FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

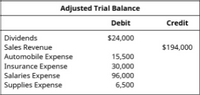

Use the following excerpts from the year-end Adjusted

Transcribed Image Text:Adjusted Trial Balance

Debit

Credit

Dividends

$24,000

Sales Revenue

$194,000

Automobile Expense

Insurance Expense

Salaries Expense

Supplies Expense

15,500

30,000

96,000

6,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The journal entry to close the Fees Earned, $750, and Rent Revenue, $175, accounts during the year-end closing process would involve:arrow_forwardWhat impact does an increase in expenses have on net income?arrow_forwardOn January 5, Barnaby, Incorporated, purchased a patent costing $100,000 with a useful life of 20 years. The company records its adjusting entries at the end of each year on December 31. Complete the necessary adjusting entry by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. View transaction list Journal entry worksheet On January 5, Barnaby, Inc., purchased a patent costing $100,000 with a useful life of 20 years. The company records its adjusting entries at the end of each year on December 31. Note: Enter debits before credits. Date Dec. 31 General Journal Debit Creditarrow_forward

- Which accounts remain open at end of year and carried over to the following year?arrow_forwardCarla Vista Corporation has the following selected transactions during the year ended December 31, 2024: Jan. 1 Purchased a copyright for $117.480 cash. The copyright has a useful life of six years and a remaining legal life of 30 years. Mar. 1 Sept. 1 Dec. 31 Acquired a franchise with a contract period of nine years for $500,850; the expiration date is March 1, 2033, Paid cash of $38,820 and borrowed the remainder from the bank. Purchased a trademark with an indefinite life for $73,190 cash. As the purchase was being finalized, spent $33.150 cash in legal fees to successfully defend the trademark in court. Purchased an advertising agency for $640,000 cash. The agency's only assets reported on its statement of financial position immediately before the purchase were accounts receivable of $58,000, furniture of $170,000, and leasehold improvements of $320,000. Carla Vista hired an independent appraiser who estimated that the fair value of these assets was accounts receivable $58,000,…arrow_forwardA fiscal period is any period of time covering a complete accounting cycle. A fiscal year consists of 12 consecutive months. The accounting cycle represents the sequence of steps in the accounting process completed during the fiscal period. Which of the following would be considered a fiscal year? (Select "Yes" for the items that are applicable and "No" for the items that do not apply) August 1, 20-- to November 30, 20-- January 1, 20-- to December 31, 20-- May 1, 20-- to April 30, 20-- July 1, 20-- to June 30, 20--arrow_forward

- CLOSING ENTRIES AND POST-CLOSING TRIAL BALANCE Refer to thework sheet in Problem 6-7A for Megaffin's Repairs. The trial balanceamounts (before adjustments) have been entered in the ledger accountsprovided in the working papers. If you are not using the working papersthat accompany this book, set up ledger accounts and enter thesebalances as of January 31, 20--. A chart of accounts is provided attached. REQUIRED 1. Journalize (page 10) and post the adjusting entries.2. Journalize (page 11) and post the closing entries.3. Prepare a post-closing trial balance.arrow_forwardcompany received a deposit for $19600 last month for services to be provided in the current month, October. By the end of October the services have been provided. What does the appropriate journal entry include at the end of October?arrow_forwardthe accounts that remain open are carried overfrom year to yeararrow_forward

- I need help with: · Entering adjustments on the spreadsheet provided. · Using the new and adjusted totals, calculate the totals on the financial statements in the spaces provided.arrow_forwardKA. Using the public company, you chose for the Topic 4 assignment (The Home Depot, INC) determine the filing requirements and deadlines based on its fiscal year-end. Specifically, what type of filer is the company? What types of filings are required? What are the company's deadlines for filing its 10-K, 10-Q, and 8-K? Why does the company need to file based on these specifications?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education