FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

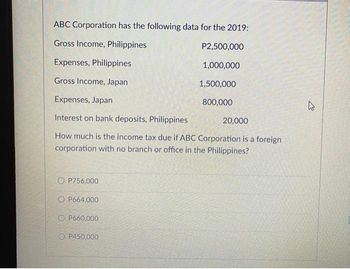

Transcribed Image Text:ABC Corporation has the following data for the 2019:

Gross Income, Philippines

P2,500,000

1,000,000

1,500,000

800,000

Expenses, Philippines

Gross Income, Japan

Expenses, Japan

Interest on bank deposits, Philippines

How much is the income tax due if ABC Corporation is a foreign

corporation with no branch or office in the Philippines?

O P756,000

OP664,000

O P660,000

OP450,000

20,000

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ASSUME THAT THE U.S. DOLLAR IS THE FUNCTIONAL CURRENCY. Ruthie Inc. had a debit adjustment of $7900 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Ruthie had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Ruthie's balance sheet at $124200. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $122200. In Ruthie's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forwardCaribbean Cruise Tours (CCT) is a Canadian controlled private corporation that operates a chain of travel agencies. In its fiscal year ending December 31, 2019, the Company had the following financial results:Active business income earned in Canada $275,000Active business income earned outside Canada 25,000Taxable capital gains NilAdjusted Aggregate Investment Income 100,000Net Income For Tax Purposes $400,000Taxable Income $325,000 The company paid no foreign taxes on its foreign operations. Its Adjusted Aggregate Investment Income was $48,000 in 2018. CCT has no associated corporations.Which one of the following amounts…arrow_forwardBrief, Inc., had a receivable from a foreign customer that is payable in the customer's local currency. On December 31, 2020, Brief correctly included this receivable for 377,500 local currency units (LCU) in its balance sheet at $290,000. When Brief collected the receivable on February 15, 2021, the U.S. dollar equivalent was $301,200. In Brief's 2021 consolidated income statement, how much should it report as a foreign exchange gain? Multiple Choice $16,200 $27,400 $0 $11,200arrow_forward

- 4arrow_forwardASSUME THAT THE LOCAL CURRENCY UNIT IS THE FUNCTIONAL CURRENCY. Cade Inc. had a debit adjustment of $6400 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Cade had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Cade's balance sheet at $121000. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $123800. In Cade's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forwardPHILIPPINES -arrow_forward

- 1.arrow_forwardWarnaSonic Inc. is an electronic company that operates in five countries around the world. Below is the information in 2019 (in Rupiah): 2 Jad Semester F... U.S. England Singapore India Autralia Sales to external entities 9,100,000 || 10,950,000 5,000,000| 13,200,000 4,250,000 Intersegment sales Operating profit/loss 2,500,000 1,700,000 -0- 4,500,000 500,000 4,100,000 3,750,000 600,000 -3,500,000 -760,000 Asset 2,100,000 4,250,000 1,100,000 2,450,000 900,000 Required: Determine the reportable segments using 3 threshold tests and external revenue test.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education