U < Data table Units produced and sold Batch size (number of units per batch) Setup-hours per…arrow_forward

- Barbara, the manager of Metlock, is analyzing the company's MOH costs from last year. Metlock had always followed an actual costing system when determining the costs of its customizable telescopes. Barbara wondered if it would be better to switch to a normal costing system, as she had heard a number of people talking about that at an industry conference she attended the previous month. Since Metlock has a highly machine-intensive operation, machine hours are used as its MOH cost driver. Here are the costs and other MOH information Barbara is analyzing: Budgeted MOH cost Actual MOH cost Budgeted machine hours Actual machine hours $426,240 Actual MOH rate $ 419,040 Determine the actual MOH rate and the budgeted MOH rate Metlock would have used last year under actual costing and normal costing, respectively. (Round answers to 2 decimal places, e.g. 52.75.) Budgeted MOH rate $ 96,000 108,000 /machine hour /machine hourarrow_forwardYou have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president has asked that you review the company's costing system and "do what you can to help us get better control of our manufacturing overhead costs." You find that the company has never used a flexible budget, and you suggest that preparing such a budget would be an excellent first step in overhead planning and control. After much effort and analysis, you determined the following cost formulas and gathered the following actual cost data for March: Utilities Maintenance Supplies Indirect labor Depreciation Cost Formula $17,000+ $0.12 per machine-hour $38,300+ $1.70 per machine-hour $0.50 per machine-hour During March, the company worked 16,000 machine-hours and produced 10,000 units. The company had originally planned to work 18,000 machine-hours during March. Required: 1. Calculate the activity variances for March. 2. Calculate the spending variances for March.…arrow_forwardYou have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president has asked that you review the company's costing system and "do what you can to help us get better control of our manufacturing overhead costs." You find that the company has never used a flexible budget, and you suggest that preparing such a budget would be an excellent first step in overhead planning and control. After much effort and analysis, you determined the following cost formulas and gathered the following actual cost data for March: Utilities Maintenance Supplies Indirect labor. Depreciation Cost Formula $16,900 $0.14 per machine-hour $38, 300+ $1.30 per machine-hour $0.70 per machine-hour $94,700+ $1.50 per machine-hour $68, 100 Actual Cost in March $ 21,360 $ 56,800 $ 13, 100 $ 124, 100 $ 69,808 During March, the company worked 17,000 machine-hours and produced 11,000 units. The company had originally planned to work 19,000 machine-hours during…arrow_forward

- The Write Way manufactures double sided pens- a pen on one side, a highlighteron the other. As the accounting manager, Shade is responsible for presenting three different versions of the company's income statement to the rest of the management team at year-end. Team members are very familiar with absorbtion costing, as they have been evaluating gross margin amounts and percentages for years. They are lesss keen on how fixed-MOH impacts the income statment, so Shade gathers the following current information. The information includes three possible capacity levels for calculating the fixed-MOH rate. Shade also notes there are no price or efficiency variances this period. Any fixed-MOH volume variase is written off to COGS.Theoretical level - 80,000 units Practical level - 60,000 units Normal level - 50,000 units Actual production - 65,000 units Sales Volume - 60,000 units Budgeted fixed-MOH cost - $240,000 Budgeted DM cost - $2.25 per unit Budgeted DL cost -$1.30 per unit Budgeted…arrow_forwardVijayarrow_forwardDanna Lumus, the marketing manager for a division that produces a variety of paper products, was considering the divisional manager’s request for a sales forecast for a new line of paper napkins. The divisional manager was gathering data so that he could choose between two different production processes. The first process would have a variable cost of $10 per case produced and fixed costs of $100,000. The second process would have a variable cost of $6 per case and fixed costs of $200,000.The selling price would be $30 per case. Danna had just completed a marketing analysis that projected annual sales of 30,000 cases. Danna was reluctant to report the 30,000 cases forecast to the divisional manager. She knew that the first process was labor-intensive, whereas the second was largely automated with little labor and no requirement for an additional production supervisor. If the first process were chosen, Jerry Johnson, a good friend, would be appointed as the line supervisor. If the…arrow_forward

- Lay's Potato Chips is examining their Wavy Lays chip line. They began the year expecting to produce 500,000 bags of potato chips. They projected that each bag would require 3 pounds of potatos and 1.5 hours of labor to manufacture. They planned to pay $2 per pound for potatos and $20 per hour for labor. They also budgeted $900,000 for variable manufacturing overhead costs and $ 450,000 of fixed manufacturing overhead costs, with both variable and fixed manufacturing overhead costs being allocated based on direct labor hours. At the end of the year, Lay's finds that they produced 880,000 bags of potato chips, using 3.25 pounds of potatos per bag and 1.25 hours of labor per bag. Due to significant inflation, the purchasing department made a deal with the supplier and purchased 3,000,000 pounds of potatos for a per-pound price of $3.25. They also spent $22 per hour for direct labor. The Wavy Lays chip line spent $843,000 on variable manufacturing overhead costs and $562,000 on fixed…arrow_forwardYou have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president has asked that you review the company's costing system and "do what you can to help us get better control of our manufacturing overhead costs." You find that the company has never used a flexible budget, and you suggest that preparing such a budget would be an excellent first step in overhead planning and control. After much effort and analysis, you determined the following cost formulas and gathered the following actual cost data for March: Actual Cost in March Utilities Maintenance Supplies Indirect labor Depreciation Cost Formula $16,800 +$0.16 per machine-hour $38,600 + $1.30 per machine-hour $0.70 per machine-hour $94,700 + $1.30 per machine-hour $67,800 $ 22,440 $ 63,600 $ 16,600 $ 126,800 $ 69,500 During March, the company worked 22,000 machine-hours and produced 16,000 units. The company had originally planned to work 24.000 machine-hours during March.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education