Concept explainers

Classification of Transactions

Below are several transactions that took place in Seneca Company last year:

a. Paid suppliers for inventory purchases.

b. Bought equipment for cash.

c. Paid cash to repurchase its own stock.

d. Collected cash from customers.

e. Paid wages to employees.

f. Equipment was sold for cash.

g. Common stock was sold for cash to investors.

h. Cash dividends were declared and paid.

i. A long-term loan was made to a supplier.

j. Income taxes were paid to the government.

k. Interest was paid to a lender.

l. Bonds were retired by paying the principal amount due.

Required:

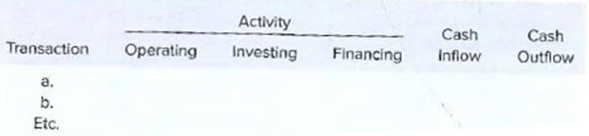

Prepare an answer sheet with the following headings:

Enter the transactions above on your answer sheet and indicate how each of them would be classified on a statement of

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- The following changes took place last year in Pavolik Company’s balance sheet accounts: Asset and Contra-Asset Accounts Liabilities and Stockholders' Equity Accounts Cash and cash equivalents $ 19 D Accounts payable $ 59 I Accounts receivable $ 23 I Accrued liabilities $ 23 D Inventory $ 56 D Income taxes payable $ 28 I Prepaid expenses $ 18 I Bonds payable $ 196 I Long-term investments $ 20 D Common stock $ 92 D Property, plant, and equipment $ 380 I Retained earnings $ 79 I Accumulated depreciation $ 79 I D = Decrease; I = Increase. Long-term investments that cost the company $20 were sold during the year for $44 and land that cost $43 was sold for $23. In addition, the company declared and paid $17 in cash dividends during the year. Besides the sale of land, no other sales or retirements of plant and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock. The company’s income…arrow_forward16. Elaine Company experienced the following changes in selected accounts for the current year as reflected below. What total amount of cash was received from customers during the year? Accrual sales 5,000,000 Accounts receivable: January 1 800,000 December 31. 500,000 Advances from customers: January 1 300,000 December 31 400,000 a. 5,400,000 b. 5,300,000 c. 4,800,000 Od. 4,600,000arrow_forwardSuppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company’s comparative balance sheet, at December 31, is presented here.arrow_forward

- The following transactions occurred during a company’s first year of operations: Purchased a delivery van for cash Borrowed money by issuance of short-term debt Purchased treasury stock Which of the items above caused a change in the amount of working capital? A.I and II only. B.I only. C.I and III only. D.II and III only.arrow_forwardJournalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forwardSelect the financial statement to which the item belongs. Items a. The change in retained earnings due to net income and dividends. b. Amount of cash received from borrowing money from a local bank. c. Revenue from sales to customers during the year. d. Total amounts owed to workers at the end of the year. Financial Statementsarrow_forward

- 1arrow_forwardYowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) issued stock for $68,0002) borrowed $39,000 from its bank3) provided consulting services for $67,000 cash4) paid back $29,000 of the bank loan5) paid rent expense for $16,0006) purchased equipment for $26,000 cash7) paid $4,400 dividends to stockholders8) paid employees' salaries of $35,000 What is Yowell's net income for Year 1?arrow_forwardAnalyzing Transactions Using the Financial Statement Effects Template Following are selected transactions of Mogg Company. Record the effects of each using the financial statement effects template. 1. Shareholders contribute $15,000 cash to the business in exchange for common stock. 2. Employees earn $750 in wages that have not been paid at period-end. 3. Inventory of $4,500 is purchased on credit. 4. The inventory purchased in transaction 3 is sold for $6,750 on credit. 5. The company collected the $6,750 owed to it per transaction 4. 6. Equipment is purchased for $7,500 cash. 7. Depreciation of $1,500 is recorded on the equipment from transaction 6. 8. The Supplies account had a $3,800 balance at the beginning of this period; a physical count at period-end shows that $1,200 of supplies are still available. No supplies were purchased during this period. 9. The company paid $15,000 cash toward the principal on a note payable; also, $750 cash is paid to cover this note's interest…arrow_forward

- Packard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $1.400 cash from the issue of common stock. 2) Borrowed $870 from a bank. 3) Earned $1,100 of revenues. 4) Paid expenses of $340 5) Paid a $140 dividend During Year 2. Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $775 of common stock. 2) Repaid $535 of its debt to the bank. 3) Earned revenues of $1,200. 4) Incurred expenses of $540. (5) Paid dividends of $190. The amount of total liabilities on Packard's Year 1 balance sheet is Multiple Choice с $870 $1,210 $610 $335 Drow 50 Nextarrow_forwardI need help with this question. The format of how to respond is belowarrow_forwardA company has current assets of $475,000 and current liabilities of $325,000. For each action on the right, indicate the effect on the current ratio (Increase, decrease, or no change). Analyze each action independently of the others. v The company uses cash to pay off a bank loan that is not due for two years. A. No change. B. Increase, v The company collects cash from outstanding accounts receivable. C. Decrease. v The company recognizes insurance expense from a prepaid insurance asset. v The company receives cash from issuing new shares of stock. v The company sells $9,500 of products on account. Using FIFO, the cost of goods sold for the products is $5,200. v The company acquires $12,000 of inventory on account. earch 12:01 PM 5/5/2021 DELL F3 F4 F5 F6 F7 F8 F9 F10 F11 F12 PrtScr Insert Delete #3 %2$ 近arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education