Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ப

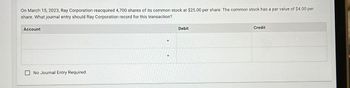

Account

On March 15, 2023, Ray Corporation reacquired 4,700 shares of its common stock at $25.00 per share. The common stock has a par value of $4.00 per

share. What journal entry should Ray Corporation record for this transaction?

No Journal Entry Required

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.arrow_forwardKindly help me with accounting questionsarrow_forwardAt December 31, 2020, the balance sheet of Meca International Included the following shareholders' equity accounts: ($ in millions) $ 60 300 410 Shareholders' Equity Common stock, 60 million shares at $1 par excess of par Paid-in capital Retained earnings Required: Assuming that Meca International views Its share buybacks as treasury stock, record the appropriate journal entry for each of the following transactions: (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Enter your answers in millions (1.e.. 10,000,000 should be entered as 10).) 1. On February 12, 2021, Meca reacquired 1 million common shares at $13 per share. 2. On June 9, 2022, Meca reacquired 2 million common shares at $10 per share. 3. On May 25, 2023, Meca sold 2 million treasury shares at $15 per share. Determine cost as the weighted-average cost of treasury shares. 4. For the previous transaction, assume Meca determines the cost of treasury shares by the…arrow_forward

- Denzerarrow_forwardOwearrow_forwardThe shareholders' equity section of the balance sheet of TNL Systems Incorporated included the following accounts at December 31, 2023: Shareholders' Equity Common stock, 200 million shares at $1 par Paid-in capital-excess of par Paid-in capital-share repurchase Retained earnings Required: 1. During 2024, TNL Systems reacquired shares of its common stock and later sold shares in two separate transactions. Prepare the entries for both the purchase and subsequent resale of the shares assuming the shares are (a) retired and (b) viewed as treasury stock. a. On February 5, 2024, TNL Systems purchased 8 million shares at $12 per share. b. On July 9, 2024, the corporation sold 3 million shares at $14 per share. c. On November 14, 2026, the corporation sold 3 million shares at $9 per share. 2. Prepare the shareholders' equity section of TNL Systems' balance sheet at December 31, 2026, comparing the two approaches. Assume all net income earned in 2024-2026 was distributed to shareholders as…arrow_forward

- At December 31, 2020, the balance sheet of Meca International included the following shareholders' equity accounts: Shareholders’ Equity ($ in millions) Common stock, 70 million shares at $1 par $ 70 Paid-in capital—excess of par 420 Retained earnings 530 Required:Assuming that Meca International views its share buybacks as treasury stock, record the appropriate journal entry for each of the following transactions: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) On February 12, 2021, Meca reacquired 1 million common shares at $12 per share. On June 9, 2022, Meca reacquired 2 million common shares at $9 per share. On May 25, 2023, Meca sold 2 million treasury shares at $15 per share. Determine cost as the weighted-average cost of treasury shares. For the previous transaction, assume Meca determines the cost of treasury…arrow_forwardD1.arrow_forwardT1.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning