FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

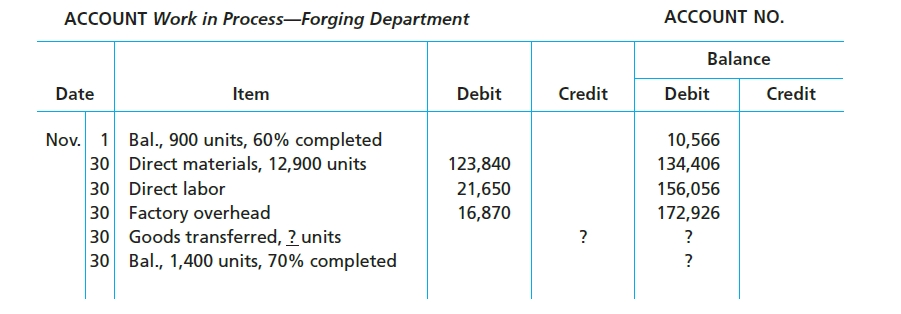

The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $9,000 of direct materials.

Attachment

a. Determine the number of units transferred to the next department.

b. Determine the costs per equivalent unit of direct materials and conversion.

c. Determine the cost of units started and completed in November.

Transcribed Image Text:ACCOUNT Work in Process-Forging Department

ACCOUNT NO.

Balance

Debit

Credit

Debit

Credit

Date

Item

Nov. 1 Bal., 900 units, 60% completed

30 Direct materials, 12,900 units

30 Direct labor

30 Factory overhead

30 Goods transferred, ? units

30 Bal., 1,400 units, 70% completed

10,566

134,406

156,056

123,840

21,650

16,870

172,926

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Information for the Hi-Test company’s production process for September follows. Assume that all materials are added at the beginning of this production process, and that conversion costs are added uniformly throughout the process. Work in process inventory, September 1 (2,000 units, 100% complete with respect to direct materials, 80% complete with respect to direct labor and overhead; consists of $45,000 of direct materials cost and $56.320 conversion cost). = $101,320 Costs incurred in September Direct materials = $375,000 Conversion. = $341.000 Work in process inventory, September 30 (7.000 units, 100% complete with respect to direct materials, 40% complete with respect to conversion) = $___? Units started in September = 28.000 Units completed and transferred to finished goods inventory. = 23.000 < Question > The total variable cost of goods transferred out. The total variable cost of ending work in process inventory.arrow_forwardThe following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $54,610 of direct materials. ACCOUNT Work in Process—Forging Department ACCOUNT NO. Date Item Debit Credit Balance Debit Credit Nov. 1 Bal., 4,300 units, 30% completed 58,738 30 Direct materials, 39,000 units 487,500 546,238 30 Direct labor 56,340 602,578 30 Factory overhead 77,805 ? 680,383 30 Goods finished, ? units ? 30 Bal., 3,400 units, 60% completed ? a. Determine the number of units transferred to the next department. units b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places. Cost per equivalent unit of direct materials $ Cost per equivalent unit of…arrow_forwardThe following cost information is available for July for the Crest Plant at Calvert Company: Beginning work-in-process inventory Materials cost $ 63,280 Conversion cost 40,002 Total $ 103,282 Current costs Materials cost $ 140,120 Conversion cost 421,038 Total $ 561,158 Materials are added at the beginning of the process. The following quantities have been recorded: Beginning inventory, 45,200 partially complete gallons, 25 percent complete with respect to conversion costs. Units started in July, 90,400 gallons. Units transferred out in July, 101,700 gallons. Ending inventory, 33,900 gallons, 40 percent complete with respect to conversion costs. Required: Compute the cost of goods transferred out and the ending inventory for July using the weighted-average method. please do not image format answer.arrow_forward

- Department M had 2,000 units 60% completed in process at the beginning of June, 12,000 units completed during June, and 800 units 33% completed at the end of June. What was the number of equivalent units of production for conversion costs for June if the first-in, first-out method is used to cost inventories?arrow_forwardAt the start of June, the polishing department had 15,000 units in beginning inventory. During the month it received 25,000 units from the department. It started and completed 17,000 units and transferred 32,000 units to the department. It had 8,000 units ending work in process inventory. Direct materials are added at the beginning of the process. Units in beginning work in process inventory were 50% complete in respect to conversion costs. Units in ending work in process inventory were 40% complete with respect to conversion costs. Prepare the production cost report for the department for the equivalent units of production for the month of June. Use the FIFO methodarrow_forwardCosts per Equivalent Unit and Production Costs The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $33,320 of direct materials. LOOK AT IMAGE TO help solve D. and E Cost per equivalent units of $9.50 for Direct Materials and $2.10 for Conversion Costs. Based on the above data, determine each of the following amounts. If required, round your interim calculations to two decimal places. Round final answers (a-c) to the nearest dollar. a. Cost of beginning work in process inventory completed in November.$ 40222 b. Cost of units transferred to the next department during November.$ 368502 c. Cost of ending work in process inventory on November 30.$30753 d. Costs per equivalent unit of direct materials and conversion included in the November 1 beginning work in…arrow_forward

- The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $35,700 of direct materials. ACCOUNT Work in Process-Forging Department Date Nov. Item 1 Bal., 3,400 units, 60% completed 30 Direct materials, 31,000 units 30 Direct labor 30 Factory overhead 30 Goods finished, 2 units 30 Bal., 2,700 units, 80% completed LA Debit 316,200 33,410 46,140 Credit ? ACCOUNT NO. Balance Debit Credit 40,596 356,796 390,206 436,346 ? ? a. Determine the number of units transferred to the next department. units b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places. Cost per equivalent unit of direct materials Cost per equivalent unit of conversion c. Determine the cost of units started and completed in November.arrow_forwardA department adds all the direct materials to a process at the beginning of the process and incurs conversion costs uniformly throughout the process. For the month of January, there were no units in the beginning Work In Process inventory; 90,000 units were started into production; and there were 20,000 units that were 40% complete with respect to conversion in Work In Process ending inventory at the end of January. What were the equivalent units of production for materials for the month of January? A. 98,000 equivalent units B. 70,000 equivalent units C. 82,000 equivalent units D. 90,000 equivalent unitsarrow_forwarda. Determine the number of units transferred to the next department. b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places. Cost per equivalent unit of direct materials Cost per equivalent unit of direct materials c. Determine the cost of units started and completed in November.arrow_forward

- Radford Products adds materials at the beginning of the process in Department A. The following information on physical units for Department A for the month of January is available. Units started in January 892,000 Units completed in January 916,000 Work in process, January 1 (25% complete with respect to conversion) 97,000 Work in process, January 31 (40% complete with respect to conversion) 73,000. Compute the equivalent units for materials costs and for conversion costs using the FIFO method.arrow_forwardSuppose that manufacturing is performed in sequential production departments. Prepare a journalentry to show a transfer of partially completed units from the first department to the second department. Assume the amount of costs transferred is $50,000.arrow_forwardEquivalent Units of Materials Cost The Rolling Department of Kraus Steel Company had 200 tons in beginning work in process inventory (60% complete) on October 1. During October, 3,900 tons were completed. The ending work in process inventory on October 31 was 300 tons (25% complete). What are the total equivalent units for direct materials for October if materials are added at the beginning of the process?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education