FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

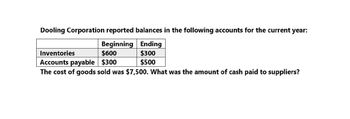

Dooling Corporation reported balances in the following accounts for the current year:

Transcribed Image Text:Dooling Corporation reported balances in the following accounts for the current year:

Beginning

$600

Ending

$300

Inventories

Accounts payable $300

$500

The cost of goods sold was $7,500. What was the amount of cash paid to suppliers?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cold Duck Manufacturing Inc. has the following end-of-year balance sheet: Cold Duck Manufacturing Inc. Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: Current Liabilities: Cash and equivalents $150,000 Accounts payable $250,000 Accounts receivable 400,000 Accrued liabilities 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 Net plant and equipment(cost minus depreciation) $2,100,000 Total Debt $1,500,000 Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity $1,500,000 Total Assets $3,000,000 Total Liabilities and Equity $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Cold Duck Manufacturing Inc. generated $350,000 net income on sales of…arrow_forwardWrite a journal entry for the following beginning balance: “accounts receivable (net of allowance of 5200) 235,884"arrow_forwardThe financial statements for Castile Products, Incorporated, are given below: Castile Products, Incorporated Balance Sheet December 31 Assets Current assets: Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 10% Total liabilities. Stockholders equity Connon stock, $5 per value. Retained earnings Total stockholders equity Total liabilities and stockholders' equity Castile Products, Incorporated Income Statement For the Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net incone before taxes Income taxes (30%) Net income $24,000 230,000 370,000 9,000 633,000 860,000 $1,493,000 $ 290,000 320,000 610,000 $150,000. 733,000 883,000 $1,493,000 $ 2,290,000 1,220,000 1,070,000 580,000 490,000 32,000 458,000 137,400 $ 320,600arrow_forward

- On the basis of the following data related to assets due within one year for simmons Co. prepared partial balance sheet in good from at december 31, show total current asset Cash 96,000 Notes receivable 50,000 Accounts receivable 275,000 Allowance for Doubtfull Account 40,000 Interest Receivable 1,000arrow_forwardWildhorse Corporation, a publicly traded company, is preparing the comparative financial statements to be included in the annual report to shareholders. Wildhorse's fiscal year ends May 31. The following information is available. 1. 2. 3. 4. 5. 6. 7. 1. Income from operations before income tax for Wildhorse was $1,500,000 and $1,900,000, respectively, for the fiscal years ended May 31, 2021, and 2020. 2. Wildhorse experienced a loss from discontinued operations of $600,000 from a business segment disposed of on March 3, 2021. A 20% combined income tax rate applies to all of Wildhorse Corporation's profits, gains, and losses. Wildhorse's capital structure consists of preferred shares and common shares. The company has not issued any convertible securities or warrants and there are no outstanding stock options. Wildhorse issued 136,000 of $10 par value, 5% cumulative preferred shares in 2013. All of these shares are outstanding, and no preferred dividends are in arrears. Determine the…arrow_forwardThe following information has been extracted from the annual reports of Lilydale Ltd and Monbulk Ltd. Lilydale Ltd Monbulk Ltd $2 950 300 17 100 Sales (net credit) revenue for year Allowance for Doubtful Debts, 1/7/18 Allowance for Doubtful Debts, 30/6/19 Accounts receivable (gross) 1/7/18 Accounts receivable (gross) 30/6/19 $2 204 300 27 100 19780 28 100 722 650 368 000 485 800 384 200 (a) Calculate the receivables turnover ratio and average collection period for both companies. Comment on the difference in their collection experiences. (b) Compare the success or otherwise of their cash collection policies, given that the average receivables turnover for the industry in which the companies operated is 7. Credit terms for both companies are 2/10, n/30.arrow_forward

- The year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $34,000; Liabilities = ?; Common Stock = $6,400; Revenue = $13,800; Dividends = $1,450; Beginning Retained Earnings = $4,450; Ending Retained Earnings = $8,400.The amount of liabilities reported on the end-of-period balance sheet was:arrow_forwardSelected income statement data follow for Harper, Inc., for the year ended December 31 (in thousands). What is the company's times interest earned ratio? Operating income before interest Interest expense Operating income after interest Income tax Income after tax 35.6 30.6 11.2 24.4 6,617 189 6.428 1,607 4,821arrow_forward1. The following account balances were extracted from the accounting records of Macy Corporation at the end of the year:Accounts Receivable $1,100,000Allowance for Uncollectible Accounts (Credit) $37,000Uncollectible-Account Expense $63,000What is the net realizable value of the accounts receivable? Select one:A. $1,163,000B. $1,137,000C. $1,100,000D. $1,063,000 Please show all steps.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education