FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

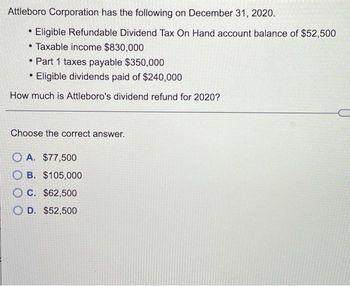

Transcribed Image Text:Attleboro Corporation has the following on December 31, 2020.

• Eligible Refundable Dividend Tax On Hand account balance of $52,500

●

Taxable income $830,000

• Part 1 taxes payable $350,000

Eligible dividends paid of $240,000

How much is Attleboro's dividend refund for 2020?

●

Choose the correct answer.

OA. $77,500

OB. $105,000

OC. $62,500

OD. $52,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardIMPORTANT: PLEASE SEE IMAGE, ANSWER PART B CORRECTLY AND ILL LIKE YOUR ANSWER. I attached part a for guidance THANK YOU! Bramble Company has the following two temporary differences between its income tax expense and income taxes payable. 2020 2021 2022 Pretax financial income $816,000 $925,000 $930,000 Excess depreciation expense on tax return (30,200 ) (40,900 ) (10,200 ) Excess warranty expense in financial income 20,800 9,700 8,000 Taxable income $806,600 $893,800 $927,800 The income tax rate for all years is 20%.arrow_forwardDinesh bhaiarrow_forward

- nku.2arrow_forwardS a. What is MSU's interest expense deduction for 2023? $ For 2023, MSU Corporation has $500,000 of adjusted taxable income, $22,000 of business interest income, and $120,000 of business interest expense. It has average annual gross receipts of more than $29,000,000 over the prior three taxable years. b. How much interest expense can be deducted for 2023 if MSU's adjusted taxable income is $300,000?arrow_forwardPlease do not give image format and Show all calculationarrow_forward

- help me with the steps and answersarrow_forwardArndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses Pretax accounting income (income statement) Taxable income (tax return) 760 800 $ 128 $ 116 $ 180 $ 200 Tax rate: 25% a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint View this as two temporary differences-one reversing in 2021; one originating in 2021. d. 2021 expenses included a $14 million unrealized loss from reducing…arrow_forwarddont uplode any image in answerarrow_forward

- mgarrow_forwardZ (Corporate income tax) Meyer Inc. has taxable income (earnings before taxes) of $319,000. Calculate Meyer's federal income tax liability using the tax table shown in the popup window: What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) 2 30 F2 W S Data table iple X भ command Taxable Income $0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38% 35% Over $18,333,333 (Click on the icon in order to copy its contents into a spreadsheet.) # 3 Get more help - 80 E D $ 4 C 000 000 F4 R Print F % 5 Marginal Tax Rate 15% 25% 34% V F5 T Done G MacBook Air A 6 P F6 B Y & 7 H 44 F7 U N X 00 * 8 J DII FB 1 1 M 9 K MOSISO BB F9 O 1 O < I H L F10 Clear all P 11 • V command : ; FIX { + + 11 Check answer = 1 ? option 14 1 F12 } 1 A delete 1arrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education