FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

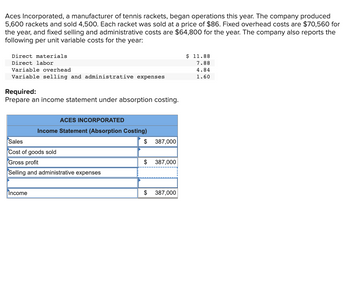

Transcribed Image Text:Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced

5,600 rackets and sold 4,500. Each racket was sold at a price of $86. Fixed overhead costs are $70,560 for

the year, and fixed selling and administrative costs are $64,800 for the year. The company also reports the

following per unit variable costs for the year:

Direct materials

Direct labor

Variable overhead

Variable selling and administrative expenses

Required:

Prepare an income statement under absorption costing.

ACES INCORPORATED

Income Statement (Absorption Costing)

Sales

Cost of goods sold

Gross profit

Selling and administrative expenses

Income

$

$

387,000

387,000

$ 387,000

$ 11.88

7.88

4.84

1.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,450 rackets and sold 5,630. Each racket was sold at a price of $90. Fixed overhead costs are $96,850 per year, and fixed selling and administrative costs are $68,200 per year. The company also reports the following per unit variable costs for the year. Direct materials $ 12 Direct labor 8 Variable overhead 5 Variable selling and administrative expenses 2 Prepare an income statement under variable costing.arrow_forwardam. 121.arrow_forwardWestern Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are $80,910 in March and rose to $93,120 in April. It costs Western Trucking $0.14 per mile in variable costs. In March, the delivery trucks were driven a total of 87,000 miles, and in April, they were driven a total of 97,000 miles. Using this information, answer the following: A. What were the total costs to operate the fleet in March and April, respectively? March April Total cost $fill in the blank 1 $fill in the blank 2 B. What were the cost per mile to operate the fleet in March and April, respectively? If required, round your answers to nearest cent. March April Cost per mile $fill in the blank 3 $fill in the blank 4arrow_forward

- The following information pertains to the first year of operation for Crystal Cold Coolers Inc.: Number of units produced Number of units sold Unit sales price Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit ($224,000/2,800 units) Total variable selling expenses ($11 per unit sold) Total fixed general and administrative expenses Complete this question by entering your answers in the tabs below. Required: Prepare Crystal Cold's full absorption costing income statement and variable costing income statement for the year. Full Absorption Costing 2,800 2,400 340 60 45 13 80 Variable Costing $ 26,400 $ 60,000arrow_forwardAces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 5,800 rackets and sold 4,700. Each racket was sold at a price of $88. Fixed overhead costs are $74,240 for the year, and fixed selling and administrative costs are $65,000 for the year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses Required: Prepare an income statement under variable costing. $ 11.94 7.94 4.92 1.80arrow_forwardThe following information pertains to the first year of operation for Crystal Cold Coolers Inc.: Number of units produced Number of units sold Unit sales price Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit ($224,000/2,800 units) Total variable selling expenses ($11 per unit sold) Total fixed general and administrative expenses Complete this question by entering your answers in the tabs below. Full Absorption Costing LA LA LA LA LA Variable Costing $ $ $ Required: Prepare Crystal Cold's full absorption costing income statement and variable costing income statement for the year. 2,800 2,400 340 60 45 13 80 $ 26,400 $ 60,000arrow_forward

- JART manufactures and sells underwater markers. Its contribution margin income statement follows. Contribution Margin Income Statement For Year Ended December 31 Per Unit Annual Total Sales (420,000 units) $ 7.00 $ 2,940,000 Variable costs Direct materials 1.46 613,200 Direct labor 0.44 184,800 Variable overhead 0.70 294,000 Contribution margin 4.40 1,848,000 Fixed costs Fixed overhead 0.30 126,000 Fixed general and administrative 0.25 105,000 Income $ 3.85 $ 1,617,000 A potential customer offers to buy 52,000 units for $3.70 each. These sales would not affect the company’s sales through its normal channels. Details about the special offer follow. Direct materials cost per unit and variable overhead cost per unit would not change. Direct labor cost per unit would be $0.62 because the offer would require overtime pay. Accepting the offer would require incremental fixed general and administrative costs of $5,200. Accepting the offer would require no…arrow_forwardWestern Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are $80,910 in March and rose to $92,150 in April. It costs Western Trucking $0.14 per mile in variable costs. In March, the delivery trucks were driven a total of 87,000 miles, and in April, they were driven a total of 95,000 miles. Using this information, answer the following: A. What were the total costs to operate the fleet in March and April, respectively? March April Total cost $ B. What were the cost per mile to operate the fleet in March and April, respectively? If required, round your answers to nearest cent. March April Cost per mile $arrow_forwardSagararrow_forward

- The following information for the past year for the Blaine Corporation has been provided: Fixed costs: Manufacturing $130,000 Marketing 18,000 Administrative 21,000 Variable costs: Manufacturing $113,000 Marketing 35,000 Administrative 38,000 During the year, the company produced and sold 60,000units of product at a selling price of $19.19 per unit. There was no beginning inventory of product at the beginning of the year. What is the contribution margin for the year?arrow_forwardWestern Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are $80,910 in March and rose to $92,150 in April. It costs Western Trucking $0.14 per mile in variable costs. In March, the delivery trucks were driven a total of 87,000 miles, and in April, they were driven a total of 95,000 miles. Using this information, answer the following: A. What were the total costs to operate the fleet in March and April, respectively? March April Total cost $fill in the blank 1 $fill in the blank 2 B. What were the cost per mile to operate the fleet in March and April, respectively? If required, round your answers to nearest cent. March April Cost per mile $fill in the blank 3 $fill in the blank 4arrow_forwardNamco Inc. is a large company that segments its business into cost and profit centers. The Cost center for the manufacture of Product M2T incurred the following costs in October: Direct Labor: $25/unit Direct Materials: $80/unit Variable Overhead: $15/unit Traceable Fixed Costs: $62,000 Common Fixed Costs: $100,000 Sales were 2,000 units in October. Each unit sells for $210. The M2T Department is being evaluated on overall profitability. In September, the department margin was $100,000. By how much did the department margin increase or decrease in October? Select one: a. $100,000 decrease b. $18,000 increase c. $82,000 decrease d. $118,000 increase e. $80,000 increasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education