FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Advertising expense

Buildings

Salaries expense

Accounts payable

Cash

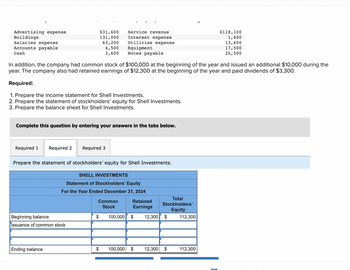

In addition, the company had common stock of $100,000 at the beginning of the year and issued an additional $10,000 during the

year. The company also had retained earnings of $12,300 at the beginning of the year and paid dividends of $3,300.

Required:

1. Prepare the income statement for Shell Investments.

2. Prepare the statement of stockholders' equity for Shell Investments.

3. Prepare the balance sheet for Shell Investments.

Required 1

Complete this question by entering your answers in the tabs below.

$31,600

131,000

63,200

4,500

3,600

Required 2 Required 3

Ending balance

Prepare the statement of stockholders' equity for Shell Investments.

Beginning balance

Issuance of common stock

Service revenue

Interest expense

Utilities expense

Equipment

Notes payable

SHELL INVESTMENTS

Statement of Stockholders' Equity

For the Year Ended December 31, 2024

Common

Stock

$

$

Retained

Earnings

100,000 $

100,000 $

12,300

Total

Stockholders'

Equity

$

12,300 $

112,300

$118,100

1,600

13,600

17,500

20,500

112,300

Expert Solution

arrow_forward

Step 1: Define Statement of Stockholder's Equity -

Stockholder's Equity includes common stock and retained earnings. Issuance of common stock will add to the value of common stock. Retained Earnings include profit earned during the financial year.

Retained earnings will decrease the value of dividend declaration and loss incurred by the company.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company issues 50,000 shares of common stock to retire 15-year bonds payable. This transaction would be reported on the statement of cash flows in O a. the cash flows from investing activities section O b. the cash flows from operating activities section O c. a separate section at the bottom O d. the cash flows from financing activities sectionarrow_forwardA company had the following selected data for two consecutive years of operation. Year 1 $12,000,000 6,000,000 Interest expense 300,000 Income tax expense 790,000 Profit 1,850,000 Using this data, determine the percentage change in the company's debt to total assets ratio from Year 1 to Year 2. Total assets Total liabilities O increase of 2% decrease of 8% no change O increase of 1% Year 2 $15,000,000 7,800,000 450,000 900,000 2,250,000arrow_forwardDetermining Retained Earnings and Net Income The following information appears in the records of Bock Corporation at year-end: Accounts Receivable $23,000 Retained Earnings ? Accounts Payable 00 Supplies Cash Common Stock 110,000 9,000 8,000 Equipment, net 154,000 a. Calculate the balance in Retained Earnings at year-end $ 0 b. If the amount of the retained earnings at the beginning of the year was $30,000 and $12,000 in dividends is paid during the year, calculate net income for the year. $42,000arrow_forward

- ces For the year just completed, Hanna Company had net income of $90,500. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable December 31 End of Year $ 55,000 $ 152,000 $ 451,000 $ 12,000 $ 356,000 $ 8,000 $ 35,000 Beginning of Year $ 83,000 $184,000 $ 343,000 $ 14,000 $ 400,000 $ 11,500 $ 27,000 The Accumulated Depreciation account had total credits of $58,000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash and cash outflows as negative amounts.) Hanna Company Statement of Cash Flows-Indirect Method (partial) +arrow_forward5arrow_forwardConsolidated Statements of Earnings For the Years Ended December 31, (in thousands of dollars) Year 8 Sales $64,000 Cost of sales. 50,000 Gross profit 14,000 Operating expenses before interest and income taxes 8,000 Interest expense 1,780 Earnings before income taxes 4,220 Income tax expense 1,900 Net earnings $ 2,320 MORKSEN CORP. Consolidated Statements of Financial Position At December 31, (in thousands of dollars) Year 8 Year 7 Assets Current assets Cash $ 480 $ 380 740 10,880 Short-term investments Accounts receivable 740 8,400 Merchandise inventory 16,660 10,060 Total current assets 28,660 19,680 Property, plant, and equipment Land 4,000 4,000 Buildings and equipment 26,000 26,000 30,000 30,000 8,940 7,440 Less: Accumulated depreciation. Net property, plant, and equipment 21,060 22,560 Total assets $49,720 $42, 240 Liabilities and Shareholders' Equity Current Liabilities Bank loan $16,500 $11,400 Accounts payable 6,000 4,300 Other liabilities 1,640 1,600 Income tax payable 960…arrow_forward

- Shareholders' Equity Tinman Corporation reports the following balances at the end of the current year: Common Stock, $5 par, $50,000; Retained earnings, $110,000; Additional Paid-in Capital on Common Stock, $200,000; Income Taxes Payable, $9,800; and Accumulated Other Comprehensive Income, $26,000. Prepare the shareholders' equity section of Tinman's year-end balance sheet. Tinman Corporation Partial Balance Sheet December 31 Shareholders' Equity Contributed Capital: Total contributed capital Total Shareholders' Equityarrow_forwardSedona Corporation declared and paid a cash dividend of $6,800 in the current year. Its comparative financial statements, prepared at December 31, reported the following summarized information: Current Year Previous Year Income Statement $ 120,000 56,000 64,000 38,000 4,200 21,800 6,540 $ 15,260 $ 107,000 52,000 55,000 34,600 4,200 16,200 4,860 Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Interest Expense Income before Income Tax Expense Income Tax Expense (30%) Net Income $ 11,340 Balance Sheet Cash $ 72,110 19,000 27,000 97,000 $ 215,110 $ 44,000 1,050 42,000 87,050 91,200 36,860 Accounts Receivable, Net Inventory Property and Equipment, Net $ 36,000 14,000 40,000 107,000 $ 197,000 $ 34,800 600 42,000 77,400 91,200 28,400 Total Assets Accounts Payable Income Tax Payable Notes Payable (long-term) Total Liabilities Common Stock (par $10) Retained Earnings Total Liabilities and Stockholders' Equity $ 215,110 $ 197,000arrow_forwardUse the horizontal model, or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at Kissick Co. Issued 210,000 shares of $6-par-value common stock for $1,260,000 in cash. Borrowed $540,000 from Oglesby National Bank and signed a 13% note due in two years. Incurred and paid $420,000 in salaries for the year. Purchased $650,000 of merchandise inventory on account during the year. Sold inventory costing $630,000 for a total of $980,000, all on credit. Paid rent of $110,000 on the sales facilities during the first 11 months of the year. Purchased $170,000 of store equipment, paying $50,000 in cash and agreeing to pay the difference within 90 days. Paid the entire $120,000 owed for store equipment and $610,000 of the amount due to suppliers for credit purchases previously recorded. Incurred and paid utilities expense of $44,000 during the year. Collected $845,000 in cash from customers during…arrow_forward

- Create a Balance sheet for this information given:arrow_forwardBalance sheet and income statement data indicate the following: Company A Company B $1,200,000 495,000 75,000 50,000 21,000 Bonds payable, 8%, 24-year bonds Income before income tax for year Income tax for year Interest payable Interest receivable 28,000 a. For each company, what is the times interest earned ratio? (Round to one decimal place.) $900,000 130,000 12,000 Company A Company B b. Which company gives potential creditors more protection?arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education