FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

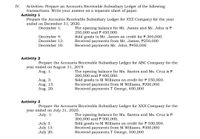

Transcribed Image Text:Activities: Prepare an Accounts Receivable Subsidiary Ledger of the following

transactions. Write your answer on a separate sheet of paper.

Activity 1

Prepare the Accounts Receivable Subsidiary Ledger for XYZ Company for the year

ended on December 31, 2020.

IV.

December 1:

The opening balance for Mr. James and Mr. John is P

250,000 andP 450,000.

Sold goods to Mr. James on credit for P 300,000.

Received payments from Mr. James, P250,000

Received payments Mr. John, P450,000

December 4:

December 12:

December 16:

Activity 2

Prepare the Accounts Receivable Subsidiary Ledger for ABC Company for the

year ended on August 31, 2019.

Aug. 1:

Aug. 3:

Aug. 13:

Aug. 20:

The opening balance for Ms. Santos and Ms. Cruz is P

200,000 and P 400,000.

Sold goods to M Williams on credit for P 350,000.

Received payments from M Williams, P200,000

Received payments T George, 400,000

Activity 3

Prepare the Accounts Receivable Subsidiary Ledger for XXX Company for the

year ended on July 31, 2020.

July. 1:

July 3:

July 13:

July 20:

The opening balance for Ms. Santos and Ms. Cruz is P

300,000 and P 500,000.

Sold goods to M Williams on credit for P 300,000.

Received payments from M Williams, P300,000

Received payments T George, 500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress On May 10, Sunland Company sold merchandise for $5.800 and accepted the customer's Best Business Bank MasterCard. At the end of the day, the Best Business Bank MasterCard receipts were deposited in the company's bank account. Best Business Bank charges a 4.5% service charge for credit card sales. Prepare the entry on Sunland Company's books to record the sale of merchandise. (Omit cost of goods sold entries.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation May 10 eTextbook and Media Save for Later Debit Credit Attempts: 0 of 2 used Submit Answerarrow_forwardcharrow_forwardPharoah Company has a balance in its Accounts Payable control account of $8,460 on January 1, 2022. The subsidiary ledger contains three accounts: Hale Company, balance $2,970; Janish Company, balance $1,770; and Valdez Company. During January, the following payable-related transactions occurred. Purchases Payments Returns Hale Company $6,750 $5,990 $ 0 Janish Company 5,060 1,770 3,500 Valdez Company 5,885 6,430 0 What is the January 1 balance in the Valdez Company subsidiary account? Balance in the Valdez Company subsidiary account $arrow_forward

- On December 1, 2022 Pharoah Company had the following account balances. Cash Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment (a) 12 17 During December, the company completed the following transactions. 19 22 26 31 Dec. 7 Received $3,640 cash from customers in payment of account (no discount allowed). Purchased merchandise on account from Green Co. $12,800, terms 1/10, n/30. Sold merchandise on account $15,600, terms 2/10, n/30. The cost of the merchandise sold was $10,200. Debits $18,100 Date 2,300 7,690 15,500 1,620 30,800 + $76,010 + Accumulated Depreciation-Equipment Accounts Payable Common Stock Retained Earnings Paid salaries $2,030. Paid Green Co. in full, less discount. Received collections in full, less discounts, from customers billed on December 17. Received $2,650 cash from customers in payment of account (no discount allowed). Credits Journalize the December transactions. (Assume a perpetual inventory system.) (Credit account titles are…arrow_forwardJournalize the transactions shown below in the two-column general journal that follows. Calculate HST (13%) on all sales transactions. | Oct. 2 Cash Sales Slip No. 102 to S. Stewart, $102.50 plus taxes. 6 Sales Invoice No. 617 to Jack Morrison, $250.90 plus taxes. Cheque Copy 10 No. 910 to Industrial Suppliers, $500 on account. Cash Receipt From Jack Mahoney, $322.50 on account. 12 18 Purchase Invoice From Grand's Stationers, S60.50 for office supplies taxes. 20 Cheque Copy No. 911 to Jack Whitcombe, $525 for personal use. 24 Bank Debit Memo $31.90 for bank service charge. Cash Sales Slip No. 103 to J. Beck, $450 plus taxes. 31arrow_forwardnkt.1arrow_forward

- Following is information from Fredrickson Company for its first month of business. Credit Sales Jan. 10 Stern Company 19 Diaz Brothers 23 Rex Company Required 1 Required 2 1. Journalize the above transactions in the accounts receivable subsidiary ledger. 2. Journalize the accounts receivable balance listed in the general ledger at month's end. Date $4,200 1,700 2,650 Complete this question by entering your answers in the tabs below. Date Journalize the above transactions in the accounts receivable subsidiary ledger. Debit ACCOUNTS RECEIVABLE LEDGER Stern Company Debit Cash Collections Jan. 20 Stern Company 28 Diaz Brothers 31 Rex Company Credit Diaz Brothers Credit $ 2,100 1,700 1,378 Balance Balancearrow_forwardProvide the answer is correct optionarrow_forwardJournal Entries for Accounts and Notes ReceivablePittsburgh, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $33,000, 60 day, eight percent note on account from J. Albert. Aug.7 Received payment from J. Albert on her note (principal plus interest). Sep.1 Received an $39,000, 120 day, nine percent note from R.T. Matthews Company on account. Dec.16 Received a $31,800, 45 day, ten percent note from D. Leroy on account. Dec.30 R.T. Matthews Company failed to pay its note. Dec.31 Wrote off R.T. Matthews account as uncollectible. Pittsburgh, Inc. uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $48,200. An analysis of aged receivables indicates that the desired balance of the allowance account should be $43,000.…arrow_forward

- Please Include June 23 transaction on page 11arrow_forwardTanger Company has three customers: E, F, and G. The beginning accounts receivable subsidiary ledger of customers F and G have $2,600 and $1,500, respectively. The beginning Accounts Receivable balance in the general ledger is $12,000. Calculate the ending amount in the accounts receivable subsidiary ledger account of customer E, if customer E also made a $3,900 payment. OA. $4,000 OB. $3,900 OC. $1,500 OD. $2,600arrow_forwardRecord the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education