FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

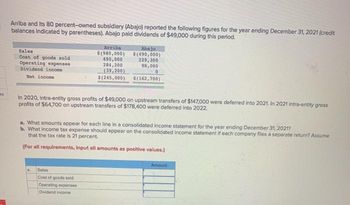

Transcribed Image Text:Arriba and its 80 percent-owned subsidiary (Abajo) reported the following figures for the year ending December 31, 2021 (credit

balances indicated by parentheses). Abajo paid dividends of $49,000 during this period.

Sales

Cost of goods sold

Operating expenses

Dividend income

Net income

Arriba

$(980,000)

Abajo

$(490,000)

490,000

229,300

284,200

98,000

(39,200)

0

$(245,000) $(162,700)

In 2020, Intra-entity gross profits of $49,000 on upstream transfers of $147,000 were deferred into 2021. In 2021 intra-entity gross

profits of $64,700 on upstream transfers of $178,400 were deferred into 2022.

a. What amounts appear for each line in a consolidated income statement for the year ending December 31, 2021?

b. What income tax expense should appear on the consolidated income statement if each company files a separate return? Assume

that the tax rate is 21 percent.

(For all requirements, Input all amounts as positive values.)

Sales

Cost of goods sold

Operating expenses

Dividend income

Amount

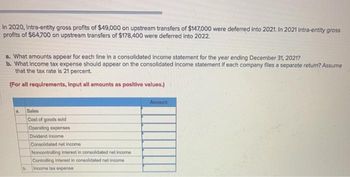

Transcribed Image Text:In 2020, Intra-entity gross profits of $49,000 on upstream transfers of $147,000 were deferred into 2021. In 2021 Intra-entity gross

profits of $64,700 on upstream transfers of $178,400 were deferred into 2022.

a. What amounts appear for each line in a consolidated income statement for the year ending December 31, 2021?

b. What income tax expense should appear on the consolidated income statement if each company files a separate return? Assume

that the tax rate is 21 percent.

(For all requirements, Input all amounts as positive values.)

a.

Sales

Cost of goods sold

Operating expenses

Dividend income

Consolidated net income

Noncontrolling interest in consolidated net income

Controlling interest in consolidated net income

b.

Income tax expense

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give image formatarrow_forwarda. Compute the taxable income and income tax expense-current for 2020. Compute also the deferred tax asset at December 31, 2020.b. Prepare journal entries to record income tax expense for 2020.arrow_forwardAn entity reported pretax accounting income of P5,000,000 for the current year. The taxable income was P5,500,000. The difference is due to rental received in advance. Rental income is taxable when received. The income tax rate is 30% and the entity made no estimated tax payment in the current year. What amount should be reported as total income tax expense for the current year?arrow_forward

- A 17arrow_forwardThe pretax financial income (or Loss) figures for Limerick co. are as follows: 2017 83,000 2018 (53,000) 2019 (36,000) 2020 115,000 2021 104,000 Pretax financial income( or loss) and taxable income(loss) were the same for all years involved. Assume a 25% tax rate for 2017 and a 20% tax rate for the remaining years. Prepare the journal entires for the years 2017 to 2021 to record income tax expense and the effects of the net operating loss carryforward. All income and losses relate to normal operations (in recording the benefits of a loss carryforward assume that no valuation account is deemed necessary.arrow_forwardWith respect to GRIP and LRIP balances, which of the following statements is NOT correct? A CCPC'S GRIP account is increased by 72% percent of the company's taxable income. A CCPC'S GRIP account is reduced by the amount of eligible dividends designated in the preceding taxation year. A CCPC'S GRIP account is increased by the amount of eligible dividends received during the current year. A public company's LRIP account is increased by the amount of non-eligble dividends received.arrow_forward

- Prepare the bottom portion of Sheridan's 2021 income statement, beginning with “Income from continuing operations before income taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan Corporation Income Statement (Partial) 2$ $ $arrow_forward1. soru At the end of 2019, The Business with 20% Corporate tax rate has Expenses: TL3.150.000 and Revenues: TL3.375.000. How much is the Tax Payable if the business prepaid income tax of TL15.000 during the accounting period? a.TL30.000 b.TL15.000 c.TL45.000 d.TL60.000arrow_forwardRequired Answer each of the following questions by providing supporting computations. 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the three items labeled pretax. 2. Compute the amount of income from continuing operations before income taxes. What is the amount of the income tax expense? What is the amount of income from continuing operations? 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? 4. What is the amount of net income for the year?arrow_forward

- A company reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year Pretax Income (Loss) Tax Rate 2018 $142,000 17% 2019 94,000 17 2020 (208,800) 22 2021 318,500 22 In 2021, what amount of income tax payable should be reported for the company, assuming the loss can carry forward?arrow_forwardPlease answer in good accounting form. Thankyou 7. Compute for the taxable incomearrow_forwardStatement 1: the income of the estate distributed to the beneficiary during the year is subject to final withholding tax of 15%. Statement 2: the withholding tax on the income distributed to the beneficiary is creditable against the total tax liability of the beneficiary. Group of answer choices Statements 1 and 2 are true. Statement 1 is false but statement 2 is true. Statement 1 is true but statement 2 is false. Statements 1 & 2 are false.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education