Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Text Predictions: On

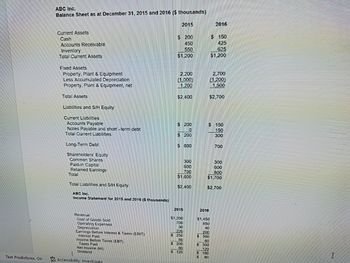

ABC Inc.

Balance Sheet as at December 31, 2015 and 2016 ($ thousands)

Current Assets

Cash

Accounts Receivable

Inventory

Total Current Assets

Fixed Assets

Property, Plant & Equipment

Less Accumulated Depreciation

Property, Plant & Equipment, net

Total Assets

Liabilities and S/H Equity

Current Liabilities

Accounts Payable

Notes Payable and short-term debt

Total Current Liabilities

Long-Term Debt

Shareholders Equity

Common Shares

Paid-In Capital

Retained Earnings

Total

Total Liabilities and S/H Equity

ABC Inc.

Income Statement for 2015 and 2016 ($ thousands)

Revenue

Cost of Goods Sold

Operating Expenses

Depreciation

Earnings Before Interest & Taxes (EBIT)

Interest Paid

Income Before Taxes (EBT)

Taxes Paid

Net Income (NA)

Dividend

IN

Accessibility: Investigate

2015

$ 200

450

550

$1,200

2.200

(1,000)

1,200

$2,400

$ 200

0

$ 200

$600

300

600

700

$1,600

$2,400

2015

$1.200

700

30

220

$ 250

50

$ 200

80

$ 120

2016

$ 150

425

625

$1,200

2,700

(1,200)

1,500

$2,700

2016

$1,450

850

40

200

$360

60

$ 300

120

$ 180

$

80

$ 150

150

300

700

300

600

800

$1,700

$2,700

I

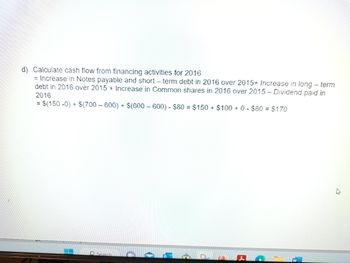

Transcribed Image Text:d) Calculate cash flow from financing activities for 2016

= Increase in Notes payable and short-term debt in 2016 over 2015+ Increase in long-term

debt in 2016 over 2015+ Increase in Common shares in 2016 over 2015 - Dividend paid in

2016

= $(150 -0) + $(700-600) + $(600-600) - $80 = $150 + $100+ 0 - $80 = $170

Search

C

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Balance Sheets as of December 31, 2015 and 2016 2015 2016 2015 2016 Assets Liabilities and Owners' Equity Cash Accounts receivable Inventory Net fixed assets 21,900 24,300 Common stock $ 850 $ 1,210 126 Accounts payable 1,370 Short-term notes payable $ 1,080 $ 970 500 0 4,350 4,610 Long-term debt 11,900 13,500 6,000 6,200 Retained earnings Total assets $28,310 $30,406 Total liabilities and owners' equity 8,830 $28,310 $30,406 9,736 2016 Income Statement Sales Cost of goods sold Depreciation Interest Taxes Net income $30,710 18,470 6,132 744 1,824 $ 3,540 What are the values of the three components of the DuPont identity? Use ending balance sheet values. Multiple Choicearrow_forwardSome recent financial statements for Earl Grey Golf Corp. follow. EARL GREY GOLF CORP. 2017 and 2018 Statement of Financial Position Assets Liabilities and Owners' Equity 2017 2018 2017 Current assets Cash Accounts receivabl 12,448 e Fixed assets 15, 235 Inventory 25,392 27,155 Total $ 61,886 $ 66,645 Net plant and equipment $ 24,046 Total assets $386,58 1 2018 $ 24, 255 $324,65 $365,73 Sales Cost of goods sold Depreciation $ 432,37 9 Current liabilitie S Accounts payable Notes payable 12,000 11,571 Total $46,755 $ 80,000 Other Long-term debt Owners' equity Earnings before interest and taxes Interest paid Taxable income Taxes (35%) Common stock and $ 23,184 $ 27,420 Total liabilitie s and owners' equity $40,000 paid-in surplus Retained 219,82 earnings Total 6 $ 259,82 6 EARL GREY GOLF CORP. 2018 Statement of Comprehensive Income 386,58 1 $366,996 253, 122 32,220 $ 81,654 10,800 15,553 $ 53,773 $ 95,000 $ 40,000 $ $ 14,300 $ 67,354 23,574 243, 60 6 283, 60 6 432, 37 Net income Dividends…arrow_forwardThe comparative balance sheet of Pelican Joe Industries Inc. for December 31, 2016 and 2015, is as follows: 1 Dec. 31, 2016 Dec. 31, 2015 2 Assets 3 Cash $490.00 $160.00 4 Accounts receivable (net) 280.00 200.00 5 Inventories 175.00 110.00 6 Land 400.00 450.00 7 Equipment 225.00 175.00 8 Accumulated depreciation-equipment (60.00) (30.00) 9 Total assets $1,510.00 $1,065.00 10 Liabilities and Stockholders’ Equity 11 Accounts payable (merchandise creditors) $175.00 $160.00 12 Dividends payable 30.00 13 Common stock, $10 par 100.00 50.00 14 Paid-in capital: Excess of issue price over par—common stock 250.00 125.00 15 Retained earnings 955.00 730.00 16 Total liabilities and stockholders’ equity $1,510.00 $1,065.00 The following additional information is taken from the records: 1. Land was sold for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education