FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:nces

?

Mc

Graw

Mill

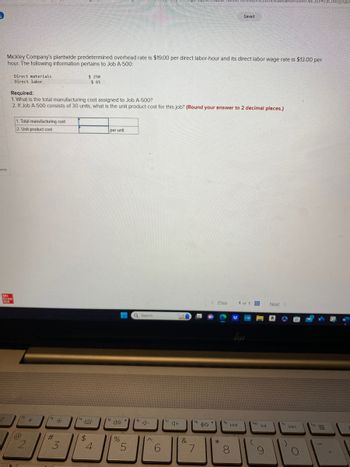

Mickley Company's plantwide predetermined overhead rate is $19.00 per direct labor-hour and its direct labor wage rate is $13.00 per

hour. The following information pertains to Job A-500:

Direct materials

Direct labor

Required:

1. What is the total manufacturing cost assigned to Job A-500?

2. If Job A-500 consists of 30 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.)

1. Total manufacturing cost

2. Unit product cost

@

f2

2

#

#

3

(14

$ 250

$ 65

$

4

per unit

(140

%

5

Q Search

f6

J-

6

f7

&

fa

7

< Prev

*

fg

Saved

U

144

8

1 of 1

fio

DII

9

Next >

ty

DDI

O

2F#/activity/que

f12

Expert Solution

arrow_forward

Step 1: Introduce to manufacturing cost

Total manufacturing costs :- It is the total cost incurred in the manufacturing of product during the period. It is the sum of direct material used, direct labor cost and manufacturing overhead applied to production. Unit product cost is calculated by dividing total manufacturing costs by units produced.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rahularrow_forwardRahularrow_forwardMickley Company's plantwide predetermined overhead rate is $23.00 per direct labor-hour and its direct labor wage rate is $15.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor $ 210 $ 150 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 80 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forward

- Pls help me with the clear solution on the paperarrow_forwardAcme Company manufactures and sells two products, Product A and Product B. Acme's total manufacturing overhead cost is $168,000, and Acme applies overhead to jobs using three activity-based overhead rates, computed as follows: Activity Cost pool ? ? Machine hours Allocation base Number of setups Setups Machining Packaging .$15,000 Units packed O $33.60 O $31.20 O $36.60 O $37.20 Units of allocation base Product A Product B 20 setups 20 setups 1,000 hours 150 units ? 350 units Allocation rate $450 per setup $27 per MH ? If Acme decides to use a plantwide overhead rate with machine hours as the allocation base, what would be its plantwide overhead rate?arrow_forwardNewhard Company assigns overhead cost to jobs on the basis of 112% of direct labor cost. The job cost sheet for Job 313 includes $12,964 in direct materials cost and $10,300 in direct labor cost. A total of 1,200 units were produced in Job 313. Required: a. What is the total manufacturing cost assigned to Job 313? b. What is the unit product cost for Job 313? a. Total manufacturing cost b. Unit product costarrow_forward

- Mickley Company's plantwide predetermined overhead rate is $22.00 per direct labor-hour and its direct labor wage rate is $10.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 70 units, what is its unit product cost? Note: Round your answer to 2 decimal places. 1. Total manufacturing cost 2. Unit product cost $ 270 $ 100 $ 8 per unitarrow_forwardA company has the following overhead costs and activities: Estimated Expected Activity Product V Product W Product X Overhead Activities and Activity Measures Machine setups (setups) Processing customer orders (orders) Assembling products (assembly-hours) $9,178.00 Cost $7,234.50 $3,565.50 69 12 10 20 9 21 492 697 111 1. If the company allocates overhead to products using assembly hours as the single allocation base, how much overhead will be allocated to product X? A. $1,706 B. $784 C. $618 D. $304 2. How much overhead cost would be assigned to Product V using the activity-based costing system? A. $158 B. $91,722 C. $10,385 D. $5,485arrow_forwardFickel Company has two manufacturing departments—Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $20.00 per direct labor-hour and $16.00 per direct labor-hour, respectively. The company’s direct labor wage rate is $22.00 per hour. The following information pertains to Job N-60: Assembly Testing & Packaging Direct materials $ 380 $ 41 Direct labor $ 187 $ 99 Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forward

- Frary Corporation is a building contractor. Frary tracks product costs in its job cost system and uses board feet to apply overhead to jobs. Frary has calculated an overhead rate of $61.52 per board foot and they have recorded the following information for job number E4641: Direct labor hours: 45 Direct labor rate: $17.14 Direct material: $5,784.00 Total board feet: 243 The total cost of job number E4641 is: Select one: A. $20,733.36 B. $6,555.30 C. $5,862.66 D. $9,323.70 E. $21,504.66arrow_forwardAssume that RamCo applies overhead to jobs based on direct labor cost. Job A1 was started and completed and sold to customer for $500. The Job A1 cost sheet shows $200 for direct materials, $100 for direct labor, and $60 for overhead on its job cost sheet. Job A2 is still in process at year end and shows charges of $280 for direct materials and $150 for direct labor. How much overhead should be charged to Job A2 at year end? $0 $60 $90 $120 000arrow_forwardThe Silver Corporation uses a predetermined overhead rate to apply manufacturing overhead to jobs. The predetermined overhead rate is based on labor cost in Dept. A and on machine-hours in Dept. B. At the beginning of the yea the Corporation made the following estimates: Direct labor cost Manufacturing overhead Direct labor-hours Machine-hours Dept. A Dept. B $60,000 $40,000 $90,000 $45,000 6,000 9,000 2,000 15,000 What predetermined overhead rates would be used in Dept. A and Dept. B, respectively?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education