Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer? ? Financial accounting

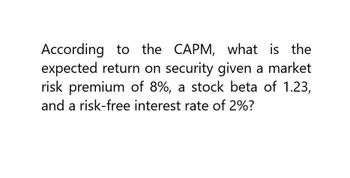

Transcribed Image Text:According to the CAPM, what is the

expected return on security given a market

risk premium of 8%, a stock beta of 1.23,

and a risk-free interest rate of 2%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- According to the CAPM, what is the expected return on a security given market risk premium of 13%, a stock beta of 1.77, and a risk free interest rate of 2%? Put the answer in decimal place.arrow_forwardAssume that a security is fairly priced and has an expected rate of return of 0.13. The market expected rate of return is 0.13, and the risk-free rate is 0.04. The beta of the stock is A. 1.7. B. 0.95. C. 1. D. 1.25.arrow_forwardAssume that security returns are generated by the single-index model,Ri = αi + βiRM + eiwhere Ri is the excess return for security i and RM is the market’s excess return. The risk-free rate is 2%. Suppose also that there are three securities A, B, and C, characterized by the following data: Security βi E(Ri) σ(ei) A 0.7 7 % 20 % B 0.9 9 6 C 1.1 11 15 a. If σM = 16%, calculate the variance of returns of securities A, B, and C. b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C? (Enter the variance answers as a percent squared and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.)arrow_forward

- Assume that security returns are generated by the single-index model, Ri = αi + βiRM + ei where Ri is the excess return for security i and RM is the market’s excess return. The risk-free rate is 3%. Suppose also that there are three securities A, B, and C, characterized by the following data: Security βi E(Ri) σ(ei) A 1.4 14 % 23 % B 1.6 16 14 C 1.8 18 17 a. If σM = 22%, calculate the variance of returns of securities A, B, and C. b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C? (Enter the variance answers as a percent squared and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.)arrow_forwardThe risk-free rate is 5.6%, the market risk premium is 8.5%, and the stock’s beta is 2.27. What is the required rate of return on the stock, E(Ri)? Use the CAPM equation.arrow_forwardAssume that security returns are generated by the single-index model, Ri = alphai + BetaiRM + ei where Ri is the excess return for security i and RM is the market's excess return. The risk-free rate is 2%. Suppose also that there are three securities A, B, and C, characterized by the following data. Security Betai E(Ri) sigma(ei) A 1.4 15% 28% B 1.6 17% 14% C 1.8 19% 23% a. If simaM = 24%, calculate the variance of returns of securities A, B, and C (round to whole number). Variance Security A Security B Security C b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C (enter the variance answers as a whole number decimal and the mean as a whole number percentage)? Mean Variance Security A ?% Security B ?% Security C ?%arrow_forward

- Assume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.arrow_forwardWhat is the equation for the Security Market Line? Define each term. If an asset has a beta of 2.0, what type of return should it realize compared to the market portfolio?arrow_forwardAlpha of stockarrow_forward

- The market portfolio (M) has the expected rate of return E(rM) = 0.12. Security A is traded in the market. We know that E(rA) = 0.17 and βA = 1.5. (1) What is the rate of return of the risk-free asset (rf)? (2) Security B is also traded in the market. βB = 0.8. Then what is “fair” expected rate of return of security B according to the CAPM? (3) Security C is a third security traded in the market. βC = 0.6, and from the market price, investors calculate E(rC) = 0.1. Is C overpriced or underpriced? What is αC?arrow_forwardAssume that using the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (bA) to beta of B (bB). (please show all workings)arrow_forwardCapmarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning