CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Compute the dollar markup and the markup percent based?? Accounting

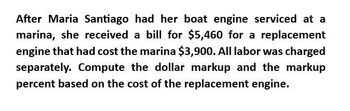

Transcribed Image Text:After Maria Santiago had her boat engine serviced at a

marina, she received a bill for $5,460 for a replacement

engine that had cost the marina $3,900. All labor was charged

separately. Compute the dollar markup and the markup

percent based on the cost of the replacement engine.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- After Jared Motorsports completed a rally race, the vehicle required a new transmission. A local mechanic charged $4,500 for a rebuilt transmission, which had cost the mechanic $3,250. All labor charges were additional. Compute the dollar markup and markup percent based on the cost of the rebuilt transmission.arrow_forwardCan i get help please?arrow_forwardhi expert please help mearrow_forward

- Kegler Bowling buys scorekeeping equipment with an invoice cost of $190,000. The electrical work required for the installation costs $20,000. Additional costs are $4,000 for delivery and $13,700 for sales tax. During the installation, the equipment was damaged and the cost of repair was $1,850. What is the total recorded cost of the scorekeeping equipment?arrow_forwardOn October 9, Wonder Inflatables Co. paid $1,150 to install a hydraulic lift and $40 for an air filter for one of its delivery trucks. Journalize the entries for the new lift and air filter expenditures.arrow_forwardRizio Company purchases a machine for $14,800, terms 2/10, n/60, FOB shipping point. Rizio paid within the discount period and took the $296 discount. Transportation costs of $334 were paid by Rizio. The machine required mounting and power connections costing $1,023. Another $482 is paid to assemble the machine, and $40 of materials are used to get it into operation. During installation, the machine was damaged and $350 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine. Amount Included in Cost of Equipment: Invoice price of machine Net purchase price Total cost to be recordedarrow_forward

- Rizio Company purchases a machine for $10,600, terms 1/10, n/60, FOB shipping point. Rizio paid within the discount period and took the $106 discount. Transportation costs of $240 were paid by Rizio. The machine required mounting and power connections costing $733. Another $346 is paid to assemble the machine, and $40 of materials are used to get it into operation. During installation, the machine was damaged and $325 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine.arrow_forwardRizio Company purchases a machine for $13,600, terms 2/10, n/60, FOB shipping point. Rizio paid within the discount period and took the $272 discount. Transportation costs of $307 were paid by Rizio. The machine required mounting and power connections costing $940. Another $443 is paid to assemble the machine, and $40 of materials are used to get it into operation. During installation, the machine was damaged and $270 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine, Amount Included in Cost of Equipment: Invoice price of machine 24 13,600 272 Net purchase price 13,328 Transportation 307 Mounting and power connections 940 Assembly 443 Materials used in adjusting 40 Total cost to be recorded 2$ 15,058 eBook Pro G Search or type URL ** %23 $4 & 2 4. 6 7 10 E T Y U D F G H. K Larrow_forwardOn August 7, Green River Inflatables Co. paid $1,675 to install a hydraulic lift and $40 for an air filter for one of its delivery trucks. Journalize the entries for the new lift and air filter expenditures.arrow_forward

- Rizio Co. purchases a machine for $12,500, terms 2∕10, n∕60, FOB shipping point. Rizio paid within the discount period and took the $250 discount. Transportation costs of $360 were paid by Rizio. The machine required mounting and power connections costing $895. Another $475 is paid to assemble the machine, and $40 of materials are used to get it into operation. During installation, the machine was damaged and $180 worth of repairs were made. Compute the cost recorded for this machine.arrow_forwardRizio Co. purchases a machine for $14,800, terms 1/10, n/60, FOB shipping point. Rizio paid within the discount period and took the $148 discount. Transportation costs of $334 were paid by Rizio. The machine required mounting and power connections costing $1,023. Another $482 is paid to assemble the machine and $40 of materials are used to get it into operation. During installation, the machine was damaged and $215 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine. Amount Included in Cost of Equipment: Invoice price of machine Net purchase price Total cost to be recordedarrow_forwardRizio Company purchases a machine for $13,800, terms 2/10, n/60, FOB shipping point. Rizio paid within the discount period and took the $276 discount. Transportation costs of $312 were paid by Rizio. The machine required mounting and power connections costing $954. Another $450 is paid to assemble the machine, and $40 of materials are used to get it into operation. During installation, the machine was damaged and $285 worth of repairs were made.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you