FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

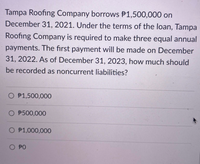

Transcribed Image Text:Tampa Roofing Company borrows P1,500,000 on

December 31, 2021. Under the terms of the loan, Tampa

Roofing Company is required to make three equal annual

payments. The first payment will be made on December

31, 2022. As of December 31, 2023, how much should

be recorded as noncurrent liabilities?

O P1,500,000

O $500,000

O P1,000,000

O PO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that on September 1, 2022, Brannigan, which has a year-end of December 31, borrows $120,000,000 on a three-year, 7%note. The note requires annual interest payments and repayment ofthe principal plus the final year's interest at the end of the thirdyear.Even though no payment is due on December 31, interest must beaccrued for the periodarrow_forwardRequired 1 Calculate the future value. On January 1, 2020, $30,000 is deposited into a savings account. Assuming a 4% interest rate, calculate the amount accumulated on January 1, 2023, if interest is compounded annually. N (period of time) | (Interest) PV (Present Value FV (Future Value) PMT (Annuity) On January 1, 2020, $30,000 is deposited into a savings account. Assuming a 4% interest rate, calculate the amount accumulated on January 1, 2023, if interest is compounded semi-annually. N (period of time) | (Interest) PV (Present Value FV (Future Value) PMT (Annuity) Page 1 On January 1, 2020, $30,000 is deposited into a savings account. Assuming a 4% interest rate, calculate the amount accumulated on January 1, 2023, if interest is compounded quarterly. N (period of time) | (Interest) PV (Present Value FV (Future Value) PMT (Annuity) 2 In each of the three scenarios the FV should continue to increase. Explain why this passes the reasonablenes test.arrow_forwardOn November 30, 2023, Calla Resources Ltd. borrowed $180,000 from a bank by signing a four-year installment note bearing interest at 8%. The terms of the note require equal payments each year on November 30, starting November 30, 2024. Use TABLE 14A 2 (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the size of each installment payment. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Payment "T" 2. Complete an installment note amortization schedule for this note. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values.) Period Ending Beginning Balance Period Interest Expense Payments Debit Notes Payable Credit Cash Ending Balancearrow_forward

- 2. C-type Company receives $ 400,000 when it issues 6% mortgage note payable for 4 years to finance the construction of a building at December 31, 2020. The term provides for semiannual installment payment of 34,000 (including real estate tax and insurance $1900) on June 30 and December 31. Instructions: i. Prepare an installment payments schedule for the first 4 years. Prepare entries for the mortgage loan and first installment payment. Show the Balance sheet representation at December 31, 2020. ii. iii.arrow_forwardWhat amount should be reported as the warranty liability for 2021 and 2022, respectively?* a. 20,000 and 170,000 b. 170,000 and 650,000 c. 500,000 and 650,000 d. 500,000 and 170,000arrow_forwardSales made in 2021 for $3,000,000 includes a 2-year warranty coverage, included in the price. The estimated cost for warranty is expected to be 2% for the first year and 5% for the second year. How much warranty expense should be recorded in 2021? Question 4 options: $60,000 $150,000 $100,500 $210,000arrow_forward

- On January 1, 2021, Tropical Paradise borrows $33,000 by agreeing to a 6%, four-year note with the bank. The funds will be used to purchase a new BMW convertible for use in promoting resort properties to potential customers. Loan payments of $775.01 are due at the end of each month with the first installment due on January 31, 2021. Record the issuance of the installment note payable and the first two monthly payments. (Do not round intermediate calculations. Round your final answers to 2 decimal places. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardYellow Company purchases a truck on January 1, 2021. According to the contract Yellow will not make any payments in 2021, 2022 and 2023. Yellow is to make an annuity payment of $5,000 starting December 31, 2024 through December 31, 2028. Calculate the cost of the truck.arrow_forwardCullumber Electronics issues a $355,500, 3%, 10-year mortgage note on December 31, 2021. The proceeds from the note are to be used in financing a new research laboratory. The terms of the note provide for annual installment payments, exclusive of real estate taxes and insurance, of $41,675. Payments are due on December 31. (a) Prepare an installment payments schedule for the first 4 years. (Round answers to 0 decimal places, e.g. 15,250.) Annual Interest Period Cash Payment Interest Expense Reduction of Principal Principal Balance Issue Date $enter a dollar amount 1 $enter a dollar amount $enter a dollar amount $enter a dollar amount enter a dollar amount 2 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 3 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 4 enter a dollar amount…arrow_forward

- Ll.102.arrow_forwardCulver Company loans Sheffield Company $1,870,000 at 7% for 3 years on January 1, 2025. Culver intends to hold this loan to maturity and has the financial ability to do so. The fair value of the loan at the end of each reporting period is as follows. December 31, 2025 December 31, 2026 December 31, 2027 No. Prepare the journal entries at December 31, 2025, and December 31, 2027, for Culver related to these bonds, assuming (a) it does not use the fair value option, and (b) it uses the fair value option. Interest is paid on January 1. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) (a) No. (b) Date $1,924,000 1,892,000 Date 1,870,000 Account Titles and Explanation Account Titles and Explanation (To record interest revenue) Debit Debit II…arrow_forwardP11.3 (a)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education