FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

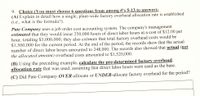

Transcribed Image Text:9. Choice ((You must choose 6 questions from among #’s 5-13 to answer):

(A) Explain in detail how a single, plant-wide factory overhead allocation rate is established

(i.e.. what is the formula?).

Pate Company uses a job order cost accounting system. The company's management

estimated that they would incur 250.000 hours of direct labor hours at a cost of $12.00 per

hour, totaling $3,000,000; they also estimate that total factory overhead costs would be

$1,500,000 for the current period. At the end of the period, the records show that the actual

number of direct labor hours amounted to 248.000. The records also showed that actual (not

the allocated amount) overhead costs amounted to $1,520,000.

(B) Using the preceding example, calculate the pre-determined factory overhead

allocation rate that was used, assuming that direct labor hours were used as the base.

(C) Did Pate Company OVER-allocate or UNDER-allocate factory overhead for the period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Could I see how to solve this problem please?arrow_forwardYou have been given the following information about the production of Lisa Co., and are asked to provide the factory manager with information for a meeting with the vice president of operations. Standard Cost Card Direct materials (6 pounds at $5 per pound) $30.00 Direct labor (0.8 hours at $10) 8.00 Variable overhead (0.8 hours at $3 per hour) 2.40 Fixed overhead (0.8 hours at $7 per hour) 5.60 $46.00 The following is a variance report for the most recent period of operations. Variances Costs Total Standard Cost Price Quantity Direct materials $405,000 $8,296 F $9,800 U Direct labor 108,000 5,775 U 7,500 Uarrow_forwardAustin Company uses a job order cost accounting system. The company's executives estimated that direct labor would be $3,960,000 (180,000 hours at $22/hour) and that factory overhead would be $1,480,000 for the current period. At the end of the period, the records show that there had been 160,000 hours of direct labor and $1,180,000 of actual overhead costs. Using direct labor hours as a base, what was the predetermined overhead allocation rate?arrow_forward

- Mickley Company's plantwide predetermined overhead rate is $20.00 per direct labor-hour and its direct labor wage rate is $12.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor $ 290 $ 120 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 80 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forwardMason Company has two manufacturing departments-Machining and Assembly. All of the company's manufacturing overhead costs are fixed costs. It provided the following estimates at the beginning of the year as well as the following information for Jobs A and B: Estimated Data Manufacturing overhead Direct labor-hours Machine-hours Job A Direct labor-hours Machine-hours Job B Direct labor-hours Machine-hours Machining $5,054,000 19,000 266,000 Machining Assembly 5 10 11 2 Machining 4 12 Assembly 5 3 Assembly $361,000 266,000 14,000 Total 15 13 Total 9 15 Total $5,415,000 285,000 280,000 Required: 1. If Mason Company uses a plantwide predetermined overhead rate with direct labor-hours as the allocation base, how much manufacturing overhead cost would be applied to Job A? Job B? 2. Assume Mason Company uses departmental predetermined overhead rates. The Machining Department is allocated based on machine-hours and the Assembly Department is allocated based on direct labor-hours. How much…arrow_forwardMickley Company's plantwide predetermined overhead rate is $20.00 per direct labor-hour and its direct labor wage rate is $10.00 per hour. The following information pertains to Job A-500: Direct materials. Direct labor $ 260 $ 50 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 80 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forward

- Fickel Company has two manufacturing departments-Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $16.00 per direct labor-hour and $12.00 per direct labor-hour, respectively. The company's direct labor wage rate is $20.00 per hour. The following information pertains to Job N-60: Direct materials Direct labor Assembly $ 340 $ 180 1. Total manufacturing cost 2. Unit product cost Testing & Packaging $25 $40 Required: 1. What is the total manufacturing cost assigned to Job N-60? 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) per unitarrow_forwardMackey Company's plantwide predetermined overhead rate is $25.00 per DLH and its direct labor wage is $21.00 per hour. For Job N, Direct materials is $1,000 and Direct labor is $420. a. What is the total manufacturing cost assigned to Job N? b. If Job N consists of 60 units, what is the unit product cost for this job?arrow_forwardA company has an overhead application rate of 120% of direct labor costs. How much overhead would be allocated to a job if it required total labor costing $30,000? O $6.000 O $25.000 O $36,000 O $187.500 O $360.000 Question 10 O.K. Company uses a job order cost accounting system and allocates its overhead on the basis of direct labor costs. O.K. expects to incur $1,100,000 of overhead during the next period and expects to use 50,000 labor hours at a cost of $10.00 per hour. What is O.K. Company's overhead application rate? O 4.55% O 45.45% O 220% O 227% O 2,200% Question 11arrow_forward

- Your Company uses a predetermined overhead rate based on machine hours to apply manufacturing overhead to jobs. Last year, the company worked 38,500 direct labor-hours and incurred $756,800 of actual manufacturing overhead cost. Overhead was over-applied by $5,000. What was the predetermined overhead rate? (Round to two digits if necessary.) Group of answer choices $19.15 $19.66 $19.79 $19.53 $19.50arrow_forwardFickel Company has two manufacturing departments-Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $22.00 per direct labor-hour and $18.00 per direct labor-hour, respectively. The company's direct labor wage rate is $24.00 per hour. The following information pertains to Job N-60: Direct materials Direct labor Assembly $ 390 $ 228 1. Total manufacturing cost 2. Unit product cost Testing & Packaging Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Do not round intermediate calculations. Round your answer to 2 decimal places.) $45 $ 132 Answer is complete but not entirely correct. $ $ 971 X 97.10 X per unitarrow_forwardces Mickley Company's plantwide predetermined overhead rate is $20.00 per direct labor-hour and its direct labor wage rate is $15.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor $ 230 $ 75 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 40 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education