Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

How much interest expense is incurred?

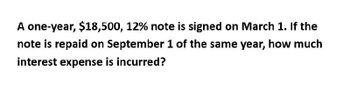

Transcribed Image Text:A one-year, $18,500, 12% note is signed on March 1. If the

note is repaid on September 1 of the same year, how much

interest expense is incurred?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A one-year, $22,400, 10% note is signed on May 1. If the note is repaid on November 1 of the same year, how much interest expense is incurred?arrow_forwardHow much interest expense is incurred?arrow_forwardAssuming a 360-day year, when a $12,750, 90-day, 11% interest-bearing note payable matures, total payment will amount to: Select the correct answer. $1,403 $14,153 $13,101 $351arrow_forward

- A promissory note has the following details: Principal: $5,000 . Term: 90 days . Interest: $150 Find the interest rate (Assume a 360- day year).arrow_forwardA company needs to record six months of accrued interest on a four-year, 12%, $12,000 promissory note payable. How much interest expense should be accrued? $2,160 $720 $1,440 $1,080arrow_forwardJain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual interest rate of 3.5%, due in 6 months. What journal entry is created when Jain honors the note?arrow_forward

- Sunshine Service Center received a 120-day, 6% note for $40,000, dated April 12 from a customer on account. Assume 360 days per year. a. Determine the due date of the note. b. Determine the maturity value of the note. When required, round your answers to the nearest dollar.$fill in the blank df5724f79f8d02f_2 c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Aug. 10 Cash Cash Note Receivable Note Receivable Interest Revenue Interest Revenuearrow_forwardplease help mearrow_forwardPlease help me.with this question general Accountingarrow_forward

- Lone Star Company received a 90-day, 6% note for $80,000, dated March 12 from a customer on account. (Assume a 360-day year when calculating interest.) a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. June 10arrow_forwardOn April 1, 20X1, Nelsen Inc. accepts a $100,000, 8% note. The note receivable and interest are due on March 31, 20X2 (one year later). On March 31, 20X2, Nelson Inc. will record interest revenue of: $2,000. $8,000. $6,000. $0.arrow_forwardOn November 1, Alan Company signed a 120-day, 12% note payable, with a face value of $19,800. What is the adjusting entry for the accrued interest at December 31 on the note? (Use 360 days a year.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College