FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:et

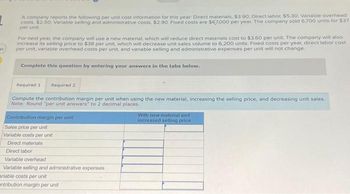

A company reports the following per unit cost information for this year: Direct materials, $3.90, Direct labor, $5.30, Variable overhead

costs, $2.50, Variable selling and administrative costs, $2.90, Fixed costs are $67,000 per year. The company sold 6,700 units for $37

per unit

For next year, the company will use a new material, which will reduce direct materials cost to $3.60 per unit. The company will also

increase its selling price to $38 per unit, which will decrease unit sales volume to 6,200 units. Fixed costs per year, direct labor cost

per unit, variable overhead costs per unit, and variable selling and administrative expenses per unit will not change.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute the contribution margin per unit when using the new material, increasing the selling price, and decreasing unit sales.

Note: Round "per unit answers" to 2 decimal places.

Contribution margin per unit

Sales price per unit

Variable costs por unit

Direct materials

Direct labor

Variable overhead

Variable selling and administrative expenses

ariable costs per unit

entribution margin per unit

With new material and

increased selling price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- want the answer of this questionarrow_forwardRequired information [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,850 rackets and sold 5,330. Each racket was sold at a price of $90. Fixed overhead costs are $89,050 per year, and fixed selling and administrative costs are $67,000 per year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses Prepare an income statement under variable costing. ACES INCORPORATED Income Statement (Variable Costing) Sales Less: Variable expenses Variable cost of goods sold Vanable selling and administrative expenses Contribution margin Fixed overhead Fixed selling and administrative expenses 333 X x X > $ 89,050✔ 67,000 $479,700 335,790 $12 8 5 2 156,050 Income $ 179,740 "Red text indicates no response was expected in a cell or a formula-based calculation is…arrow_forwardAces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,450 rackets and sold 5,630. Each racket was sold at a price of $90. Fixed overhead costs are $96,850 per year, and fixed selling and administrative costs are $68,200 per year. The company also reports the following per unit variable costs for the year. Direct materials $ 12 Direct labor 8 Variable overhead 5 Variable selling and administrative expenses 2 Prepare an income statement under variable costing.arrow_forward

- Astro Company sold 22,000 units of its only product and reported income of $70,200 for the current year. During a planning session for next year's activities, the production manager notes that variable costs can be reduced 46% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $154,000. Total units sold and the selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($54 per unit) Variable costs ($48 per unit) Contribution margin Fixed costs Income Sales level required in dollars Numerator: 3. Compute the sales level required in both dollars and units to earn $240,000 of target income for next year with the machine installed. (Do not round intermediate calculations. Round your answers to 2 decimal places. Round "Contribution margin ratio" to nearest whole percentage) Sales level required in units Numerator: $ 1,188,000 1,056,000 1…arrow_forwardAces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,450 rackets and sold 5,630. Each racket was sold at a price of $90. Fixed overhead costs are $96,850 per year, and fixed selling and administrative costs are $68,200 per year. The company also reports the following per unit variable costs for the year. Direct materials $ 12 Direct labor 8 Variable overhead 5 Variable selling and administrative expenses 2arrow_forwardGrey Inc. has been purchasing a component, Z for $85 a unit. The company is currently operating at 75% of full capacity, and no significant increase in production is anticipated in the near future. The cost of manufacturing a unit of Z, determined by absorption costing method, is estimated as follows: Direct materials $30 Direct labor 15 Variable factory overhead 26 Fixed factory overhead 10 Total $81 Prepare a differential analysis report, dated March 12 of the current year, on the decision to make or buy Part Z. Grey Inc. Proposal to Manufacture Part Z March 12, 20XX Purchase price of Part Z Differential cost to manufacture Z: Direct materials X Direct labor X Variable factory overhead X Cost savings from manufacturing Part Zarrow_forward

- Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 5,800 rackets and sold 4,700. Each racket was sold at a price of $88. Fixed overhead costs are $74,240 for the year, and fixed selling and administrative costs are $65,000 for the year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses Required: Prepare an income statement under variable costing. $ 11.94 7.94 4.92 1.80arrow_forwardAstro Company sold 23,000 units of its only product and reported income of $264, 600 for the current year. During a planning session for next year's activities, the production manager notes that variable costs can be reduced 44% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $156,000. Total units sold and the selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($56 per unit) $ 1, 288,000 Variable costs ($35 per unit ) 805, 000 Contribution margin 483,000 Fixed costs 218,400 Income $ 264,600 Problem 18 - 3A (Algo) Part 1 1. Compute the break - even point in dollar sales for next year assuming the machine is installed. (Round your answers to 2 decimal places.)arrow_forwardSteel Metals Ltd manufactures and sells iron rods that is used in the construction of roads. The product is manufactured and sold in 20' long rods. The product is generally produced and sold to match customer demand, and there is not a significant amount of finished goods inventory at any point in time. Summary information for 2020 is as follows: Sales were $20,000,000, consisting of 5,000,000 rods. Total variable costs were $11,000,000. Total fixed costs were $8,000,000. Net income was $1,000,000. The general economic conditions appear to be deteriorating heading into 2021, and there is some concern about a reduction in sales volume. The following questions should each be answered independent of one another. Required: a) What is the company's break-even point in 20' long rods? b) Can the company sustain a 30% reduction in total volume, and remain profitable? c) The company's sole shareholder, Pant Sharma, generally lives off dividends paid by the business. The business typically…arrow_forward

- Use this information for Timmer Corporation to answer the question that follows. Timmer Corporation just started business in January. There were no beginning inventories. During the year, it manufactured 11,700 units of product and sold 8,000 units. The selling price of each unit was $25. Variable manufacturing costs were $3 per unit, and variable selling and administrative costs were $4 per unit. Fixed manufacturing costs were $23,400 and fixed selling and administrative costs were $7,900. What would Timmer's income from operations be for the year using absorption costing? O a. $120,100 b. $128,000 c. $96,080 Od. $144,000arrow_forwardSagararrow_forwardThe following information for the past year for the Blaine Corporation has been provided: Fixed costs: Manufacturing $130,000 Marketing 18,000 Administrative 21,000 Variable costs: Manufacturing $113,000 Marketing 35,000 Administrative 38,000 During the year, the company produced and sold 60,000units of product at a selling price of $19.19 per unit. There was no beginning inventory of product at the beginning of the year. What is the contribution margin for the year?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education