FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

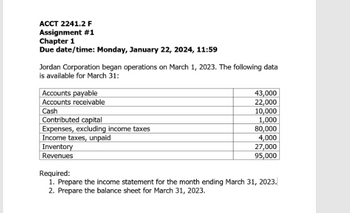

Transcribed Image Text:ACCT 2241.2 F

Assignment #1

Chapter 1

Due date/time: Monday, January 22, 2024, 11:59

Jordan Corporation began operations on March 1, 2023. The following data

is available for March 31:

Accounts payable

Accounts receivable

Cash

Contributed capital

Expenses, excluding income taxes

Income taxes, unpaid

Inventory

Revenues

43,000

22,000

10,000

1,000

80,000

4,000

27,000

95,000

Required:

1. Prepare the income statement for the month ending March 31, 2023.

2. Prepare the balance sheet for March 31, 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 12/31/2018 12/31/2019 Unearned revenue $12,900 $6,200 Cash 33,600 13,350 Prepaid rent 9,500 6,500 Supplies 5,800 2,800 Taxes payable 5,200 5,800 Wages payable 9,000 9,450 Using the above account balances, compute working capital and current ratio. Round "Current ratio" answers to two decimal places. 12/31/2018 12/31/2019 A. Working capital $_______ $_______ B. Current ratio _______ _______arrow_forward7. Weekly Osalary Cash Allowance $40.00 $75.00 $25.00 a. $1,225.00 b. $1,500.00 c. $ 425.00 d. $ 750.00 e. $1,180.00 $15.00 Tax Ben $3.80 $10.00 - $11.00 $25.00 Emp Ded СРР Emp Cont Emp Ded EI Emp Cont warrow_forward#9 O Item Prior year Current year Accounts payable 8,193.00 7,858.00 Accounts receivable 6,044.00 6,592.00 Accruals 1,021.00 1,379.00 Cash ??? ??? Common Stock 11,724.00 12,455.00 COGS 12,775.00 18,196.00 Current portion long-term 4,957.00 5,018.00 debt Depreciation expense 2,500 2,754.00 Interest expense 733 417 Inventories 4,101.00 4,775.00 Long-term debt 14,725.00 14,635.00 Net fixed assets 50,550.00 54,207.00 Notes payable 4,377.00 9,925.00 Operating expenses (excl. 13,977 18,172 depr.) Retained earnings 28,729.00 29,950.00 Sales 35,119 47,942.00 Тахes 2,084 2,775 What is the firm's cash flow from investing? Submit Answer format: Number: Round to: 0 decimal places. unanswered not_submitted Attempts Remaining: Infinityarrow_forward

- #9 O Item Prior year Current year Accounts payable 8,113.00 7,909.00 Accounts receivable 6,029.00 6,555.00 Accruals 999.00 1,352.00 Cash ??? ??? Common Stock 11,096.00 12,144.00 COGS 12,698.00 18,074.00 Current portion long-term 4,971.00 4,959.00 debt Depreciation expense 2,500 2,836.00 Interest expense 733 417 Inventories 4,232.00 4,816.00 Long-term debt 14,899.00 14,036.00 Net fixed assets 50,114.00 54,819.00 Notes payable 4,323.00 9,810.00 Operating expenses (excl. 13,977 18,172 depr.) Retained earnings 28,849.00 29,434.00 Sales 35,119 46,806.00 Таxes 2,084 2,775 What is the firm's cash flow from investing? Submit Answer format: Number: Round to: 0 decimal places. unanswered not_submitted Attempts Remaining: Infinityarrow_forwardP6arrow_forwardSafari 4:22 PM Tue Jan 30 < HW Set 1 (Ch 2 and 3) Template Calibri (Body) fx Enter text or formula here A 1 E 2.16 2 Information for Montgomery, Inc. 3 4 5 6 7 Cash 8 Accounts Receivable 9 Inventory 10 PP&E, net 11 Goodwill NOPAT for 2020 12 Other operating assets 13 A/P 14 Accrued Expenses and other 15 Unearned revenues 16 Long-term debt 17 Common stock 18 19 20 a. 21 NOA for 2019 22 NOA for 2020 23 24 b. 25 26 27 28 29 30 31 32 33 34 35 Retained earnings 2020 FCF E 2.16 E 2.17 E 3.15 11 B HE E 3.18 Home Insert $ BIU C 3,150 2019 3,590 5,650 10,240 21,840 13,160 3,450 10,400 10,350 3,120 7,680 18,840 7,540 + Draw Page Layout ABC 2020 4,260 8,340 11,460 26,110 14,310 4,720 13,310 13,740 4,770 8,350 18,930 10,100 ch LL F Formulas Data G Review View General H < E < H: AH L O M Σ ☎: 50% |||| Oarrow_forward

- Please do not give image format and solve all requiredarrow_forwardProblem 17-6AA (Algo) Income statement computations and format LO A2 [The following information applies to the questions displayed below] Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company's income tax rate is 40% for all items. a. Interest revenue. b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable. e. Other operating expenses f. Accumulated depreciation-Equipment g. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings i. Loss from operating a discontinued segment (pretax) j. Gain on insurance recovery of tornado damage k. Net sales 1. Depreciation expense-Buildings B. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit p. Income tax expense q. Cost of goods sold Debit $ 35,400 27,250 107,800 19,650 53,400 17,400 25,150 496,500 Credit $…arrow_forwardDIRECTIONS 1 Journalize the entry to RECORD the payroll 2 Journalize the entry to RECORD the employer's payroll taxes (SUTA rate is 3.7%) 3 Journalize the entry to deposit the FICA and FIT taxes TOTAL EARNINGS FICA OASDI FICA HI FIT W/H STATE TAX UNION DUES NET PAY $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 1 JOURNAL DATE DESCRIPTION DEBIT CREDIT 2 JOURNAL DATE DESCRIPTION DEBIT CREDIT…arrow_forward

- #8 O Item Prior year Current year Accounts payable 8,100.00 7,786.00 Accounts receivable 6,081.00 6,685.00 Accruals 1,000.00 1,553.00 Cash ??? ??? Common Stock 10,998.00 11,247.00 COGS 12,678.00 18,011.00 Current portion long-term 4,928.00 4,981.00 debt Depreciation expense 2,500 2,774.00 Interest expense 733 417 Inventories 4,250.00 4,824.00 Long-term debt 13,238.00 13,578.00 Net fixed assets 51,887.00 54,423.00 Notes payable 4,300.00 9,879.00 Operating expenses (excl. 13,977 depr.) 18,172 Retained earnings 28,209.00 29,224.00 Sales 35,119 45,333.00 Taxes 2,084 2,775 What is the firm's cash flow from financing? Submit Answer format: Number: Round to: 0 decimal places. unanswered not_submitted Attempts Remaining: Infinityarrow_forwardmework Assignment Exercise 7-12A (Algo) Notes receivable-accrued interest LO 7-5 On May 1, Year 1, Benz's Sandwich Shop loaned $14,000 to Mark Henry for one year at 9 percent interest. Required: a. What is Benz's interest income for Year 1? b. What is Benz's total amount of receivables at December 31, Year 1? c. How will the loan and interest be reported on Benz's Year 1 statement of cash flows? d. What is Benz's interest income for Year 2? e. What is the total amount of cash that Benz's will collect in Year 2 from Mark Henry? f. How will the loan and interest be reported on Benz's Year 2 statement of cash flows? g. What is the total amount of interest that Benz's earned on the loan to Mark Henry? Note: For all requirements, round your answers to the nearest dollar amount. a. Interest income ن و نان فان b. Receivables c. Cash used in investing activities Interest income e. Cash f. g. Interest earned 53° HO Savedarrow_forward< Pk 10:53 The following information relates to Oriole Co. for the year 2022. Owner's capital, January 1, 2022 Owner's drawings during 2022 Service revenue Salaries and wages expense 28 W Untitled document.docx 1 of 2 • Page 1 Ơ $53.827 6,728 71,321 33,081 After analyzing the data, prepare an income statement for the year ending December 31, 2022. Advertising expense Rent expense Utilities expense $2.019 11,663 3,476 ORIOLE CO. Income Statement For the Year Ended December 31, 2022 $ [7 S : Sharearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education