FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question 15 of 20

<.

-/5

View Policies

Current Attempt in Progress

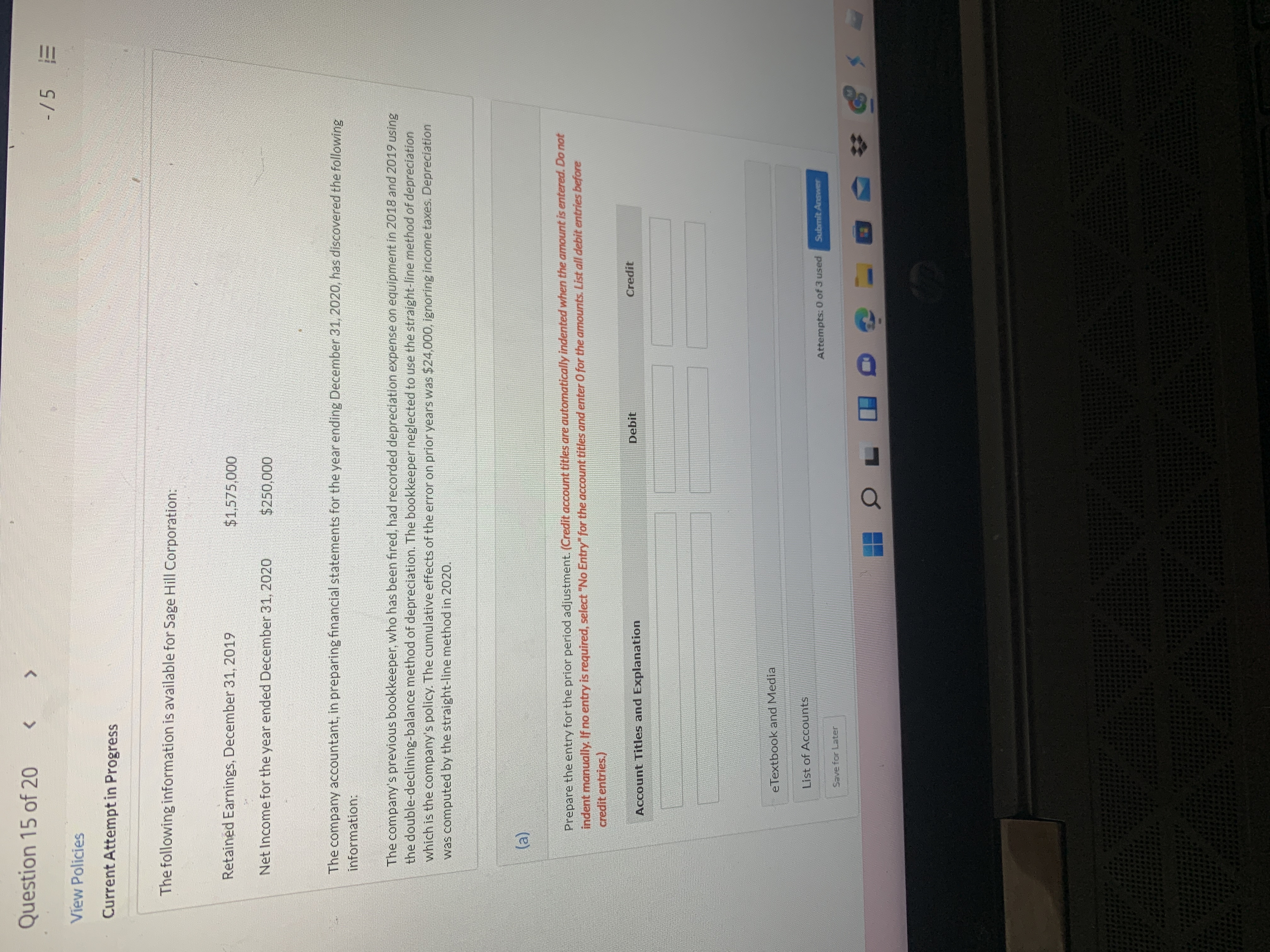

The following information is available for Sage Hill Corporation:

Retained Earnings, December 31, 2019

$1,575,000

Net Income for the year ended December 31, 2020

$250,000

The company accountant, in preparing financial statements for the year ending December 31, 2020, has discovered the following

information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on equipment in 2018 and 2019 using

the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation

which is the company's policy. The cumulative effects of the error on prior years was $24,000, ignoring income taxes. Depreciation

was computed by the straight-line method in 2020.

Prepare the entry for the prior period adjustment. (Credit account titles are automatically indented when the amount is entered. Do not

indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before

credit entries.)

Debit

Credit

Account Titles and Explanation

eTextbook and Media

List of Accounts

Attempts: 0 of 3 used

Submit Answer

Save for Later

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardQuestion: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 Below is the list of nominal ledger balances of Tonson Plc at 31 December 2021. Tonson’s financial year end is at 31 December. Nominal ledger closing balances at 31 December 2021 The following information is relevant. 1. Closing inventory at 31 December 2021 is £45,000 On further investigation of the suspense account in the trial balance above, it was discovered that: An expense of £8,250 for legal services had been posted to the suspense account and a cash receipt of £15,750 had been posted to the suspense account. This represented the disposal proceeds from selling equipment, which had been purchased on 1 March 2017 at a cost of £48,000. Tonson depreciates non-current assets as follows: buildings at 1 per cent on a straight-line basis plant and equipment at 10 per cent on a straight-line basis motor vehicles at 20 per cent on a reducing balance basis.…arrow_forwardExpense Recognition Question: How do you indicate the amount of expense that should be recognized for each of the following events of a company, that occurred during the year of 2018? 1. Space was leased from another company for a one-year period, starting November 1, 2018. Five months of rent at $2,340 per month was paid in advance. 2. Incurred $27,350 of research costs for new products. Although no new items have been created, management is certain that the research will result in new products. 3. The business used electricity and water during December for manufacturing, the company will receive the bill in January 2019 and pay it in February 2019. Electricity and water costs totalling $45,375 have been recorded for the period from January 1 to November 30, 2018. Please Explain.arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: Sales $ 2,760,000 Net operating income $ 110,400 Average operating assets $ 920,000 The following questions are to be considered independently. Brewer 8e Rechecks 2019-01-10 Required: 1. Compute the company's return on investment (ROI).arrow_forwardAssume the following general ledger account balances for Xenon Inc. for December 31, 2019 Accumulated Depreciation 50,000 Building 70,000 Depreciation Expense 20,000 Equipment 53,000 Land 90,000 Unused Supplies 3,000 What is the carrying amount of the company’s plant and equipment section of thebalance sheet at December 31, 2019?arrow_forwardPERFORM A LIQUIDITY AND PROFITABILITY ANALYSIS ON THE FOLLOWING COMPANY UTILIZING THE RATIOS LISTED: PAYABLES TURNOVER DAYS PAYABLE statement of operations 12 Months Ended Jul. 31, 2020 Jul. 31, 2019 Revenues: Revenues $ 1,497,826,000 $ 1,684,392,000 Costs and expenses: Operating expense - personnel, vehicle, plant and other 493,055,000 468,868,000 Operating expense - equipment lease expense 33,017,000 Equipment lease expense, preadoption 33,073,000 Depreciation and amortization expense 80,481,000 78,846,000 General and administrative expense 45,752,000 59,994,000 Non-cash employee stock ownership plan compensation charge 2,871,000 5,693,000 Asset impairments 0 0 Loss on asset sales and disposals 7,924,000 10,968,000 Operating income 148,670,000 113,028,000 Interest expense (192,962,000) (177,619,000) Loss on extinguishment of debt (37,399,000) Other income (expense), net (460,000) 369,000 Loss before income taxes (82,151,000)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education