FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

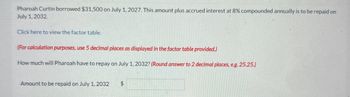

Transcribed Image Text:Pharoah Curtin borrowed $31,500 on July 1, 2027. This amount plus accrued interest at 8% compounded annually is to be repaid on

July 1, 2032

Click here to view the factor table.

(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

How much will Pharoah have to repay on July 1, 2032? (Round answer to 2 decimal places, e.g. 25.25.)

Amount to be repaid on July 1, 2032

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You have taken a loan of $55,000.00 for 30 years at 4.9% compounded quarterly. Fill in the table below: (Round all answers to 2 decimal places.) Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) Question Help! SaMarran astructor LA LA LA tA Balance $55,000.00 $ LA LAarrow_forwardCompute the amount that can be borrowed under each of the following circumstances: (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places.) 1. A promise to repay $99,000 ten years from now at an interest rate of 7%. 2. An agreement to make three separate annual payments of $20,000, with the first payment occurring 1 year from now. The annual interest rate is 5%. Option 1 Loan amount Option 2 payments Table Value Table Value Amount Amount $ Present Value Present Value 0arrow_forwardHelen Quick made an investment of $20,542.75. From this investment, she will receive $2,400 annually for the next 15 years starting one year from now. Click here to view the factor table What rate of interest will Helen's investment be earning for her? (Hint: Use Table 4.) (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to O decimal places, e.g. 25%.) Rate of interest %arrow_forward

- Required 1 Calculate the future value. On January 1, 2020, $30,000 is deposited into a savings account. Assuming a 4% interest rate, calculate the amount accumulated on January 1, 2023, if interest is compounded annually. N (period of time) | (Interest) PV (Present Value FV (Future Value) PMT (Annuity) On January 1, 2020, $30,000 is deposited into a savings account. Assuming a 4% interest rate, calculate the amount accumulated on January 1, 2023, if interest is compounded semi-annually. N (period of time) | (Interest) PV (Present Value FV (Future Value) PMT (Annuity) Page 1 On January 1, 2020, $30,000 is deposited into a savings account. Assuming a 4% interest rate, calculate the amount accumulated on January 1, 2023, if interest is compounded quarterly. N (period of time) | (Interest) PV (Present Value FV (Future Value) PMT (Annuity) 2 In each of the three scenarios the FV should continue to increase. Explain why this passes the reasonablenes test.arrow_forwardYou have taken a loan of $6,000.00 for 3 years at 2.9% compounded monthly. Fill in the table below: (Round all answers to 2 decimal places.) Payment number Payment amount Principal Amount Interest Balance 0) $6,000.00 1) $ 2) 3) $ $arrow_forwardHalep Inc. borrowed $39,070 from Davis Bank and signed a 1-year note payable stating the interest rate was 8% compounded annually. 1. Using the Present Value of an Annuity of 1 TABLE4 or Figure B2 in the textbook E, calculate the factor. 2. Next, determine the annual payment amount. 3. Then, determine the interest portion of the payment for year 1. 4. Finally, determine the principal portion of the payment for year 1. Round to the nearest penny, two decimal places.arrow_forward

- On January 1, a company agrees to pay $28,000 in nine years. If the annual interest rate is 3%, determine how much cash the company can borrow with this agreement. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.)arrow_forwardYou have taken a loan of $77,000.00 for 29 years at 5.3% compounded quarterly. Fill in the table below: (Round all answers to 2 decimal places.) Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) $ S $ $ Balance $77,000.00 $ sarrow_forwardKrista borrowed $17,432. The loan is to be repaid by three equal payments due in 80, 154, and 263 days from now respectively Determine the size of the equal payments at an interest rate of 7% with a focal date of today The size of the equal payments is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education