FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

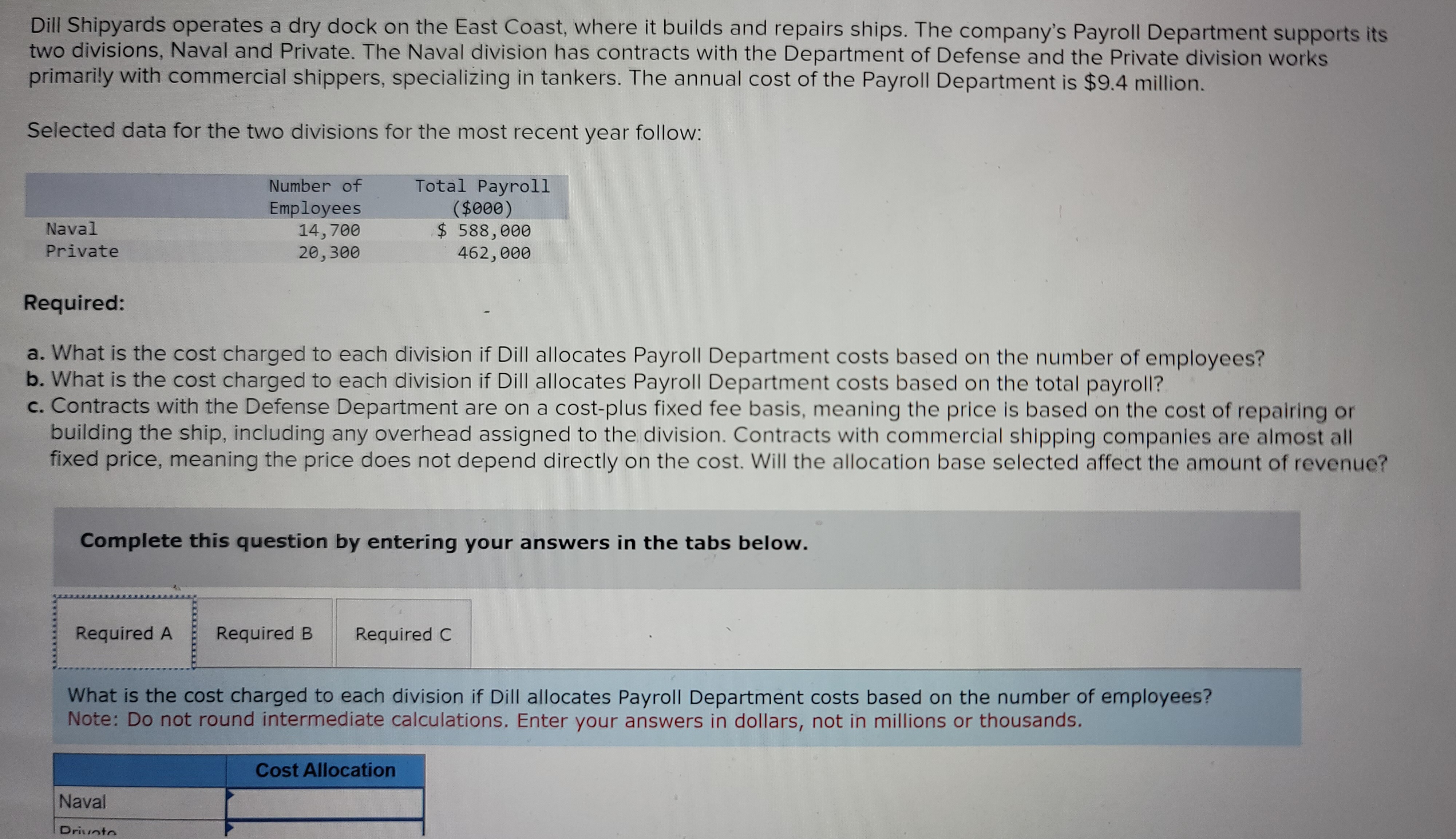

Transcribed Image Text:Dill Shipyards operates a dry dock on the East Coast, where it builds and repairs ships. The company's Payroll Department supports its

two divisions, Naval and Private. The Naval division has contracts with the Department of Defense and the Private division works

primarily with commercial shippers, specializing in tankers. The annual cost of the Payroll Department is $9.4 million.

Selected data for the two divisions for the most recent year follow:

Total Payroll

($000)

$ 588,000

462,000

Naval

Private

Required:

a. What is the cost charged to each division if Dill allocates Payroll Department costs based on the number of employees?

b. What is the cost charged to each division if Dill allocates Payroll Department costs based on the total payroll?

c. Contracts with the Defense Department are on a cost-plus fixed fee basis, meaning the price is based on the cost of repairing or

building the ship, including any overhead assigned to the division. Contracts with commercial shipping companies are almost all

fixed price, meaning the price does not depend directly on the cost. Will the allocation base selected affect the amount of revenue?

Complete this question by entering your answers in the tabs below.

Required A

Number of

Employees

14,700

20,300

Naval

What is the cost charged to each division if Dill allocates Payroll Department costs based on the number of employees?

Note: Do not round intermediate calculations. Enter your answers in dollars, not in millions or thousands.

Drivoto

Required B Required C

Cost Allocation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager’s salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $230,000. Each department’s overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. Department A Department B Budgeted department overhead (excludes plantwide overhead) $ 108,000 $ 329,000 Actual department overhead 120,000 344,000 Expected total activity: Direct labor hours 44,000 10,000 Machine-hours 18,000 47,000 Actual activity:…arrow_forwardGeneral Motors has three auto divisions (1, 2, and 3). It also has an accounting division and a management consultingdivision. The question is: What fraction of the cost of the accounting and management consulting divisions should be allocatedto each auto division? We assume that the entire cost of the accounting and management consulting departments must beallocated to the three auto divisions. During a given year, the work of the accounting division and management consultingdivision is allocated as shown in Table 4.For example, accounting spends 10% of its time on problems generated by the accounting department, 20% of its time onwork generated by division 3, and so forth. Each year, it costs $63 million to run the accounting department and $210 millionto run the management consulting department. What fraction of these costs should be allocated to each auto division? Thinkof $1 in costs incurred in accounting work. There is a .20 chance that this dollar should be allocated to each…arrow_forwardLogan Products has two production departments-assembly and finishing. These are supported by two service departments-sourcing (purchasing and handling of materials and human resources) and operations (work scheduling, supervision, and inspection). Logan has the following labor hours devoted by each of the service departments to the other departments. Total Labor Hours Used by Departments Sourcing Operations Sourcing 10,000 Operations 20,000 The costs incurred in the plant are as follows: Departments Sourcing Operations Assembly Departmental Costs $ 222,000 300,000 Assembly 40,000 60,000 Finishing 60,000 50,000 Finishing Total Required: 448,000 293,000 $ 1,263,000 1. What are the costs allocated to the two production departments using (a) the direct method, (b) the step method, when the sourcing department that provides the greatest percentage of services to other service departments goes first, and (c) the reciprocal method? 2. What are the total costs in the production departments…arrow_forward

- The Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $641,850 are allocated on the basis of machine hours. The Accounting Department's costs of $212,400 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $390,000 and $590,000, respectively. Maintenance Accounting A B Machine hours 495 65 3,600 290 Number of employees 2 2 8 4 What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first? Note: Do not round intermediate calculations.arrow_forwardThompson Aeronautics repairs aircraft engines. The company’s Purchasing department supports its two departments, Defense and Commercial. The Defense division has contracts with the Department of Defense and the Commercial division works primarily with domestic airlines and air freight companies. The cost of the Purchasing Department is $6 million annually. Information on the activity of the Purchasing department for the last year follows. Number ofPurchase Orders Dollar Amountof Purchases Defense 7,500 $ 135,000,000 Commercial 42,500 165,000,000 Required: a. What is the cost charged to each division if Thompson allocates Purchasing department costs based on the number of purchase orders? b. What is the cost charged to each division if Thompson allocates Purchasing department costs based on the dollar amount of the purchases? c. Contracts with the Defense department are on a cost-plus fixed fee basis, meaning the price is based on the cost of…arrow_forwardMackenzie Mining has two operating divisions, Northern and Southern, that share the common costs of the company's human resources (HR) department. The annual costs of the HR department total $14,000,000 a year. You have the following selected information about the two divisions: Northern Southern Number of Wage and Salary Employees Expense ($000) 2,310 $ 173,600 1,890 106,400 Required: Determine the cost allocation if $9.5 million of the HR costs are fixed and allocated on the basis of employees, and the remaining costs, which are variable, are allocated on the basis of the wage and salary expense total. Note: Do not round intermediate calculations. Enter your answers in dollars, not in millions or thousands. Fixed Variable Total Northern Southern CHarrow_forward

- Banc Corporation Trust is considering either a bank-wide overhead rate or department overhead rates to allocate $396,000 of indirect costs. The bank-wide rate could be based on either direct labor-hours (DLH) or the number of loans processed. The departmental rates would be based on direct labor-hours for Consumer Loans and a dual rate based on direct labor-hours and the number of loans processed for Commercial Loans. The following information was gathered for the upcoming period: Department Consumer DLH 16,000 9,000 Loans Processed Direct Costs 700 300 $ 280,000 $ 180,000 Commercial If Banc Corporation Trust uses a bank-wide rate based on the number of loans processed, what would be the total costs for the Consumer Department? Multiple Choice О $254,000 О $280,000 O O $576,000 $557,200 G Aarrow_forwardThe Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager’s salary, accounting personnel, cafeteria, and human resources, is budgeted at $400,000. During the past year, actual plantwide overhead was $385,000. Each department’s overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. Department A Department B Budgeted department overhead (excludes plantwide overhead) $ 153,000 $ 439,900 Actual department overhead 170,000 459,900 Expected total activity: Direct labor hours 50,000 25,000 Machine-hours 15,000 53,000 Actual activity:…arrow_forwardThe centralized employee travel department of Bourgeois Company has costs of $405,600. The department has serviced a total of 3,900 travel reservations for the period. The South Division has made 2,260 reservations during the period, and the West Division has made 1,640 reservations. Additional data for the two divisions is following below: SouthDivision WestDivision Sales $3,150,470 $2,929,810 Cost of goods sold 1,638,240 1,669,990 Selling expenses 786,360 718,100arrow_forward

- Kia Corporation has two departments, A and B. Central costs could be allocated to the two departments in various ways. Square footage of department A and B 6,000 and 18,000 square feet respectively, Number of employees of department A and B 1,500 and 500 respectively, and sales of department A and B $400,000 and $2,000,000 respectively. If total processing costs of $96,000 are allocated on the basis of number of employees, the amount allocated to Department B would be: a. $24,000 b. $28,800 c. $16,000 d. $67,200arrow_forwardArmada Shipping is a global logistics company. The company is organized into two divisions: Contracts and Retail. The Contracts Division, which is by far the larger division, handles customers who have regular shipping requirements and have signed contracts specifying costs and schedule for up to one year. The Retail Division handles shipments for customers who have only occasional shipping requirements and pay on an as-used basis. Billing for all customers is handled by the corporate Accounts Receivable Department. Accounts Receivable performs two major activities: billing and accounts. Billing refers to preparing and sending the bills as well as processing the payments. Accounts refers to establishing accounts, ensuring credit status, following up on collection, and so on. The costs of the Accounts Receivable Department are allocated to the two divisions based on the number of bills prepared. The manager of the Contracts Division has complained that the allocated costs from Accounts…arrow_forwardBaldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Employees Hours Department direct costs Costs Personnel Legal Complete this question by entering your answers in the tabs below. Total Personnel $ Personnel $ 10,800 $ 320,000 Required: a. Allocate the cost of the service departments to the operating divisions using the direct method. b. Allocate the cost of the service departments to the operating divisions using the step method. Start with Legal. c. Allocate the cost of the service departments to the operating divisions using the reciprocal method. 320,000 $ 320,000 $ Required A Required B Required C Allocate the cost of the service departments to the operating divisions using the reciprocal method. Note: Do not round intermediate calculations. Round your final answers…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education