FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

On December 1 jasmin Ernst

Transcribed Image Text:MN

IN

LO

%24

%24

%23

Ceng

Piedr

3 Grade

Grad

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/quest

Saved

Help

Save & Ex

H1 Exercises i

Chec

12

M ---

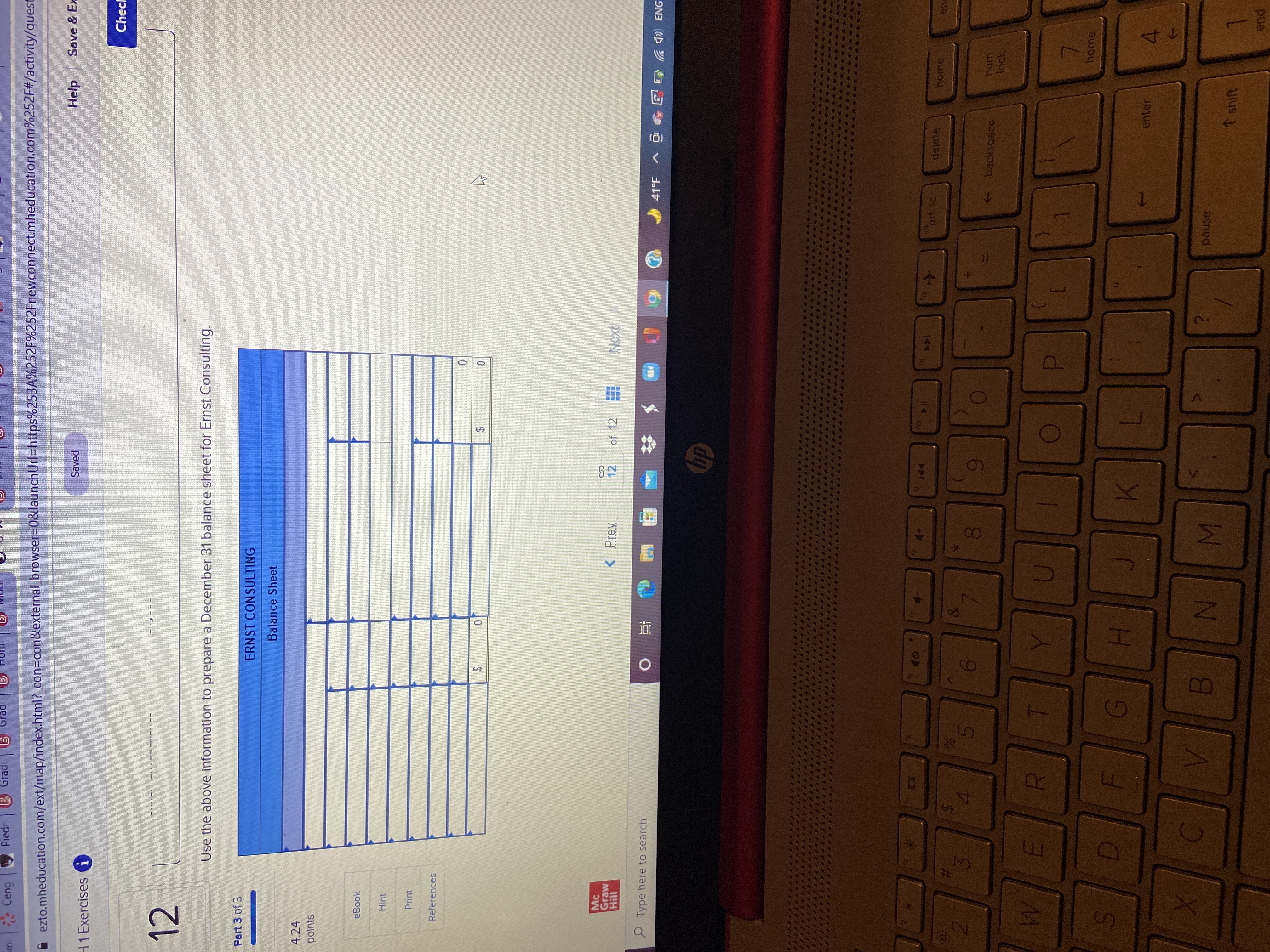

Use the above information to prepare a December 31 balance sheet for Ernst Consulting.

Part 3 of 3

ERNST CONSULTING

Balance Sheet

4.24

polnts

eBook

Hint

Print

References

2$

Mc

Graw

< Prev

%24

12

of 12

P Type here to search

直

41°F

LA a 4)) ENG

回 v

dp

114

ins

prt sc

144

delete

home

%23

4.

00

->

backspace

num

lock

home

enter

pause

↑shift

pua

![%24

* Ceng

Piedn B Grade

B Grad

B Hom

X 0 9 p

B CH1 B Mind

B CPT1 Ceng

Piedr

6 webs

G acco +

zto.mheducation.com/ext/map/index.html?_con3Dcon&external browser3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/ques

xercises G

Saved

Help

Save & E

Che

Required information

B of 3

[The following information applies to the questions displayed below.]

On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,000 in assets to

launch the business. On December 31, the company's records show the following items and amounts.

Cash withdrawals by owner

000

Consulting revenue

Cash

$2,000

000

3,550

Accounts receivable

Rent expense

000 96

Salaries expense

3,250

Land

Office equipment

Accounts payable

Owner investments

000

094

580

Book

000

Telephone expense

Hint

00S

Miscellaneous expenses

Print

000

eferences

Use the above information to prepare a December 31 balance sheet for Ernst Consulting.

ERNST CONSULTING

Balance Sheet

< Prev

12

of 12

Next

Fraw

pe here to search

ツ西回 o< bt

dy

f12

SUI

prt sc

delete

home

114

&

%23

inu](https://content.bartleby.com/qna-images/question/c8dd77b5-aa2f-476b-a254-53a03790e775/37410fc9-3a07-41ea-b848-ac4a193e95a9/f1f027.jpeg)

Transcribed Image Text:%24

* Ceng

Piedn B Grade

B Grad

B Hom

X 0 9 p

B CH1 B Mind

B CPT1 Ceng

Piedr

6 webs

G acco +

zto.mheducation.com/ext/map/index.html?_con3Dcon&external browser3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/ques

xercises G

Saved

Help

Save & E

Che

Required information

B of 3

[The following information applies to the questions displayed below.]

On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,000 in assets to

launch the business. On December 31, the company's records show the following items and amounts.

Cash withdrawals by owner

000

Consulting revenue

Cash

$2,000

000

3,550

Accounts receivable

Rent expense

000 96

Salaries expense

3,250

Land

Office equipment

Accounts payable

Owner investments

000

094

580

Book

000

Telephone expense

Hint

00S

Miscellaneous expenses

Print

000

eferences

Use the above information to prepare a December 31 balance sheet for Ernst Consulting.

ERNST CONSULTING

Balance Sheet

< Prev

12

of 12

Next

Fraw

pe here to search

ツ西回 o< bt

dy

f12

SUI

prt sc

delete

home

114

&

%23

inu

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Question 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forwardKay turned 73 on March 17th of Year 2 (which was after the year 2023 and before the year 2033). Her profit-sharing account balance was $500,000 at the end of Year 1 and $550,000 at the end of Year 2. Her beneficiary is her favorite granddaughter, Jordan, who turned 12 years old on July 23rd of Year 2. Assume that the joint life expectancy factor for a 73-year-old and a 12-year-old is 73 and the joint life expectancy for a 74-year-old and a 13-year-old is 72. Also, assume that the life expectancy factor based on the uniform lifetime table for someone who is 72, 73 and 74, is 27.4, 26.5, and 25.5, respectively. Kay takes a distribution of $10,000 in November of Year 1 and in Year 2. What is the Kay's minimum distribution for Year2? $18,868. $6,849. $20,073. $20,755.arrow_forwardWhen did Walt diedarrow_forward

- Grady received $8,760 of Social Security benefits this year. Grady also reported salary and interest income this year. What amount of the benefits must Grady include in his gross income under the following five independent situations? Grady files married separate and reports salary of $23,540 and interest income of $740arrow_forwardMargaret issues a promissory note payable to the order of Pancho. Pancho indroses the note toAdolfo, then Adolfo to Beatrice, then Beatrice back to Margaret. What happened to the obligationof Margaret?arrow_forward50. Mr. O, Filipino, married, died on August 1, 2018, three years after his marriage to Mrs. O. He left the following: a. Property inherited by Mr. O from his father who died February 14, 2013 b. Property inherited by Mrs. O from her father who died February 14, 2014 c. Property inherited by Mr. O from his mother who died February 14, 2015 d. Property inherited by Mrs. O from her mother who died February 14, 2016 c. Property acquired thru the labor of P3,000,000 1,200,000 1,800,000 1,400,000 Mr. O Mrs. O Mr. & Mrs. O (family bome) 2,000,000 1,500,000 2,400,000 1,600,000 f. Other personal property Deductions claimed by the estate: a. Funeral expense b. Unpaid mortgages on property in letters: a 500,000 c. Claims against the estate d. Accrued taxes (before the death of Mr.O) 220,000 b. 300,000 c. 180,000 d 200,000 170,000 80,000 Determine the net taxable estate assuming 1. Conjugal partnership of gains 2. Absolute community of propertyarrow_forward

- Joe is a return preparer who completes Paul's return on March 1. Joe presents it to Paul for his signature on April 1. The return is due on April 15, but Pau does not pay Joe until June 1. Joe must furnish a copy of the return to Paul no later than?arrow_forwardHarry is divorced from Kate. Pursuant the divorce decree, they alternate years claiming their son Frank as a dependent. For 2021 Kate released Frank's dependency exemption to Harry. Harry filed his 2021 return using the single filing status and reported agi of 62000. Which of the following is true regarding Harry's 2021 recovery rebate credit?arrow_forward6. In relation to the Income of Minors, which of the following is a prescribed person under ITAA36 Div. 6AA:Select one:a. Lulu who is permanently disabled and aged 16b. Carl who is married and is 17 years oldc. Nine-year-old Lucy whose parents are entitled to a carer allowanced. Ten-year-old Franke whose guardians are entitled to a double orphan pensionarrow_forward

- Mark (age 55 in 2020) and his late wife, Mary, were married in 1990. Mark and Mary have a son, Matt, who was born in 2009. Mary passed away on October 4, 2020. Mark has not remarried. Mark maintained a household for Matt, his dependent child (qualifying child), for all of 2020 & 2021. What allowable filing status would be most beneficial for Mark to use in 2020?arrow_forwardIn September, Amina hired Bryan as a delivery man. Bryan was to commence work on 1 November. On 1 October, Amina wrote to Bryan telling him that, despite their agreement, economic circumstances were such that she no longer required his services. Can Bryan sue Amina? Explain your answers in light of the principles learned on breach of contract. (maximum 500 words)arrow_forwardAshley Panda lives at 1310 Meadow Lane, Wayne, OH 43466, and her Social Security number is 123-45-6777. Ashley is single and has a 20-year-old son, Bill. His Social Security number is 111-11-1112. Bill lives with Ashley, and she fully supports him. Bill spent 2019 traveling in Europe and was not a college student. He had gross income of $4,655 in 2019. Bill paid $4,000 of lodging expenses that Ashley reimbursed after they were fully documented. Ashley paid the $4,000 to Bill using a check from her sole proprietorship. That amount is not included in the items listed below. Ashley had substantial health problems during 2019, and many of her expenses were not reimbursed by her health insurance. Ashley owns Panda Enterprises, LLC (98-7654321), a data processing service that she reports as a sole proprietorship. Her business is located at 456 Hill Street, Wayne, OH 43466. The business activity code is 514210. Her 2019 Form 1040, Schedule C for Panda Enterprises shows revenues of $315,000,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education