FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

1. How much Is ending raw materials inventory?

2. How much is in ending work in process inventory?

3. How much is in ending finished goods inventory?

4. How much is gross profit?

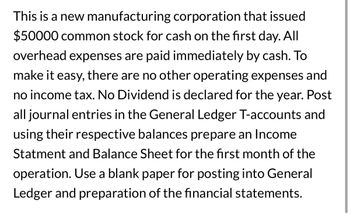

Transcribed Image Text:This is a new manufacturing corporation that issued

$50000 common stock for cash on the first day. All

overhead expenses are paid immediately by cash. To

make it easy, there are no other operating expenses and

no income tax. No Dividend is declared for the year. Post

all journal entries in the General Ledger T-accounts and

using their respective balances prepare an Income

Statment and Balance Sheet for the first month of the

operation. Use a blank paper for posting into General

Ledger and preparation of the financial statements.

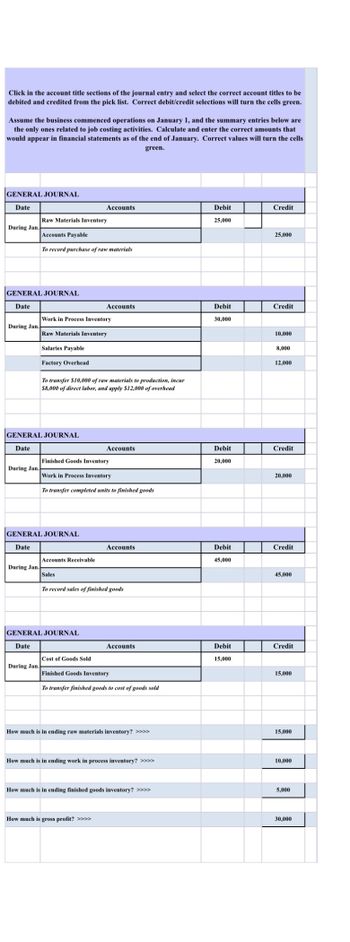

Transcribed Image Text:Click in the account title sections of the journal entry and select the correct account titles to be

debited and credited from the pick list. Correct debit/credit selections will turn the cells green.

Assume the business commenced operations on January 1, and the summary entries below are

the only ones related to job costing activities. Calculate and enter the correct amounts that

would appear in financial statements as of the end of January. Correct values will turn the cells

green.

GENERAL JOURNAL

Date

During Jan.

GENERAL JOURNAL

Date

During Jan.

During Jan.

Raw Materials Inventory

Accounts Payable

To record purchase of raw materials

During Jan.

GENERAL JOURNAL

Date

Salaries Payable

Factory Overhead

During Jan.

Work in Process Inventory

Raw Materials Inventory

GENERAL JOURNAL

Date

To transfer $10,000 of raw materials to production, incur

$8,000 of direct labor, and apply $12,000 of overhead

Accounts Receivable

Accounts

Finished Goods Inventory

Work in Process Inventory

To transfer completed units to finished goods

Sales

GENERAL JOURNAL

Date

Accounts

Cost of Goods Sold

Accounts

To record sales of finished goods

Accounts

How much is gross profit? >>>>

Accounts

Finished Goods Inventory

To transfer finished goods to cost of goods sold

How much is in ending raw materials inventory? >>>>

How much is in ending work in process inventory? >>>>

How much is in ending finished goods inventory? >>>>

Debit

25,000

Debit

30,000

Debit

20,000

Debit

45,000

Debit

15,000

Credit

25,000

Credit

10,000

8,000

12,000

Credit

20,000

Credit

45,000

Credit

15,000

15,000

10,000

5,000

30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following best defines " stockout costs"? A) They are physical goods used in operations. B) They are costs associated with retrieving inventory items from a workshop C) They are costs associated with interruptions to assembly lines D) They are associated with inventory being unavailable when needed to meet demand. E) None of the above.arrow_forwardin a merchandising business gross profit is equal to the sales revenue minus (a) the sum of cost of goods sold and sales commissions (b) cost of goods sold (c) the sum of cost of goods sold and operating expenses (d) the sum of cost of goods sold, operating expenses and prepaid expensesarrow_forwardGross profit is: The amount left over after cost of goods sold is subtracted from net sales. A.Net sales less operating expenses. B.Sales less sales discount. C.less sales discounts. D.Net sales less selling expensesarrow_forward

- When overhead is overapplied, is the balance of Cost of Goods Sold, before adjustment, too low ortoo high? Why?arrow_forwardWhat is the purpose of the lower of cost or net realizable value rule? What would happen if a company was to report their inventory at replacement cost?arrow_forward3. As product costs expire(expensed), they become part of a. selling expenses. b. inventory. C. cost of goods sold. d. sales revenue.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education