FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

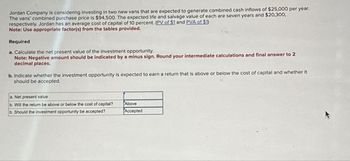

Transcribed Image Text:Jordan Company is considering investing in two new vans that are expected to generate combined cash inflows of $25,000 per year.

The vans' combined purchase price is $94,500. The expected life and salvage value of each are seven years and $20,300,

respectively. Jordan has an average cost of capital of 10 percent. (PV of $1 and PVA of $1)

Note: Use appropriate factor(s) from the tables provided.

Required

a. Calculate the net present value of the investment opportunity.

Note: Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to 2

decimal places.

b. Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it

should be accepted.

a. Net present value

b. Will the return be above or below the cost of capital?

b. Should the investment opportunity be accepted?

Above

Accepted

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The management of NUBD Co. is considering three investment projects-W, X, and Y. Project W would require an investment of P21,000, Project X of P66,000, and Project Y of P95,000. The present value of the cash inflows would be P22,470 for Project W, P73,920 for Project X, and P98,800 for Project Y. Rank the projects according to the profitability index, from most profitable to least profitable. *arrow_forwardGonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on investments is 10%. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year Initial investment 1. 2. 3. Net Cash Flows Project 1 $(60,000) 15,000 27,400 22,000 Project 2 $(55,500) 35,000 15,000 22,000 a. Compute payback period for each project. Based on payback period, which project is preferred? b. Compute net present value for each project. Based on net present value, which project is preferred?arrow_forwardMonterey Company is considering investing in two new vans that are expected to generate combined cash inflows of $30,000 per year. The vans’ combined purchase price is $93,000. The expected life and salvage value of each are four years and $23,000, respectively. Monterey has an average cost of capital of 7 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required Calculate the net present value of the investment opportunity. (Round your intermediate calculations and final answer to 2 decimal places.) Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted.arrow_forward

- Find internal rate of return of a project with an initial cost of $43,000, expected net cash inflows of $9,550 per year for 8 years, and a cost of capital of 10.50%.Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. Group of answer choices 15.05% 14.60% 14.90% 16.24% 17.73%arrow_forwardPhoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $234,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 14,000 $ 98,000 Year 2 110,000 98,000 Year 3 170,000 98,000 Totals $ 294,000 $ 294,000 a. The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted.b. Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.arrow_forwardBlossom Company accumulates the following data concerning a proposed capital investment: cash cost $217,280, net annual cash flows $44,000, and present value factor of cash inflows for 10 years is 5.22 (rounded). (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45).) Determine the net present value, and indicate whether the investment should be made. Net present value 24 The investment be made.arrow_forward

- Kelli is considering a project that would last for 3 years and have a cost of capital of 10.98 percent. The relevant level of net working capital for the project is expected to be $9,620.00 immediately (at year 0); $30,700.00 in 1 year; $27,500.00 in 2 years; and $8,520.00 in 3 years. Relevant expected operating cash flows and cash flows from capital spending in years 0, 1, 2, and 3 are presented in the following table. What is the net present value of this project? Operating cash flows Year 0 $0.00 Year 1 Year 2 Year 3 $52,500.00 $52,500.00 $52,500.00 Cash flows from capital spending -$97,700.00 $0.00 $0.00 $7,800.00 O $99,678.69 (plus or minus $10) $84,352.32 (plus or minus $10) O $114,320.23 (plus or minus $10) $24,215.27 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forwardHook Industries is considering the replacement of one of its old metal stamping machines. Three alternative replacement machines are under consideration. The cash flows associated with each are shown in the following table attached: . The firm's cost of capital is 10%. a. Calculate the net present value (NPV) of each press. b. Using NPV, evaluate the acceptability of each press. c. Rank the presses from best to worst using NPV.arrow_forwardBeyer Company is considering buying an asset for $350,000. It is expected to produce the following net cash flows. Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal places.)arrow_forward

- A project that costs $2,300 to install will provide annual cash flows of $730 for each of the next 5 years. a. Calculate the NPV if the opportunity cost of capital is 12%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV b. Is this project worth pursuing? Yes O No c. What is the project's internal rate of return IRR? (Do not round intermediate calculations. Round your answer to 2 decimal places.) %24arrow_forwardCitrus Company is considering a project with estimated annual net cash flows of $28,755 for nine years that is estimated to cost $135,000 Citrus's cost of capital is 11 percent. Required: 1. Determine the net present value of the project. (Future Value of $1, Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) 2. Based on NPV, determine whether project is acceptable to Citrus. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the project. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your final answer to 2 decimal places. Net Present Value Show less Aarrow_forwardPhoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $330,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 46,000 $ 130,000 Year 2 142,000 130,000 Year 3 202,000 130,000 Totals $ 390,000 $ 390,000 a. The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted.b. Using the answer from part a, is the internal rate of return higher or lower than 8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education