FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

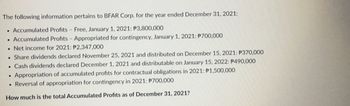

Transcribed Image Text:The following information pertains to BFAR Corp. for the year ended December 31, 2021:

. Accumulated Profits Free, January 1, 2021: P3,800,000

. Accumulated Profits - Appropriated for contingency, January 1, 2021: P700,000

. Net income for 2021: P2,347,000

. Share dividends declared November 25, 2021 and distributed on December 15, 2021: P370,000

. Cash dividends declared December 1, 2021 and distributable on January 15, 2022: P490,000

Appropriation of accumulated profits for contractual obligations in 2021: P1,500,000

. Reversal of appropriation for contingency in 2021: P700,000

How much is the total Accumulated Profits as of December 31, 2021?

.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Benefit obligation, 1 January 20X6 Current service cost for 20X6 SFP Accrued net OPEB liability, 1 January, 20X6 Accumulated OCI, OPEBS, 1 January 20X6, loss Fund assets, 1 January 20X6 Contributions to the benefit fund for 20X6-paid 1 April Benefit payments to retired employees for 20X6 evenly over year Actual return on fund assets Yield rate on long-term corporate bonds $ 77,000 20,000 15,000 31,000 62,000 9,800 16,000 350 7 % With this information, how would i calculate projected obligation? OPEB expense? Net OPEB? Accumulate OCI OPEB?arrow_forwardRefer to the situation described below Assume Electronic Distribution prepares its financial statements according to IFRA. Also, assume that 10% is the current interest rate on high- quality corporate bonds. Sin millions PBO balance January 1 480 Plan assets balance January 1 300 Service cost 75 Interest cost 45 Gain from change in an actuarial assumption 22 Benefits paid (36) Actual return on plan assets 20 Contributions 2021 60 Calculate the net pension cost for 2021, separating its components into appropriate categories for reporting. Prepare the journal entries to record (a) the components of net pension cost, (b)gains or losses, (c) past service cost, (d) funding, and (e) payment of benefits for 2021. What amount will Electronic Distribution report in its 2021 balance sheet as a net pension asset or net pension liability?arrow_forwardEmployee benefitsarrow_forward

- On January 1, 20X1, Trouble Company had the following information regarding its defined benefit plan. Fair value of plan assets (FVPA), Jan 1 P480,000 Present value of the defined benefit obligation, Jan. 1 360,000 • Discount rate based on high quality corporate bonds 5% Information regarding the defined benefit plan as of December 31, 20X1 is as follows: • Contributions made to the fund, July 1, 20X1 P800,000 Benefits paid to retirees, September 30, 20X1 200,000 1,128,000 Fair value of plan assets (FVPA), Dec 31 Present value of the defined benefit obligation, Dec 31 720,000 How much is the interest income on plan assets?arrow_forwardAttleboro Corporation has the following on December 31, 2020. • Eligible Refundable Dividend Tax On Hand account balance of $52,500 ● Taxable income $830,000 • Part 1 taxes payable $350,000 Eligible dividends paid of $240,000 How much is Attleboro's dividend refund for 2020? ● Choose the correct answer. OA. $77,500 OB. $105,000 OC. $62,500 OD. $52,500arrow_forwardTaxable income and pretax financial income would be identical for Sweet Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income computations have been prepared. Taxable income 2024 2025 2026 Excess of revenues over expenses (excluding two temporary differences) $166,000 $212,000 $97,900 Installment gross profit collected 8,000 8,000 8,000 Expenditures for warranties Taxable income (5,200) (5,200) (5,200) $168,800 $214,800 $100,700 Pretax financial income 2024 2025 2026 Excess of revenues over expenses (excluding two temporary differences) $166,000 $212,000 $97,900 Installment gross profit recognized 24,000 -0- -0- Estimated cost of warranties (15,600) -0- -0- Income before taxes $174,400 $212,000 $97,900 The tax rates in effect are 2024, 20%; 2025 and 2026, 25%. All tax rates were enacted into law on January 1, 2024. No deferred income taxes existed at the beginning of 2024. Taxable income is expected in all future…arrow_forward

- 2 ($ in thousands) Discount rate, 7% Expected return on plan assets, 8% Actual return on plan assets, 7% Service cost, current year January 1, current year: Projected benefit obligation Accumulated benefit obligation Plan assets (fair value)" Prior service cost- AOCI (current year amortization, $30) Net gain- AOCI (current year amortization, $12) There were no changes in actuarial assumptions. December 31, current year: Cash contributions to pension fund, December 31, current year Benefit payments to retirees, December 31, current year Required: 1. Determine pension expense for the current year. $ 500 3,250 2,950 3,350 420 520 435 460 2. Prepare the journal entries to record (a) pension expense, (b) gains and losses (if any), (c) funding, and (d) retiree benefits for the current year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine pension expense for the current year. Note: Amounts to be deducted should be indicated with a minus sign.…arrow_forwardSandhill Co. had the following selected balances at December 31, 2021: Projected benefit obligation $4,640,000 Accumulated benefit obligation 4,540,000 Fair value of plan assets 4,285,000 Accumulated OCI (PSC) 165,000 Calculate the pension asset/liability to be recorded at December 31, 2021. Pension $arrow_forwardHawkins Corporation has the following balances at December 31, 2020. Projected benefit obligation $2,600,000 Plan assets at fair value 2,000,000 Accumulated OCI (PSC) 1,100,000 How should these balances be reported on Hawkins' balance sheet at December 31, 2020?arrow_forward

- Subject; accountingarrow_forwardArriba and its 80 percent-owned subsidiary (Abajo) reported the following figures for the year ending December 31, 2021 (credit balances indicated by parentheses). Abajo paid dividends of $49,000 during this period. Sales Cost of goods sold Operating expenses Dividend income Net income Arriba $(980,000) Abajo $(490,000) 490,000 229,300 284,200 98,000 (39,200) 0 $(245,000) $(162,700) In 2020, Intra-entity gross profits of $49,000 on upstream transfers of $147,000 were deferred into 2021. In 2021 intra-entity gross profits of $64,700 on upstream transfers of $178,400 were deferred into 2022. a. What amounts appear for each line in a consolidated income statement for the year ending December 31, 2021? b. What income tax expense should appear on the consolidated income statement if each company files a separate return? Assume that the tax rate is 21 percent. (For all requirements, Input all amounts as positive values.) Sales Cost of goods sold Operating expenses Dividend income Amountarrow_forwardSubject: acountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education